What is the latest form for notification of changes in tax registration information in Vietnam? What are procedures for notification of changes in tax registration information in 2022?

Do enterprises have to apply for taxpayer registration before beginning their business operations in Vietnam?

Based on Clause 1, Article 30 of the Law on Tax Administration 2019 stipulates as follows:

“Article 30. Subjects of taxpayer registration and issuance of tax identification number

1. Taxpayers must apply for taxpayer registration and be issued a tax identification number by the tax authority before starting production, business activities, or incurring obligations with the state budget. Subjects of taxpayer registration include:

a) Enterprises, organizations, and individuals performing taxpayer registration through a single-window mechanism along with enterprise registration, cooperative registration, and business registration in accordance with the Law on Enterprises and other relevant laws;

b) Organizations and individuals not falling under the case stipulated in point a of this clause apply for taxpayer registration directly with the tax authority as regulated by the Minister of Finance.”

Enterprises shall apply for taxpayer registration before starting business activities. Enterprises apply for taxpayer registration through a single-window mechanism along with enterprise registration.

What is the latest form for notification of changes in tax registration information in Vietnam? What are procedures for notification of changes in tax registration information in 2022?

What are procedures for notification of changes in taxpayer registration information along with enterprise registration in Vietnam?

Based on Article 36 of the Law on Tax Administration 2019 stipulates as follows:

“Article 36. notification of changes in tax registration information

1. Taxpayers who conduct taxpayer registration along with enterprise registration, cooperative registration, or business registration, when there is a change in taxpayer registration information, must notify the change in taxpayer registration information along with the change in enterprise registration, cooperative registration, or business registration as prescribed by law.

If a taxpayer changes their headquarters address leading to a change in the managing tax authority, the taxpayer must complete tax-related procedures with the directly managing tax authority as prescribed by this Law before registering the change in information with the enterprise registration agency, cooperative registration agency, or business registration agency.

2. Taxpayers who directly apply for taxpayer registration with the tax authority, when there is a change in taxpayer registration information, must notify the directly managing tax authority within 10 working days from the date of the change.

3. In the case of individuals authorizing organizations or individuals that pay income to register changes in taxpayer registration information for individuals and their dependents, they must notify the income-paying organizations or individuals no later than 10 working days from the date of the change; and the income-paying organizations or individuals are responsible for notifying the tax management agency no later than 10 working days from the date of receiving the authorization from the individuals.”

Thus, in the case where enterprises apply for taxpayer registration along with enterprise establishment registration, when there is a change in taxpayer registration information, they will notify the change along with the change in enterprise registration information.

What are procedures for notification of changes in tax registration information at the Business Registration Office in Vietnam?

Based on Article 59 of Decree 01/2021/ND-CP stipulates as follows:

“Article 59. Notification of changes in taxpayer registration content

1. In the case where enterprises change the content of taxpayer registration without changing the content of business registration, except for the change in the method of tax calculation, the enterprise shall send a notification signed by the legal representative of the enterprise to the Business Registration Office where the enterprise is headquartered.

2. Upon receiving the notification, the Business Registration Office shall issue a receipt, check the validity of the dossier, enter the data into the National Business Registration Information System, and transfer the information to the taxpayer registration information system. If the enterprise requires, the Business Registration Office shall issue a confirmation of the change in business registration content to the enterprise.”

Thus, when changing taxpayer registration information without changing business registration content, the enterprise shall notify the business registration office to carry out the procedures.

What is the form for notification of changes in tax registration information in Vietnam?

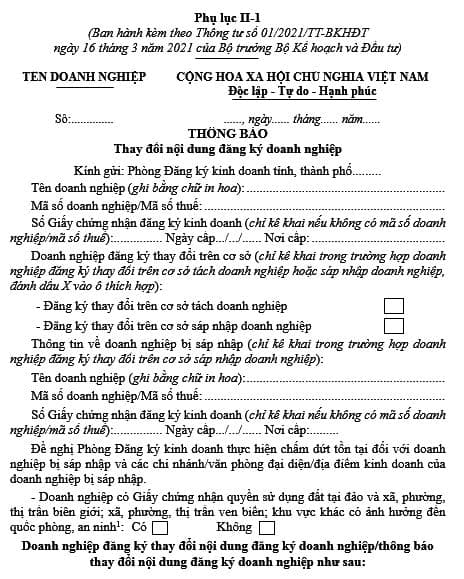

The form for notification of changes in tax registration information is stipulated in Appendix II-1 issued together with Circular 01/2021/TT-BKHDT as follows:

Download the latest form for notification of changes in tax registration information: Here.

LawNet