How to determine the reservation of payment period in Vietnam in 2024? How much is the maximum wage on which unemployment insurance premiums are based in 2024?

- How to determine the reservation of payment period in Vietnam in 2024?

- How much is the maximum wage on which unemployment insurance premiums are based in Vietnam?

- When is the time to participate in unemployment insurance in Vietnam?

- How long is the period of payment of unemployment insurance premiums in Vietnam?

How to determine the reservation of payment period in Vietnam in 2024?

On December 29, 2023, the Minister of Labor, War Invalids and Social Affairs issued Circular 15/2023/TT-BLDTBXH on amendments to Circular 28/2015/TT-BLDTBXH on guidelines for article 52 of the Law on employment 2013 and Decree 28/2015/ND-CP on guidelines for the Law on employment 2013 in terms of unemployment insurance.

Pursuant to Clause 1, Article 9, Circular 28/2015/TT-BLDTBXH, the reservation of payment period is as follows:

Reservation of payment period shall be determined as follows:

Payment period to be preserved | = | Total payment period | - | Payment period equivalent to the amount of unemployment benefit received |

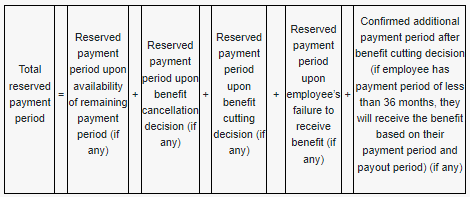

Pursuant to Clause 4, Article 1 of Circular 15/2023/TT-BLDTBXH amended and supplemented a number of articles, the reservation of payment period shall be determined as follows:

Reservation of payment period shall be determined as follows:

How to determine the reservation of payment period in Vietnam in 2024? How much is the maximum wage on which unemployment insurance premiums are based in 2024?

How much is the maximum wage on which unemployment insurance premiums are based in Vietnam?

First: For workers who receive wages under the State-prescribed regime:

Pursuant to Clause 1, Article 58 of the Law on Employment 2013, in case the monthly wage on which unemployment insurance premiums are based is higher than the twenty months’ statutory pay rate, the monthly wage on which unemployment insurance premiums will be equal to the twenty months’ statutory pay rate at the time of payment of unemployment insurance premiums.

The statutory pay rate from July 1, 2023 is 1,800,000 VND/month according to Clause 2, Article 3 of Decree 24/2023/ND-CP.

Thus, the maximum wage on which unemployment insurance premiums are based from July 1, 2023 is 36,000,000 VND.

Second: For workers paying unemployment insurance premiums under the wage regime decided by employers:

Pursuant to Clause 2, Article 58 of the Law on Employment 2013, in case the monthly wage on which unemployment insurance premiums are based is higher than the twenty months’ region-based minimum wage, the monthly wage on which unemployment insurance premiums are based will be equal to the twenty months’ region-based minimum wage as prescribed by the Labor Code 2019 at the time of payment of unemployment insurance premiums

The current region-based minimum wage is specified in Article 3 of Decree 38/2022/ND-CP.

Thus, the maximum wages on which unemployment insurance premiums are based are as follows:

Region | Statutory minimum wages per month (Unit: VND/month) | The maximum wages on which unemployment insurance premiums are based (Unit: VND/hour) |

Region I | 4.680.000 | 93.600.000 |

Region II | 4.160.000 | 83.200.000 |

Region III | 3.640.000 | 72.800.000 |

Region IV | 3.250.000 | 65.000.000 |

When is the time to participate in unemployment insurance in Vietnam?

Pursuant to Article 44 of the Law on Employment 2013, regulations on participation in unemployment insurance are specifically as follows:

Participation in unemployment insurance

1. Employers shall pay unemployment insurance premiums for workers to social insurance organizations within 30 days from the effective date of labor contracts or working contracts.

2. Monthly, employers shall pay unemployment insurance premiums at the level specified at Point b, Clause 1, Article 57 of this Law and make deductions from the wages of workers at the level specified at Point a, Clause

1, Article 57 of this Law, for simultaneous payment to the Unemployment Insurance Fund.

3. Based on the balance of the Unemployment Insurance Fund, the State shall transfer supporting funds from the state budget to the Fund at the level specified by the Government under Clause 3, Article 59 of this Law.

Thus, employers shall pay unemployment insurance premiums for workers to social insurance organizations within 30 days from the effective date of labor contracts or working contracts.

How long is the period of payment of unemployment insurance premiums in Vietnam?

Pursuant to Article 45 of the Law on Employment 2013, the specific period of payment of unemployment insurance premiums is as follows:

Period of payment of unemployment insurance premiums

1. The period of payment of unemployment insurance premiums for receipt of unemployment insurance benefits is the total of consecutive or interrupted periods of payment of unemployment insurance premiums from the starting time of such payment to the time the worker terminates his/her labor contract or working contract under law but during which he/she has not yet received any unemployment allowance.

2. After a worker stops receiving unemployment allowance, his/her previous period of payment of unemployment insurance premiums is not counted for receiving unemployment allowance for the subsequent time. The period of payment of unemployment insurance premiums for the subsequent receipt of unemployment insurance benefits will be counted from the beginning, except the case of stopping receiving unemployment allowance under Points b, c, h, l, m and n, Clause 3, Article 53 of this Law.

3. The period of payment of unemployment insurance premiums is not counted for receiving job loss allowance or severance pay under the laws on labor and public employees.

Thus, according to the above regulations, there is no time limit for reservation of payment period.

Instead, it only regulates the period of payment of unemployment insurance premiums is the total of consecutive or interrupted periods of payment of unemployment insurance premiums from the starting time of such payment to the time the worker terminates his/her labor contract or working contract under law but during which he/she has not yet received any unemployment allowance.

The period in which the employee has not yet received any unemployment allowance will be accumulated for receive unemployment allowance when eligible.

Note: Circular 15/2023/TT-BLDTBXH comes into force from February 15, 2024.

LawNet