Will the notification of receipt of electronic documents in electronic tax transactions in Vietnam be made in Template 01-1/TB-TDT?

When do electronic documents in electronic tax transactions in Vietnam have legal value?

Under Article 5 of Decree 165/2018/ND-CP, electronic documents in electronic tax transactions shall be considered an original if one of the following methods is adopted:

[1] The electronic document is digitally signed by an electronic document originator and relevant responsible organization or individual as prescribed by specialized law.

[2] The information system provides a method of ensuring integrity of the electronic document in the sending, receiving and storage process; records that an organization or individual has generated an electronic document and relevant responsible organization or individual has engaged in processing the electronic document, and adopts one of the following methods to authenticate whether the organization or individual generates the electronic document and relevant responsible organization or individual engages in processing the electronic document: digital certificate-based authentication, biometric authentication, authentication using two factors or more, including one-time authentication code or random authentication code.

[3] Other methods agreed upon by parties, ensuring the integrity of data, authenticity and non-repudiation in accordance with regulations of the Law on E-Transactions.

In addition to the three requirements above, electronic documents must satisfy all requirements for state management and conform to regulations of specialized law.

Format, generation, sending and receipt of electronic documents and validity thereof shall comply with the Law on E-Transactions.

Thus, according to the above regulations, electronic documents in electronic tax transactions have legal value as original documents when one of the three requirements above is met.

At the same time, electronic documents must satisfy all requirements for state management and conform to regulations of specialized law, and ensure presentable conformity.

Will the notification of receipt of electronic documents in electronic tax transactions in Vietnam be made in Template 01-1/TB-TDT? (Image from the Internet)

What are the regulations on electronically signing e-documents in Vietnam?

Under Clause 5, Article 7 of Circular 19/2021/TT-BTC, electronic documents in tax transactions are electronically signed as follows:

- Regarding e-documents which are notifications automatically generated and sent by the GDT’s web portal to taxpayers or automatically generated and sent by the GDT’s tax administration system to taxpayers through its web portal as prescribed in Article 5 of Circular 19/2021/TT-BTC, it is required to use the GDT’s token issued by the certification authority in accordance with regulations of the Ministry of Information and Communications.

- Regarding e-documents which are generated by tax officials on the GDT’s tax administration system according to the tax administration procedures to be sent to taxpayers through the GDT’s web portal as prescribed in Article 5 of Circular 19/2021/TT-BTC, it is required to use both token of the tax authority issued by the certification authority in accordance with regulations of the Ministry of Information and Communications and digital signatures of the tax officials issued by the Government Cipher Committee within the functions and tasks assigned and within the power prescribed by the Law on Tax Administration and its guiding documents.

- GDT shall build a digital signing system in order to manage the digital signatures issued to tax officials; manage digital signing procedures in a manner that satisfies regulations and ensures safety and security.

- T-VAN service providers, banks, IPSPs and other regulatory bodies shall upon carrying out e-tax transactions as prescribed in this Circular must use digital signatures appended with the digital certificates issued by public certification authorities or issued or recognized competent authorities.

- The use of digital signatures and e-transaction verification codes is collectively referred to as electronic signing.

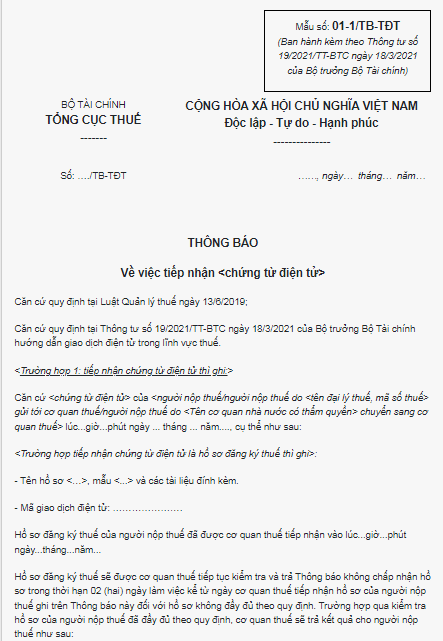

What is the notification template of receipt of electronic documents in electronic tax transactions in Vietnam?

Under the list of forms/templates issued together with Circular 19/2021/TT-BTC, the notification template of receipt of electronic documents in electronic tax transactions in Vietnam is Template 01-1/TB-TDT as follows:

>>> Download the latest notification template of receipt of electronic documents in electronic tax transactions in Vietnam.