What type of land is subject to the general declaration of non-agricultural land use tax in Vietnam?

What type of land is subject to the general declaration of non-agricultural land use tax in Vietnam?

Under Clause 1, Article 16 of Circular 153/2011/TT-BTC:

Tax declaration

1. Tax declaration principles:

1.1. Taxpayers shall accurately declare their personal information such as name, identity card number, tax identification number, address for receiving tax notices; and information on the taxable land plot such as area and use purpose in the tax declaration. For a land plot for which a certificate has been granted, information on serial number and date of issue of the certificate, serial number of the map, land area and land quota (if any) must be fully declared.

For dossiers of declaration of tax on residential land of households and individuals, commune-level People's Committees shall fill in the declaration forms' items reserved for functional agencies and transfer these declarations to district-level Tax Departments for use as a basis for tax calculation.

When necessary to clarify some items in tax declaration dossiers of organizations which serve as tax bases at the request of lax agencies, natural resources and environment agencies shall make and send certifications to tax agencies.

1.2. Annually, taxpayers are not required to make re-declaration if there is no change in taxpayers and elements that lead to changes in payable tax amounts.

Upon occurrence of an event that leads to a change in the taxpayer, the new taxpayer shall declare and submit a tax declaration dossier under this Circular within 30 (thirty) days after the date when such event .occurs. In case of arising elements leading to a change in the payable tax amount (except change of the price of a square meter of taxable land), the taxpayer shall declare and submit tax declaration dossier within 30 (thirty) days after the date when such elements arise.

1.3. General declaration of non-agricultural land use tax is required only for residential land.

Taxpayers who are required to make general declarations under this Circular shall make and submit general declarations to the district-level Tax Departments they have chosen and registered.

...

Therefore, the general declaration of non-agricultural land use tax is required only for residential land.

Taxpayers who are required to make general declarations shall make and submit general declarations to the district-level Tax Departments they have chosen and registered.

What type of land applies to the general declaration of non-agricultural land use tax? (Image from the Internet)

What does the non-agricultural land use tax declaration dossier in case of general declaration in Vietnam include?

According to Article 15 of Circular 153/2011/TT-BTC:

Dossiers of declaration of non-agricultural land use tax

1. A dossier of declaration of non-agricultural land use tax payable in a year comprises:

- A declaration of non-agricultural land use tax for each taxable land plot, made according to form No. 01/TK-SDDPNN, for households or individuals, or No. 02/TK-SDDPNN, for organizations, attached to this Circular (not printed herein);

- Copies of papers related to the taxable land plot such as: land use rights certificate, land allocation decision, land lease decision or contract; decision permitting the change of land use purpose;

- Copies of papers proving the taxpayer's eligibility for tax exemption or reduction (if any).

2. A dossier of general declaration of non-agricultural land use tax comprises:

- A general declaration of non-agricultural land use tax, made according to form No. 03/ TKTH-SDDPNN attached to this Circular (not printed herein).

Therefore, according to the regulations, the non-agricultural land use tax declaration dossier in case of general declaration is the general declaration of non-agricultural land use tax made in form No. 03/TKTH-SDDPNN issued together with Circular 153/2011/TT-BTC.

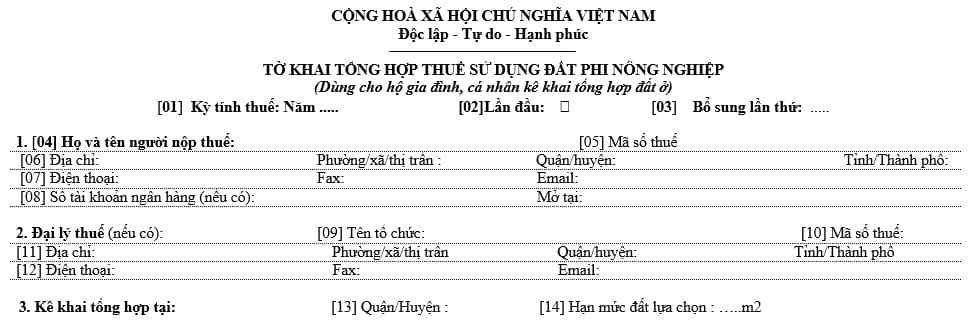

What is the general declaration form of non-agricultural land use tax in Vietnam?

The general declaration form of non-agricultural land use tax - Form No. 03/TKTH-SDDPNN applies to households and individuals aggregately declaring residential land and is issued together with Circular 153/2011/TT-BTC as follows:

Download the general declaration form of non-agricultural land use tax - Form No. 03/TKTH-SDDPNN: Here

What is the non-agricultural land use tax rate for residential land in Vietnam?

According to Article 7 of the Law on Non-agricultural Land Use Tax 2010, the non-agricultural land use tax rate is regulated as follows:

- Tax rates for residential land, including land used for commercial purposes, to be applied according to the Partially Progressive Tariff are specified as follows:

|

Tax grade |

Taxable land area (m2) |

Tax rate (%) |

|

1 |

Area within the set quota |

0.03 |

|

2 |

Area in excess of up to 3 times the set quota |

0.07 |

|

3 |

Area in excess of over 3 times the set quota |

0.15 |

-The residential land quota used as a basis for tax calculation is the new quota of residential land allocation set by provincial-level People’s Committees from the effective date of this Law.

When residential land quotas have been set before the effective date of this Law, the following provisions shall be applied:

+ When the residential land quota set before the effective date of this Law is lower than the new quota of residential land allocation, the new quota will be used as a basis for tax calculation;

+ When the residential land quota set before the effective date of this Law is higher than the new quota of residential land allocation, the old quota will be used as a basis for tax calculation.

- Residential land of multi-story buildings with many households, condominiums or underground construction works is subject to the tax rate of 0.03%.