Which entities may use Form 05/GTGT on value-added tax declaration in Vietnam?

Which entities may use Form 05/GTGT on value-added tax declaration in Vietnam?

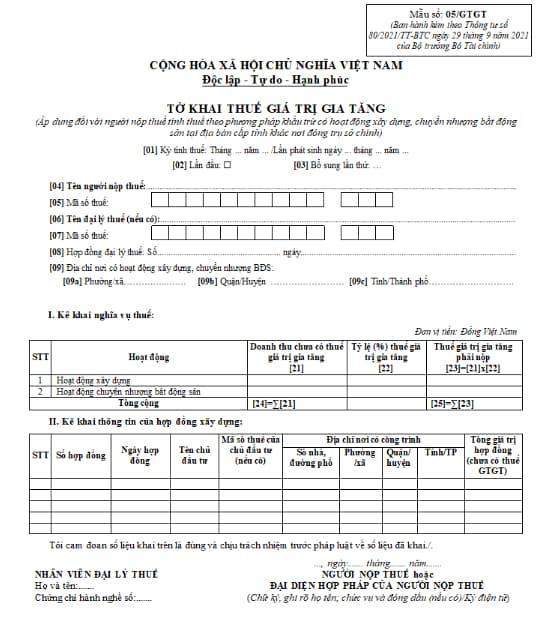

The value-added tax declaration (applied to taxpayers who calculate tax by the deduction method with construction and real estate transfer in the provinces other than the location of their main headquarters) is Form 05/GTGT issued together with Circular 80/2021/TT-BTC, which is as follows:

Download Form 05/GTGT value-added tax declaration: Here

Which entities may use Form 05/GTGT on value-added tax declaration in Vietnam? (Image from Internet)

Is real estate transfer subject to VAT distribution in Vietnam?

Based on Clause 1, Article 13 of Circular 80/2021/TT-BTC, the regulations are as follows:

Tax declaration, calculation, distribution, and payment of value-added tax

1. Cases eligible for distribution:

a) Online lottery business activities;

b) real estate transfer, except as stipulated at Point b, Clause 1, Article 11 of Decree No. 126/2020/ND-CP;

c) Construction activities as prescribed by laws on the national economy sector system and specialized laws;

d) Dependent units, business locations as production facilities (including processing and assembly facilities), except as stipulated at Point c, Clause 1, Article 11 of Decree No. 126/2020/ND-CP;

e) Hydropower plants located in multiple provinces.

...

Thus, real estate transfer are subject to value-added tax distribution, except for real estate transfer related to infrastructure investment projects and houses intended for resale (including cases of advance payments from customers as per the developer's schedule) where real estate transfer occur.

Vietnam: How is the VAT payable for real estate transfer distributed?

Based on Clause 2, Article 13 of Circular 80/2021/TT-BTC, the regulations are as follows:

Tax declaration, calculation, distribution, and payment of value-added tax

...

2. distribution methods:

a) distribution of value-added tax payable for online lottery business activities

The value-added tax payable for each province where online lottery activities occur is calculated by multiplying (=) the payable value-added tax for online lottery activities by the percentage (%) of actual ticket sales from online lottery activities in each province over the total actual ticket sales of the taxpayer.

Actual ticket sales from online lottery activities are determined as follows:

When tickets are distributed through terminals: Revenue from online lottery activities arises from the terminals registered to sell online lottery tickets within the administrative boundaries of each province according to the lottery agent contract signed with the online lottery company or the stores, ticket selling points established by the taxpayer in the area.

When tickets are distributed via phone and internet: Revenue is determined in each province where customers register to participate in the drawing upon opening their betting account as prescribed by the laws on online lottery business.

b) distribution of value-added tax payable for real estate transfer:

The value-added tax payable for each province for real estate transfer is calculated by multiplying (=) the revenue excluding value-added tax from real estate transfer in each province by 1%.

c) distribution of value-added tax payable for construction activities:

The value-added tax payable for each province for construction activities is calculated by multiplying (=) the revenue excluding value-added tax from construction activities in each province by 1%.

Revenue excluding value-added tax is determined based on the contract for construction works and project items. In cases where construction projects and project items involve multiple provinces but the revenue from the project in each province cannot be determined, after determining the 1% rate based on the project revenue, the taxpayer will determine the value-added tax payable for each province based on the percentage (%) of investment value for the project in each province over the total investment value.

...

Thus, the value-added tax payable for real estate transfer will be distributed as follows:

The value-added tax payable for each province for real estate transfer is calculated by multiplying (=) the revenue excluding value-added tax from real estate transfer in each province by 1%.