What is the latest application form for extension of excise tax payment deadline on automobiles in Vietnam in 2023? When is the deadline for submission of the application?

- When is the deadline for submitting an application for extension of the excise tax payment deadline on automobiles in Vietnam?

- What is the application form for extension of the excise tax payment deadline on automobiles in Vietnam in 2023?

- What are the procedures for extension of the excise tax payment deadline on domestically produced automobiles?

When is the deadline for submitting an application for extension of the excise tax payment deadline on automobiles in Vietnam?

Pursuant to the provisions of Clause 1, Article 4 of Decree No. 36/2023/ND-CP as follows:

Procedures for extension

1. Taxpayers who are eligible for an extension must file a written application for extension of excise tax payment deadline with the supervisory tax authority electronically, in person, or by post, as provided in the Appendix of this Decree. The application should be filed with the excise tax declaration in accordance with the law on tax administration. In case the application for extension of the excise tax payment deadline is not filed at the same time as the filing date of the excise tax declaration, their filing deadline is November 20, 2023. Tax authorities still extend the deadlines for paying excise tax as prescribed in Article 3 of this Decree.

Thus, the deadline for submitting an application for extension of the excise tax payment deadline on automobiles in Vietnam is the same time as the submission of the excise tax declaration.

In case the application for extension of the excise tax payment deadline is not filed at the same time as the filing date of the excise tax declaration, their filing deadline is November 20, 2023.

What is the latest application form for extension of excise tax payment deadline on automobiles in Vietnam in 2023? When is the deadline for submission of the application?

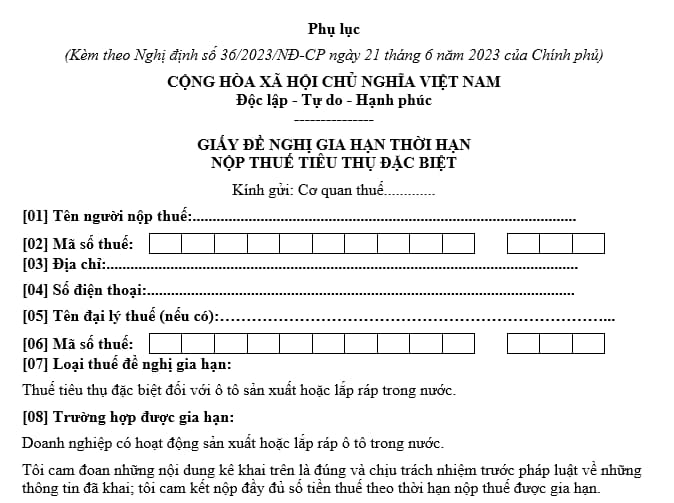

What is the application form for extension of the excise tax payment deadline on automobiles in Vietnam in 2023?

Pursuant to Decree No. 36/2023/ND-CP on extending deadlines for paying exise taxes on domestically manufactured or assembled automobiles issued by the Government of Vietnam on June 21, 2023.

An application for extension of the excise tax payment deadline on automobiles in Vietnam in 2023 is made according to the form in the Appendix issued with Decree No. 36/2023/ND-CP.

Download the application form for extension of the excise tax payment deadline on automobiles in Vietnam: Click here.

What are the procedures for extension of the excise tax payment deadline on domestically produced automobiles?

Pursuant to Article 4 of Decree No. 36/2023/ND-CP stipulating as follows:

Procedures for extension

1. Taxpayers who are eligible for an extension must file a written application for extension of excise tax payment deadline with the supervisory tax authority electronically, in person, or by post, as provided in the Appendix of this Decree. The application should be filed with the excise tax declaration in accordance with the law on tax administration. In case the application for extension of the excise tax payment deadline is not filed at the same time as the filing date of the excise tax declaration, their filing deadline is November 20, 2023.Tax authorities still extend the deadlines for paying excise tax as prescribed in Article 3 of this Decree.

2. Taxpayers shall make sure that they meet the extension eligibility requirements under this Decree and take responsibility for their extension applications.

3. Tax authorities are not required to notify taxpayers of their acceptance of an extension of the excise tax payment deadline. If the tax authority determines that the taxpayer is ineligible for the extension during the extension period, they will notify the taxpayer in writing of the suspension. The taxpayer must then make sufficient payments of both tax and late payment interest to the state budget. If, after the expiration of the extension period, the tax authority discovers during an inspection that the taxpayer was ineligible for the extension as prescribed in this Decree, then the taxpayer must pay the outstanding tax, fines, and late payment interests that are re-determined by the tax authority into the state budget.

4. During the extended period of excise tax payment, the tax authority will not charge late payment interest for the extended excise tax amount. In case the tax authority has charged the late payment interests for the excise tax declarations eligible for the extension under this Decree, they shall cancel these charges.

Thus, the procedures for extension of the excise tax payment deadline on domestically produced automobiles shall comply with the above provisions.

Specifically:

- Taxpayers who are eligible for an extension must file a written application for extension of excise tax payment deadline with the supervisory tax authority;

- Tax authorities are not required to notify taxpayers of their acceptance of an extension of the excise tax payment deadline. If the tax authority determines that the taxpayer is ineligible for the extension:

+ In case during the extension period, they will notify the taxpayer in writing of the suspension and the taxpayer must then make sufficient payments of both tax and late payment interest to the state budget.

+ If, after the expiration of the extension period, the tax authority discovers during an inspection that the taxpayer was ineligible for the extension, then the taxpayer must pay the outstanding tax, fines, and late payment interests that are re-determined by the tax authority into the state budget.

LawNet