How to download the latest 2024 HTKK software (version 5.2.4) from the General Department of Taxation of Vietnam?

What is HTKK Software and what are its benefits in Vietnam?

HTKK software is an utility software designed to assist taxpayers in filing tax returns online, specifically known as tax declaration support software.

The HTKK software is freely distributed by the General Department of Taxation of Vietnam for businesses to use to create tax declaration forms, which can include barcodes when it is necessary to print them out.

HTKK software offers several practical benefits to taxpayers, such as:

- Simplifying Tax Procedures:

With the HTKK software, all procedures can be conducted online, and documents can be submitted 24/7, including holidays and weekends, without the need to physically commute or bring along documentation and records.

- Cost Savings:

By using the HTKK software to file taxes, data can be exported and sent over the internet, saving on printing costs.

- Time Efficiency:

Taxpayers do not need to visit the Tax Department to file tax returns and pay taxes but can complete them online from home or the office.

Currently, the latest version of HTKK is version 5.2.4, which the General Department of Taxation of Vietnam updated on November 5, 2024.

Guide to Download the Latest 2024 HTKK Software (Version 5.2.4) from the General Department of Taxation of Vietnam

The General Department of Taxation of Vietnam has issued a notice regarding the upgrade of the Tax Declaration Support Application (HTKK software) to version 5.2.4, updating the fee schedule in accordance with Circular 73/2024/TT-BTC. It also updates the Tax Department under the Nam Dinh Tax Department and administrative areas in the provinces of Soc Trang, Tien Giang, Tuyen Quang, Thai Binh, Phu Yen, Ninh Thuan, Lao Cai, Khanh Hoa, Gia Lai, Dong Nai, Dak Lak, Can Tho, Vinh Long, and Quang Ninh.

To install the latest HTKK version 5.2.4, your computer operating system needs to meet the following specifications:

- Windows: Windows 7 or higher

- MACOS: Not supported

- The computer must have Net Framework 3.5 or higher installed

Below is the installation guide for the latest HTKK software 5.2.4:

Case 1: Downloading HTKK 5.2.4 for the First Time

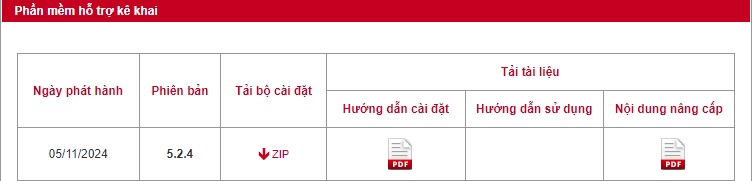

Step 1: Access the website of the General Department of Taxation of Vietnam to download the latest HTKK software at https://www.gdt.gov.vn/wps/portal/home/hotrokekhai

Step 2: Download the setup files for the HTKK application 5.2.4 (compressed file HTKK_v5.2.4.2_signed.rar)

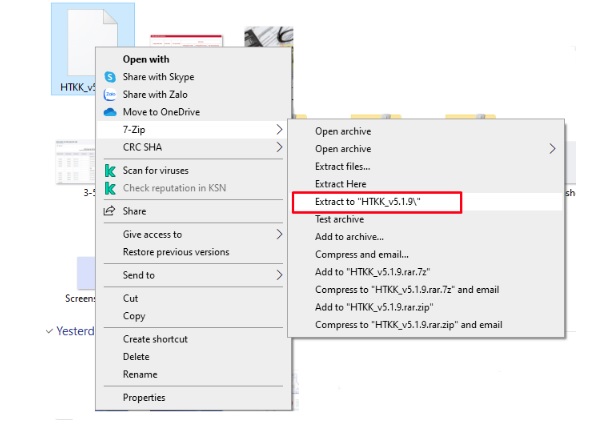

Step 3: Unzip the file HTKK_v5.2.4.2_signed.rar to obtain the setup application for HTKK 5.2.4

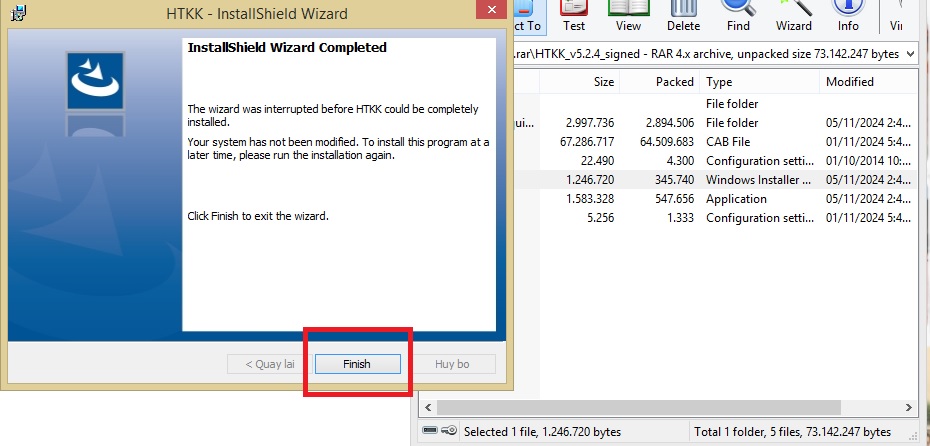

Step 4: Install the software: Navigate to the decompressed folder >> Double-click the Setup.exe file >> Click “Continue” >> Choose the folder to save the HTKK software under “Change” >> “Continue” >> “Install” >> Finally, click “Finish” to complete the installation.

Case 2: Previously Installed Lower Version of HTKK Software

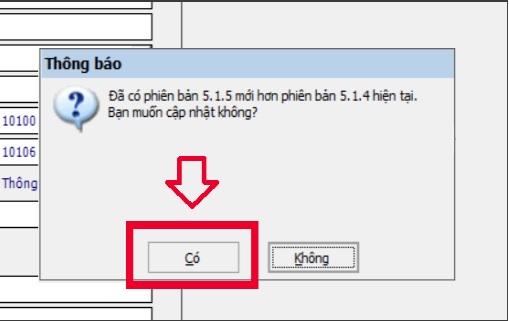

If a lower version of HTKK software was previously installed, then simply:

Step 1: Launch the HTKK application, a notification to update the software to version 5.2.4 will appear on the main interface of the application >> Choose “Yes”

Step 2: Select “Yes” when the software update is successful

Note: The information provided is for reference purposes only!

How to download the latest 2024 HTKK software (version 5.2.4) from the General Department of Taxation of Vietnam? (Image sourced from the Internet)

Vietnam: What are updates in HTKK Software 5.2.4?

According to the notice on upgrading the Tax Declaration Support Application (HTKK) version 5.2.4, which updates the fee schedule in response to Circular 73/2024/TT-BTC, there are some notable updates in HTKK 5.2.4 as follows:

(1) Update the fee schedule on the form 01/LP (TT80/2021) in response to Circular 73/2024/TT-BTC

(2) Rename the Tax Sub-Department for the Nam Dinh – My Loc area

(3) Update the administrative areas of Tuyen Quang Province according to Resolution 1106/NQ-UBTVQH15

(4) Update the administrative areas of Soc Trang Province according to Resolution 1105/NQ-UBTVQH15

(5) Update the administrative areas of Tien Giang Province according to Resolution 1202/NQ-UBTVQH15

(6) Update the administrative areas of Thai Binh Province according to Resolution 1201/NQ-UBTVQH15

(7) Update the administrative areas of Phu Yen Province according to Resolution 1200/NQ-UBTVQH15

(8) Update the administrative areas of Ninh Thuan Province according to Resolution 1198/NQ-UBTVQH15

(9) Update the administrative areas of Khanh Hoa Province according to Resolution 1196/NQ-UBTVQH15

(10) Update the administrative areas of Lao Cai Province according to Resolution 1197/NQ-UBTVQH15

(11) Update the administrative areas of Gia Lai Province according to Resolution 1195/NQ-UBTVQH15

(12) Update the administrative areas of Dong Nai Province according to Resolution 1194/NQ-UBTVQH15

(13) Update the administrative areas of Dak Lak Province according to Resolution 1193/NQ-UBTVQH15

(14) Update the administrative areas of Can Tho City according to Resolution 1192/NQ-UBTVQH15

(15) Update the administrative areas of Vinh Long Province according to Resolution 1203/NQ-UBTVQH15

(16) Update the administrative areas of Quang Ninh Province according to Resolution 1199/NQ-UBTVQH15

(17) Update the Value Added Tax Declaration – Form 01/GTGT in accordance with Circular 80/2021/TT-BTC

- Update to avoid triggering the Exception notification when receiving data from the excel report for the form GiamThue_GTGT_23_24

(18) Personal Income Tax Finalization Form – Form 02/QTT-TNCN according to Circular 80/2021/TT-BTC

- Update the indicator [24] regarding the number of dependents on Form 02/QTT according to Circular 80/2021/TT-BTC, equating it to the number of lines in the report 02-1/BK-QTT-TNCN. No edits allowed

(19) Corporate Income Tax Finalization Form – Form 03/TNDN according to Circular 80/2021/TT-BTC, 03/TNDN Circular 151/2014/TT-BTC

- Update at Appendix GDLK_ND132_01, section 4.1, indicator 9 - Financial expenses: Allow input of negative or positive numbers

Additionally, according to the announcement from the General Department of Taxation of Vietnam, starting from November 4, 2024, when preparing tax declaration documents related to the mentioned updates, organizations and individuals paying taxes will use the declaration functions in the HTKK 5.2.4 application in lieu of the previous versions.

- Download the file to look up which goods are not eligible for VAT reduction in Vietnam under Decree 72

- How to download the latest 2024 HTKK software (version 5.2.4) from the General Department of Taxation of Vietnam?

- Is there a Draft outline for the Law on Personal Income Tax replacing the Law on Personal Income Tax 2007 in Vietnam?

- What is the reference number of the tax receipt in Vietnam? What is the use of a reference number of the tax receipt when the tax receipt is burned?

- What is a form number of the receipt in Vietnam? Does the report on the use of receipts include the contents of the form number of the receipt?

- What is the environmental protection fee for natural gas obtained in the process of extraction of crude oil in Vietnam?

- What are cases of cancellation of outstanding tax in Vietnam?

- When are household businesses eligible for cancellation of outstanding tax in Vietnam?

- Is cell phone allowance subject to personal income tax in Vietnam?

- What is the VAT declaration form for computer-generated lottery business in Vietnam?