Where to look up tax debt for enterprises in Vietnam? When is tax debt for enterprises disclosed?

Where to look up tax debt for enterprises in Vietnam?

tax debt for enterprises occurs when a business has not paid the full amount of taxes and other fees to the state budget by the due date as prescribed. In other words, it is the amount that a business owes compared to the taxes they are required to pay.

Below are two methods businesses can refer to for checking tax debt for enterprises:

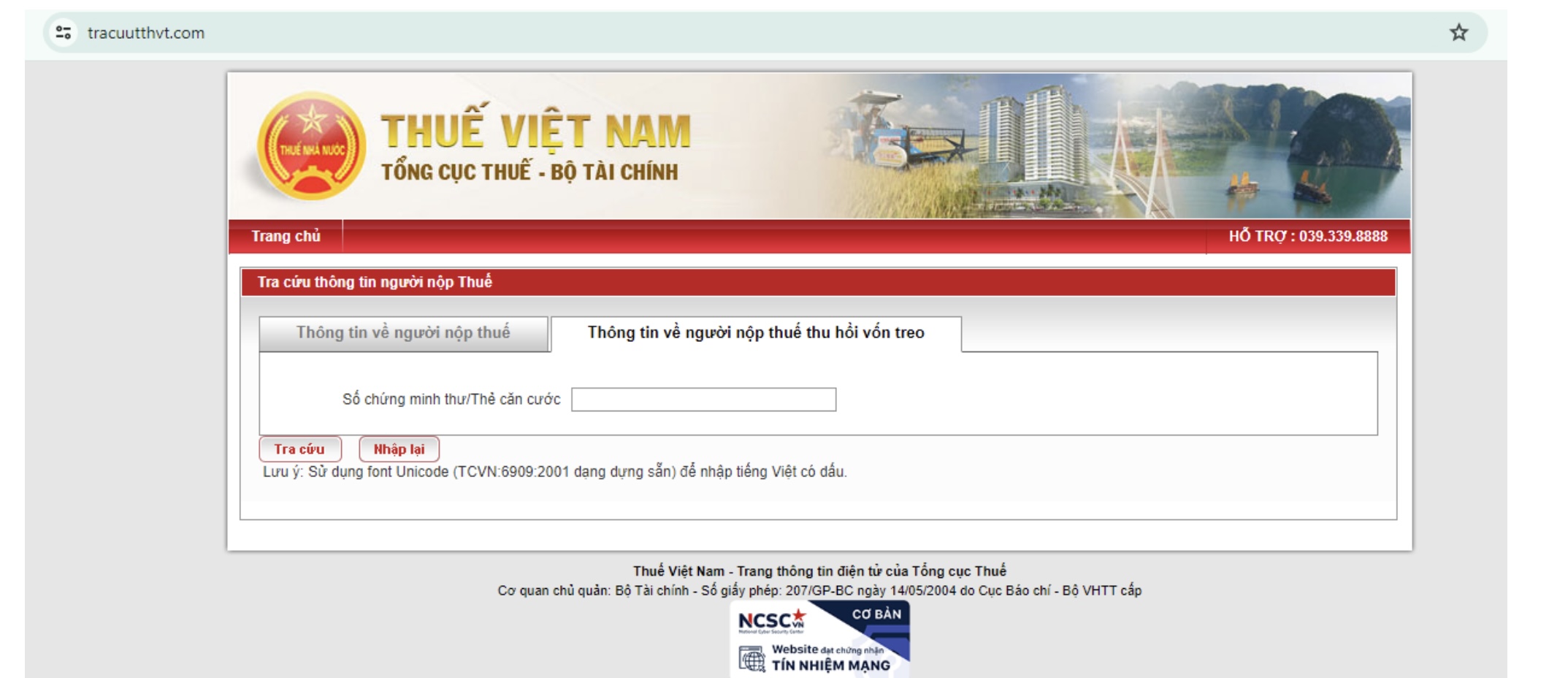

1. Access the General Department of Taxation's Electronic Portal:

Step 1: Access the official website of the General Department of Taxation of Vietnam.

Step 2: Search for the section "Check tax debt information" or "Tax lookup". This section is usually placed prominently on the homepage or in the main menu.

Step 3: Enter the tax code of the business you wish to check into the corresponding box. The tax code is a unique sequence of numbers assigned to each business upon registration.

Step 4: Click the "Search" or "Lookup" button.

2. Direct Contact with the Tax Office:

Step 1: Identify the Tax Office where the business is registered.

Step 2: Visit the Tax Office directly and request assistance in checking tax debt information.

Step 3: Prepare all necessary documents such as:

Business registration certificate

Tax code

Other related documents (if any)

Note: The information is for reference purposes only.

When is tax debt of enterprises disclosed in Vietnam?

Clause 1, Article 29 of Decree 126/2020/ND-CP stipulates the circumstances under which enterprises are publicly disclosed for tax debts by tax authorities in any of the following nine cases:

(1) Tax evasion, abetting tax evasion, appropriating taxes, violating tax laws and fleeing from their business premises; issuing, using invoices illegally.

(2) Failure to file tax returns 90 days past the deadline, according to the current tax laws.

(3) Ceasing operations but not completing procedures to terminate the tax code, not operating at the registered address.

(4) Tax violations by the taxpayer affecting the tax rights and obligations of other organizations and individuals.

(5) Not complying with the requirements of the tax authorities as stipulated by law, such as refusing to provide information or documents, not complying with inspection, audit decisions, or other requests by tax authorities according to the law.

(6) Obstructing or hindering tax officials or customs officials in the performance of their duties.

(7) More than 90 days past the deadline for paying taxes and other state budget collections or administrative decisions on tax management without voluntary compliance from the taxpayer or guarantor.

(8) Individuals or organizations not complying with administrative decisions on tax management and taking actions like dispersing assets, fleeing.

(9) Other information disclosed as prescribed by law.

Where to look up tax debt for enterprises in Vietnam? When is tax debt for enterprises disclosed? (Image from the Internet)

Where to look up tax debt for enterprises in Vietnam? When is tax debt for enterprises disclosed? (Image from the Internet)

Who has the authority to disclose taxpayer information in Vietnam?

According to Clause 3, Article 29 of Decree 126/2020/ND-CP, the authority to disclose taxpayer information is regulated as follows:

- The head of the tax management agency directly managing the taxpayer or the tax management agency where the state budget collection is managed base on actual circumstances and tax management work in the area, to decide on the selection of cases for disclosing taxpayer information with violations according to the regulation.

- Before disclosing taxpayer information, the tax management agency must review and verify to ensure the accuracy of disclosed information. The head of the tax management agency is responsible for the accuracy of disclosed information. In the event of inaccurate disclosed information, the head of the tax management agency shall correct the information and must publicly disclose the revised content in the form of public disclosure.

Vietnam: What taxpayer information shall be disclosed when there is tax debt?

Clause 2, Article 29 of Decree 126/2020/ND-CP stipulates the content and form of public disclosure of tax debts as follows:

Disclosure of taxpayer information

...

2. Content and form of disclosure

a) Disclosure content

The disclosed information includes: Tax code, taxpayer's name, address, and reason for disclosure. Depending on specific cases, the tax management agency may publicly disclose further details related to the taxpayer.

b) Form of disclosure

b.1) Posting on the electronic portal of the tax management agency, the online information site of the tax management agencies at all levels;

b.2) Disclosure in public media;

b.3) Posting at the headquarters of the tax management agency;

b.4) Through citizen receptions, press conferences, press releases, activities of spokespersons of tax management agencies at all levels as prescribed by law;

b.5) Other forms of disclosure according to related regulations.

.....

Therefore, when a taxpayer is subjected to public tax debt disclosure, the tax management agency will disclose the following information:

- Tax code.

- Taxpayer's name.

- Address.

- Reason for disclosure.

Additionally, depending on specific cases, the tax authority may disclose further related details.