Vietnam: What is the newest registration fee declaration form for real property in 2022? What property is subject to the registration fee for real property?

What property is subject to the registration fee for real property in Vietnam?

Under the regulations stipulated in Clause 1 Article 2 Circular 13/2022/TT-BTC, the property subject to registration fees is outlined as follows:

Property subject to registration fee

Property subject to registration fee shall follow Article 3 of Decree No. 10/2022/ND-CP. To be specific:

1. Real property prescribed in Clause 1 Article 3 of Decree No. 10/2022/ND-CP

a) Buildings: residential houses, business establishments, constructions for other purposes.

b) Land: agricultural and non-agricultural lands as defined in the Law on Land (regardless of the construction works on such lands).

Thus, real property includes property subject to registration fees specifically listed above.

What are the base prices for calculating registration fees for real property in Vietnam?

Under the regulations stipulated in Point a Clause 1 Article 3 Circular 13/2022/TT-BTC, the calculation of registration fees for real property in Vietnam is as follows:

(1) Base prices for land

- The value of land subject to registration fee shall be determined as follows:

|

The value of land subject to registration fee (dong) |

= |

Land area subject to registration fee (m2) |

x |

Price of one square meter of land (dong/m2) in the Land Price List issued by the People's Committee of the province or central-affiliated city |

Where:

+ The land area subject to registration fee is all the area of a land plot under the right to ownership, right of enjoyment of the organization, household or individual according to “Information sheet for determining land-related financial obligations”.

+ The price of one square meter of land in the Land Price List issued by the People's Committee of the province or central-affiliated city (hereinafter referred to as "the provincial People's Committee) shall be determined according to applicable land laws upon the declaration of registration fees.

- If land price specified in the land use right (LUR) transfer contract is higher than the price imposed by the provincial People's Committee, the base price for land shall be the price specified in the LUR transfer contract. If the land price specified in the LUR transfer contract is lower than the price imposed by the provincial People’s Committee, the base price for land shall be the price imposed by the provincial People’s Committee in accordance with effective land laws upon the declaration of registration fees.

- If a land user has been granted a LUR certificate without being required to pay registration fees, and then is permitted to have his/her current land repurposed by a competent authority and thus subject to registration fee, the base price shall be the land price for the new purpose in the Land Price List issued by the Provincial People's Committee in accordance with effective land laws upon the calculation of registration fees.

According to Point b Clause 1 Article 3 Circular 13/2022/TT-BTC, the base prices for houses are determined as follows:

- The value of a house subject to registration fee shall be determined as follows:

|

The value of the house subject to registration fee (dong) |

= |

House area subject to registration fee (m2) |

x |

Price of one square meter of the house (dong/m2) |

x |

Percentage (%) of the remaining quality of the house subject to registration fee |

Where:

+ The house area subject to registration fee is the entire area of the house’s floor (including the area of the attached ancillary works) under the legal ownership of the organization, household, or individual.

+ The price of one square meter of the house is the actual price of construction of one square meter of new floor at each house level or class which is imposed by the Provincial People's Committee according to applicable construction laws upon the declaration of registration fees.

The Department of Finance shall take charge and cooperate with the Department of Construction and relevant local authorities in, based on the regulations in Point b, Clause 1, Article 7 of Decree No. 10/2022/ND-CP, calculating the base price for the house, and submitting it to the Provincial People's Committee which will promulgate a List of Base prices applicable to local houses.

+ The percentage (%) of remaining quality of the house subject to registration fee shall be issued by the Provincial People’s Committee in accordance with law.

- If the house price specified in the sale contract is higher than the price imposed by the Provincial People's Committee, the base price for the house shall be the price specified in the sale contract.

If the house price specified in the sale contract is lower than the price imposed by the Provincial People’s Committee, the base price for the house shall be the price imposed by the Provincial People’s Committee in accordance with applicable construction laws upon the declaration of registration fees.

- In case of an apartment building, the base price shall not include maintenance costs for the shared area of the apartment building. In case, the maintenance costs for the common area of the apartment building are not separated on the invoice or sale contract, the base price shall be the total contract value recorded on the sale invoice or the sale contract.

Thus, the formula and calculation method for registration fees for real property in Vietnam are specifically provided as above.

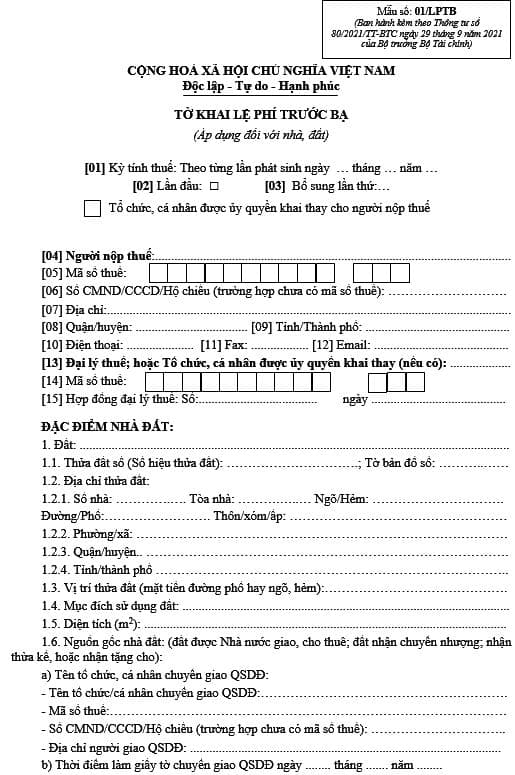

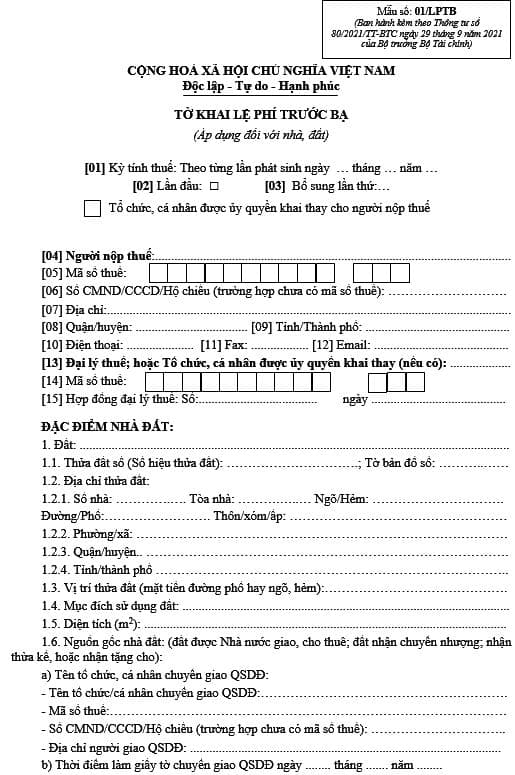

What is the newest registration fee declaration form for real property in Vietnam?

Under the regulations in Section X of Appendix II issued in conjunction with Circular 80/2021/TT-BTC, the newest registration fee declaration form for real property in Vietnam (Form 01/LPTB) is as follows:

Thus, the newest registration fee declaration form for real property in Vietnam includes the content and format as stipulated above.

Download the newest registration fee declaration form for real property in Vietnam: Here.

LawNet