Which form is used for the initial taxpayer registration declaration for representative missions of international organizations in Vietnam?

What is the representative mission of an international organization in Vietnam?

Based on the provision in Clause 3, Article 4 of the Law on Overseas Representative Missions of the Socialist Republic of Vietnam 2009, the representative mission of an international organization in Vietnam is defined as the Permanent Mission, the Mission, the Permanent Observer Mission, and other entities with similar names performing the representative functions of the State of Vietnam at intergovernmental international organizations.

Which form is used for the initial taxpayer registration declaration for representative missions of international organizations in Vietnam? (Image from the Internet)

Which form is used for the initial taxpayer registration declaration for representative missions of international organizations in Vietnam?

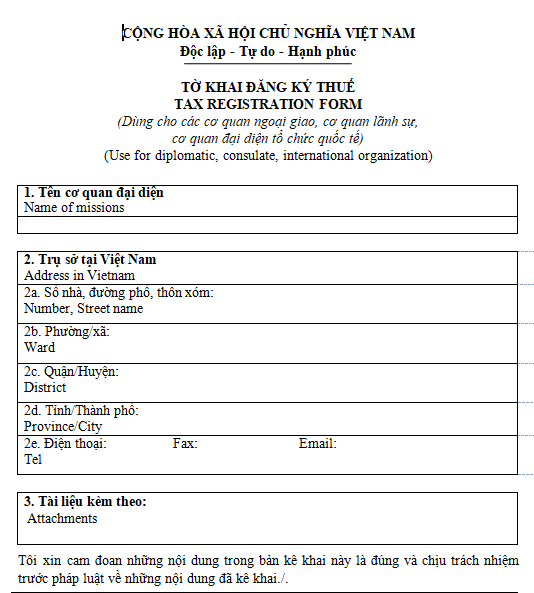

The form for the initial taxpayer registration declaration used for representative missions of international organizations in Vietnam which is eligible for VAT refund for subjects receiving diplomatic immunity is Form 06-DK-TCT issued with Circular 105/2020/TT-BTC.

DOWNLOAD >>> Form 06-DK-TCT

What are procedures for the receipt of the initial taxpayer registration for representative missions of international organizations in Vietnam?

Based on the provision in Clause 2, Article 6 of Circular 105/2020/TT-BTC regarding the receipt of the initial taxpayer registration for representative missions of international organizations in Vietnam as follows:

Receipt of taxpayer registrations

1. Taxpayer’s file

The taxpayer registration includes the initial taxpayer registration; file for change in taxpayer registration information; notice of temporary cessation of operations, business or resumption of operations after temporary cessation, business prior to the deadline; file for termination of tax identification number validity; file for recovery of tax identification number validity shall be received as stipulated in Clause 2, Clause 3, Article 41 of the Law on Tax Administration.

2. Receipt of the taxpayer's file

a) For paper files:

Tax officials receive and stamp the receipt on the taxpayer registration, clearly noting the date of receipt and the number of documents according to the list index for taxpayer registrations directly submitted at tax agencies. Tax officials issue an appointment sheet for the return of results for files that require the tax agency to return results to the taxpayer, specifying the processing time frame for each type of file received. In the case of taxpayer registrations sent by postal service, tax officials stamp the receipt, note the receipt date on the file and record it in the tax agency’s correspondence log.

Tax officials check the taxpayer registration. If the file is incomplete, requiring clarification, or additional information/documents, the tax agency notifies the taxpayer using Form No. 01/TB-BSTT-NNT in Appendix II issued with Decree No. 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam within 02 (two) working days from the date of receipt of the file.

b) For electronic taxpayer registrations: The receipt of files is carried out in accordance with the regulations of the Ministry of Finance on electronic transactions in the field of taxation.

Accordingly, the reception of the initial taxpayer registration for representative missions of international organizations in Vietnam is regulated as follows:

(1) For paper files:

- Tax officials receive and stamp the receipt on the taxpayer registration, clearly noting the date of receipt and the number of documents according to the checklist index for taxpayer registrations directly submitted at tax agencies.

Tax officials issue an appointment sheet for the return of results for the files that require the tax agency to return results to the taxpayer, specifying the processing duration for each type of file received. If the taxpayer registration is sent via postal service, tax officials stamp the receipt, note the date received on the file, and enter it in the tax agency’s correspondence log.

- Tax officials check the taxpayer registration. If the file is incomplete, requiring clarification, or additional information/documents, the tax agency notifies the taxpayer using Form No. 01/TB-BSTT-NNT in Appendix II issued with Decree 126/2020/ND-CP within 02 (two) working days from the date of receipt of the file.

(2) For electronic taxpayer registrations: The receipt of files is carried out in accordance with the regulations of the Ministry of Finance on electronic transactions in the field of taxation.