What is the written request for scrutinizing and adjusting information on payments to the state budget - Form 01/TS in Vietnam?

What is the written request for scrutinizing and adjusting information on payments to the state budget - Form 01/TS in Vietnam?

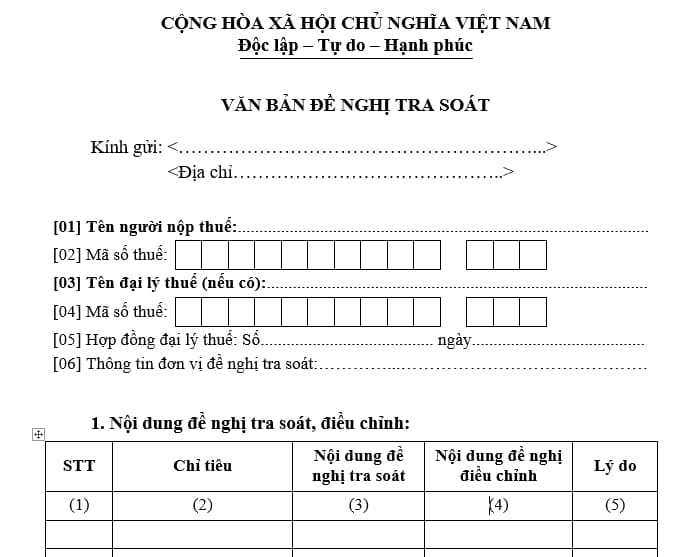

The written request for scrutinizing and adjusting information on payments to the state budget - Form 01/TS in Vietnam is Form 01/TS stipulated in Appendix 1 issued together with Circular 80/2021/TT-BTC:

Download the written request for scrutinizing and adjusting information on payments to the state budget - Form 01/TS in Vietnam: Here

What is the written request for scrutinizing and adjusting information on payments to the state budget - Form 01/TS in Vietnam? (Image from the Internet)

What does the application for scrutinizing and adjusting information on payments to the state budget in Vietnam include?

The components of the application according to Article 69 of Circular 80/2021/TT-BTC and the list of forms in Appendix 1 issued together with Circular 80/2021/TT-BTC include:

- A written request for scrutiny;

- Supporting documents (if any): copies of the taxpayer's documents about payments to state budget or copies of relevant documents, notices, decisions.

What are the procedures for scrutinizing and adjusting information on payments to the state budget if a taxpayer discovers incorrect information declared on the payment documents in Vietnam?

Under sub-item 96, Section 2 of the administrative procedure issued together with Decision 1462/QD-BTC 2022 as follows:

Step 1. The taxpayer discovers that the information recorded in the tax management application system provided periodically by the tax authority is inconsistent with the taxpayer’s monitoring information or finds the information declared on the state budget payment document is incorrect, and submits an application for scrutiny to the tax authority.

If the taxpayer submits the application via electronic transactions: The taxpayer accesses the chosen web portal (either the General Department of Taxation’s Portal/the competent state authority’s web portal, including the National Public Service Portal, the Ministry-level or provincial-level public service portal in accordance with the single-window and interconnected mechanism in administrative procedure settlement, and which is connected to the General Department of Taxation’s Portal (hereinafter referred to as the competent state authority’s web portal)/the service provider’s T-VAN portal), to prepare the declaration application and attached appendices electronically (if any), sign electronically, and send it to the tax authority via the selected web portal.

Step 2. The tax authority accepts:

- If the application is submitted directly to the tax authority or sent via postal service: the tax authority accepts the application as per regulations.- If the application is submitted to the tax authority through electronic transactions, acceptance, inspection, approval, and settlement of the application is conducted through the tax authority’s electronic data processing system:

+ Application acceptance: The General Department of Taxation’s Portal sends an acceptance notification or reason for non-acceptance of the application to the taxpayer via the selected web portal (General Department of Taxation’s Portal/the competent state authority’s web portal or the T-VAN service provider’s portal) within 15 minutes from the receipt of the taxpayer's electronic application.

+ Inspection and settlement of the application: The tax authority inspects and processes the taxpayer’s application according to the Tax Management Law and its guiding documents: The tax authority sends an acceptance/non-acceptance notification of the application for scrutiny to the taxpayer via the selected web portal (General Department of Taxation’s Portal/the competent state authority’s web portal or the T-VAN service provider’s portal) within one (1) working day from the electronic application receipt notification date.

Step 3. The tax authority processes the application for scrutiny

The tax authority cross-checks the taxpayer's information to be scrutinized with the data in the tax management application system. If the tax obligation monitoring information is insufficient, a supplemental information request notification is sent using form 01/TB-BSTT-NNT issued together with Decree 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam detailing some articles of the Tax Management Law for the taxpayer to provide additional explanations, information, and documents. From the date the complete application for scrutiny is received:

+ If the tax obligation monitoring information in the tax management application system is incorrect compared to the tax obligation monitoring base, the tax authority adjusts the information in the system to match the tax obligation monitoring base.

+ If the tax obligation monitoring information is accurate, the tax authority informs the taxpayer that no adjustment will be made.

+ If the content of the required adjustment meets the conditions for information adjustment according to regulations, the tax authority issues a written request for State Budget Collection Adjustment to the State Treasury for adjustment.

Based on the adjustment document information from the State Treasury sent through the General Department of Taxation’s Portal, the tax authority accounts for the adjustment information from the State Treasury, and adjusts the late payment amount increase or decrease arising from the adjustment (if any). Meanwhile, a settlement notification of the scrutiny written request is sent to the taxpayer.

+ If the content of the required adjustment does not meet the conditions, the tax authority notifies the taxpayer of non-adjustment stating the reasons.

Step 4. The tax authority returns the settlement result of the application for scrutiny

The tax authority issues a Notification of adjustment/Non-adjustment of the information to be scrutinized.

- When is the timing for determining overpaid tax for offsetting or refunding in Vietnam?

- What are VAT calculation methods in Vietnam?

- When is an e-invoice issued without the a valid seller's digital signature in Vietnam?

- Vietnam: Shall a VAT invoice include 02 foreign currencies?

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?