What are the regulations on the declaration of dividends divided among the state capital in joint-stock companies, multi member limited liability companies in Vietnam?

- What are the regulations on the declaration of dividends divided among the state capital in joint-stock companies, multi member limited liability companies in Vietnam?

- What is the order of tax declaration for dividends and profits divided by state capital in joint-stock companies, multi member limited liability companies in Vietnam?

- What are the conditions for the company to pay dividends to shareholders?

What are the regulations on the declaration of dividends divided among the state capital in joint-stock companies, multi member limited liability companies in Vietnam?

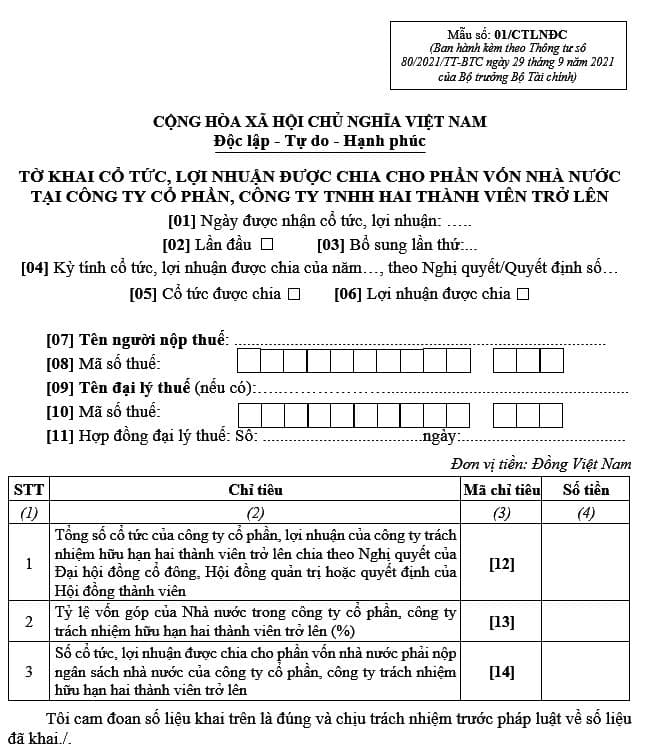

The declaration of dividends divided to the state capital in joint-stock companies and multi member limited liability companies shall be made according to Form No. 01/CTLNDC issued together with Circular No. 80/2021/TT-BTC as follows:

Download the Declaration: Click here.

What are the regulations on the declaration of dividends divided among the state capital in joint-stock companies, multi member limited liability companies in Vietnam?

What is the order of tax declaration for dividends and profits divided by state capital in joint-stock companies, multi member limited liability companies in Vietnam?

Pursuant to subsection 33, Section 2, Part II, Administrative procedures promulgated together with Decision No. 1462/QD-BTC in 2022 as follows:

Step 1: Taxpayers prepare data, compile dossiers and send them to tax authorities, no later than the 10th (tenth) day from the date on which the obligation to pay dividends and profits arises (the date of receipt of dividends, profits) is divided by the state capital in joint-stock companies, multi member limited liability companies.

Step 2: The tax authority receives:

- Tax administration agencies receive tax declaration dossiers, notify about receipt of tax declaration dossiers; in case the dossier is illegal, incomplete or not in accordance with the prescribed form, the taxpayer shall be notified within 03 working days from the date of receipt of the dossier.

- In case of receiving dossiers through the portal of the General Department of Taxation, the tax authority shall receive, examine and process the dossiers through the tax authority's electronic data processing system:

+ The portal of the General Department of Taxation sends a notice of receipt of the taxpayer's submission of the dossier or the reason for not receiving the dossier to the taxpayer via the portal that the taxpayer chooses to prepare and send the dossier (the portal of the General Department of Taxation/the portal of the competent state agency or the T-VAN service provider) no later than 15 minutes after receiving the taxpayer's electronic tax return.

+ Tax authorities shall check and process taxpayers' tax declaration dossiers in accordance with the Law on Tax Administration and guiding documents, and send notices of acceptance/disapproval of dossiers to to the electronic portal that the taxpayer chooses to make and send the dossier within 01 working day from the date stated on the notice of receipt and submission of the electronic tax return.

Taxpayers declare tax on dividends divided by state capital in joint stock companies, multi member limited liability companies?

Pursuant to subsection 33 Section 2 Part II Administrative procedures promulgated together with Decision No. 1462/QD-BTC in 2022, taxpayers shall declare tax on dividends divided by state capital in joint-stock companies, multi member limited liability companies through the following methods:

- Pay directly at the tax office.

- Or send by postal system.

- Or send the electronic file to the tax authority via electronic transaction (the portal of the General Department of Taxation/the portal of the competent state agency or the T-VAN service provider).

What are the conditions for the company to pay dividends to shareholders?

Pursuant to Article 135 of the 2020 Law on Enterprises in Vietnam stipulating as follows:

Paying dividends

1. Dividends of preference shares shall be paid under the conditions applied thereto.

2. Dividends of ordinary shares shall be determined according to the realized net profit and the dividend payment from the company’s retained earnings. The joint stock company may only pay dividend of ordinary shares when the following conditions are fully satisfied:

a) The company has fully its tax liabilities and other liabilities as prescribed by law;

b) The company’s funds are contributed to and the previous losses are made up for as prescribed by law and the company's charter;

c) After dividends are fully paid, the company is still able to fully pay its debts and other liabilities when they are due.

3. Dividends can be paid in cash, the company’s shares or other assets specified in the company's charter. If dividends are paid in cash, it shall be VND and using the methods of payment prescribed by law.

...

Thus, the joint stock company may only pay dividend of shareholders when the following conditions are fully satisfied:

- The company has fully its tax liabilities and other liabilities as prescribed by law;

- The company’s funds are contributed to and the previous losses are made up for as prescribed by law and the company's charter;

- After dividends are fully paid, the company is still able to fully pay its debts and other liabilities when they are due.

LawNet