When may a person authorize his/her income payers to finalize personal income tax for 2025 in Vietnam?

When may a person authorize his/her income payers to finalize personal income tax for 2025 in Vietnam?

Based on the provisions in sub-item 3, Section 1 of Official Dispatch 883/TCT-DNNCN of 2022, Vietnamese residents with income from wages and salaries may authorize income payers to finalize their 2025 Personal Income Tax (PIT) in the following cases:

[1] Individuals having income from wages and salaries under a labor contract of 03 months or more at one place and are currently working there at the time the organization or individual pays income and finalizes the tax, including cases where they do not work for the full 12 months of the calendar year.

If the individual is an employee transferred from an old organization to a new organization due to the old organization’s merger, consolidation, division, separation, or transformation of business type, or if the old and new organizations are in the same system, the individual can authorize the new organization to finalize the tax.

[2] Individuals have income from wages and salaries under a labor contract of 03 months or more at one place and are currently working there at the time the organization or individual pays income and finalizes the tax, even if they do not work for the full 12 months of the calendar year; simultaneously, they have occasional income in other places with an average monthly income in the year not exceeding 10 million VND, and this income has been withheld at a rate of 10% if there is no request for tax finalization for this portion of the income.

[3] After an individual has authorized tax finalization, and the income-paying organization has finalized the tax on behalf of the individual, if it’s found out that the individual must directly finalize the tax with the tax authority, the income-paying organization does not adjust its PIT finalization but only issues a tax withholding certificate for the individual based on the finalization and notes the following at the lower left corner of the tax withholding certificate for the individual to directly finalize with the tax authority:

"Company ... has finalized PIT on behalf of Mr./Ms. ... (as authorized) at line (serial number) ... of Appendix 05-1/BK-TNCN"

In cases where the organization or individual paying income uses electronic PIT withholding certificates, they must print the conversion from the original electronic PIT withholding certificates, noting the above content into the converted printout to provide to the taxpayer.

Where to download the 2025 PIT finalization authorization form for income payers in Vietnam?

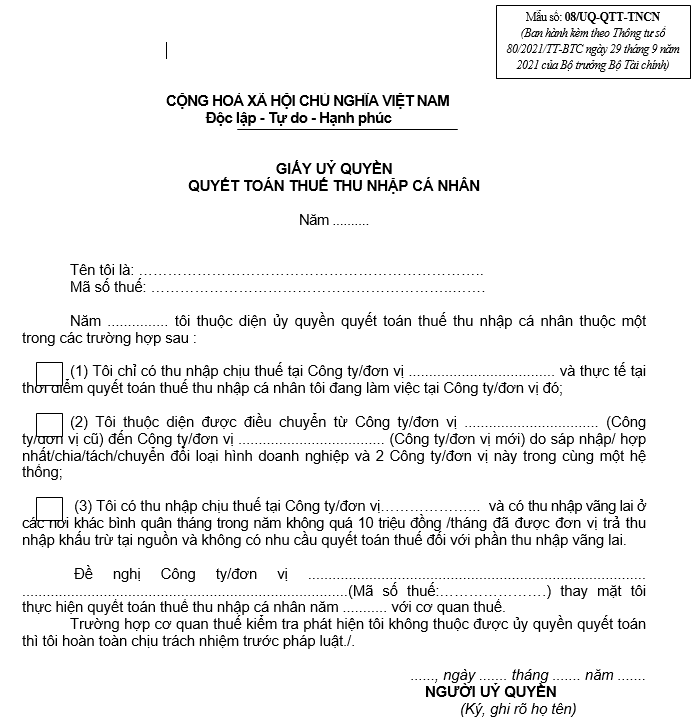

The 2025 PIT Finalization Authorization Form for income payers is carried out according to Form 08/UQ-QTT-TNCN issued with Appendix II attached to Circular 80/2021/TT-BTC.

Download: Individual Income Tax Finalization Authorization Form: https://cdn.thuvienphapluat.vn/phap-luat/2022-2/BN/2024/LAWNET/08_UQ-QTT-TNCN.doc Here

Vietnam: If persons authorize income payers to finalize their 2025 PIT, do they need to be issued withholding certificates?

According to the provisions of clause 2, Article 25 of Circular 111/2013/TT-BTC regarding tax withholding and withholding certificates as follows:

Article 25. Tax Withholding and Withholding Certificates

...

2. Withholding Certificates

a) Organizations and individuals that pay income, from which tax has been withheld according to the instructions in clause 1 of this Article, must issue withholding certificates upon request of the individual who is the subject of withholding. In cases where individuals authorize tax finalization, withholding certificates are not issued.

b) Issuing withholding certificates in special cases is as follows:

b.1) For individuals without a labor contract or with a labor contract of fewer than three (03) months: such individuals have the right to request the income-paying organization or individual to issue a withholding certificate for each tax withholding occasion or issue one certificate for multiple tax withholding occasions in one tax period.

Example 15: Mr. Q signs a service contract with company X to maintain the garden in the Company's premises once a month from September 2013 to April 2014. Mr. Q’s income is paid monthly by the Company at 3 million VND. In this case, Mr. Q can request the Company to issue a withholding certificate monthly or issue one certificate reflecting the total withheld tax from September to December 2013 and another certificate for the period from January to April 2014.

b.2) For individuals with a labor contract of three (03) months or more: the organization or individual paying the income only issues one withholding certificate for the individual in a tax period.

Example 16: Mr. R signs a long-term labor contract (from September 2013 to the end of August 2014) with company Y. In this case, if Mr. R is required to finalize taxes directly with the tax authority and requests the Company to issue a withholding certificate, the Company will issue one certificate reflecting the withheld tax from September to December 2013 and another certificate for the period from January to the end of August 2014.

Thus, in cases where individuals authorize income payers to finalize their 2025 PIT, they are not issued withholding certificates.