Where to download the payment slip form C1-02/NS? How to prepare the form C1-02/NS on the e-portal of General Department of Taxation of Vietnam?

Vietnam: Where to download the payment slip form C1-02/NS?

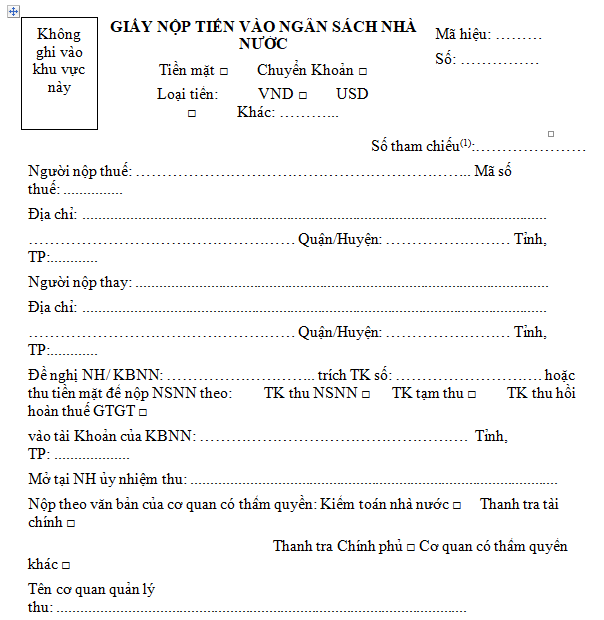

Pursuant to Form No. C1-02/NS issued together with Circular 84/2016/TT-BTC, the payment slip form for the State Budget is regulated as follows:

Download the State Budget payment slip form C1-02/NS here.

Where to download the payment slip form C1-02/NS? How to prepare the form C1-02/NS on the e-portal of General Department of Taxation of Vietnam? (Image from the Internet)

How to prepare the form C1-02/NS on the e-portal of General Department of Taxation of Vietnam?

Based on Article 6 of Circular 84/2016/TT-BTC, guidelines for declaring information on the payment slip into the state budget (form C1-02/NS) are as follows:

The taxpayer logs into the electronic tax payment system on the GDT's e-portal using the electronic tax transaction account provided by the tax authority to prepare tax payment vouchers.

The taxpayer selects to pay in one of two cases: “Prepare a payment slip” or “Prepare a payment slip for substitute payment” and declare specific information on the payment slip into the state budget (according to form No. C1-02/NS) as follows:

Information on the type of currency for tax payment:

- Select the “VND” box on the payment voucher in cases where the taxpayer is obligated to pay into the state budget in Vietnamese Dong.

- Select the “USD” box or record information about another foreign currency on the payment voucher if the taxpayer is obligated to pay into the state budget in US Dollars or other foreign currency as prescribed by law.

Information about the taxpayer and substitute payer:

- In case of selecting “Prepare a payment slip,” the system automatically displays the taxpayer’s information, including: name, tax identification number, and address of the taxpayer according to the login account.

- In case of selecting “Prepare a payment slip for substitute payment,” the system automatically displays the information of the substitute payer, including: name, and address of the substitute payer according to the login account. The substitute payer must declare the information of the taxpayer, including: name, tax identification number, and address of the taxpayer.

Information about banks/State Treasury and the account for tax deduction: Choose the bank and account from the registered list for electronic tax payments.

Information on paying the state budget:

The taxpayer selects either the “State Budget Collection” or “VAT Refund Recovery” box as follows:

- Select the “State Budget Collection” box in the case of paying tax amounts, late payments, penalties, or other contributions into the state budget.

- Select the “VAT Refund Recovery” box in cases of returning to the state budget the amount of VAT that has been refunded according to the decision of the competent authority or the taxpayer self-detects wrong refunds compared to regulations; this does not include returning the VAT that has been refunded in cases of incorrect or excess payment.

Information on the State Treasury Account: Select the name of the state treasury agency receiving the collection from the list of state treasury agencies; simultaneously, choose the bank name mandating the collection corresponding to the state treasury agency selected from the list provided by the system.

The state treasury agency receiving the budget collection is the state treasury agency at the same level as the tax administration agency. If the state treasury agency receiving the collection is not at the same level as the tax administration agency, the tax administration agency is responsible for notifying the taxpayer to select the appropriate state treasury agency name.

Information on paying according to the document of the competent authority (if any): Select one of the corresponding boxes with the issuing agency being “State Audit”, “Government Inspectorate”, “Financial Inspectorate”, “Other Competent Agencies”.

In cases of tax payment based on the decision of tax authorities at all levels, select the “Other Competent Agencies” box.

Information on the name of the tax administration agency: The system will automatically display the name of the tax agency directly managing the taxpayer. If the collection belongs to another tax agency, the taxpayer selects the tax administration agency's name from the tax agency's list.

Information about state budget contributions:

The taxpayer queries the payable amount on the electronic tax payment system and selects one or several contributions from the list of contributions displayed on the system. The taxpayer can adjust the amount of each contribution.

If there is a contribution that does not appear in the list shown on the system, the taxpayer enters the “State budget contributions” category to select an appropriate contribution and provide information on the amount to be paid to the state budget.

In cases of paying taxes, land levy, registration fees, or other contributions related to asset registration, the taxpayer provides additional information in the state budget contribution details box such as: house address, plot of land; type of vehicle, brand, type, paint color, chassis number, engine number of aircraft, ships, automobiles, motorbikes.

If payment is made under the document of a competent authority, the taxpayer must provide additional information on the name of the issuing authority.

Completion of tax payment vouchers: The taxpayer electronically signs at least 1 of the 3 positions of the payer/accounting chief/head of the unit and submits the payment slip into the state budget on the electronic tax payment system.

Is it necessary to pay interest on late payment when tax declarations are amended in Vietnam?

According to the provisions in Clause 1 Article 59 of the Law on Tax Administration 2019, taxpayers who amend personal income tax finalization declarations must pay late payment interest in the following cases:

Handling for late tax payment

1. Cases required to pay interest for late payment include:

a) Taxpayer delays in paying taxes beyond the prescribed deadline, extended deadline, the deadline stated in the tax administration agency's notification, the deadline in the tax assessment decision, or handling decision of the tax administration agency;

b) Taxpayer amends tax declarations increasing the amount of tax payable or the tax administration agency, or competent state agency discovers and audits that the amount of tax payable is understated, resulting in late payment interest on the increased tax amount calculated from the day following the original tax payment deadline of the tax period when the error occurred;

c) Taxpayer amends tax declarations reducing the amount of tax refunded or the tax administration agency, or competent state agency discovers and audits that the refunded amount is smaller than the refunded amount hence requiring late payment interest for the reclaimed refund amount calculated from the day the refund was received from the state budget;

...

A taxpayer must pay late payment interest when amending personal income tax finalization declarations under the specified circumstances.

Additionally, if the taxpayer amends tax declarations resulting in a decrease in tax payable, or if the tax administration agency or competent state agency discovers and audits a reduction in the tax payable, the taxpayer is allowed to adjust the calculated late payment interest corresponding to the reduced discrepancy.

The rate of interest for late payment as stipulated in Clause 2 of Article 59 of the Law on Tax Administration 2019 is 0.03%/day calculated on the late tax payment amount.

The duration for calculating late payment interest is continuous, starting from the day immediately following the day the late payment arose until the day preceding the day the tax debt, tax refund recovery, increased tax amount, assessed tax, or delayed transferred tax has been paid into the state budget.