What is the VAT declaration form for taxpayers engaging in business operations using the credit-invoice method in Vietnam?

What is the VAT declaration form for taxpayers engaging in business operations using the credit-invoice method in Vietnam?

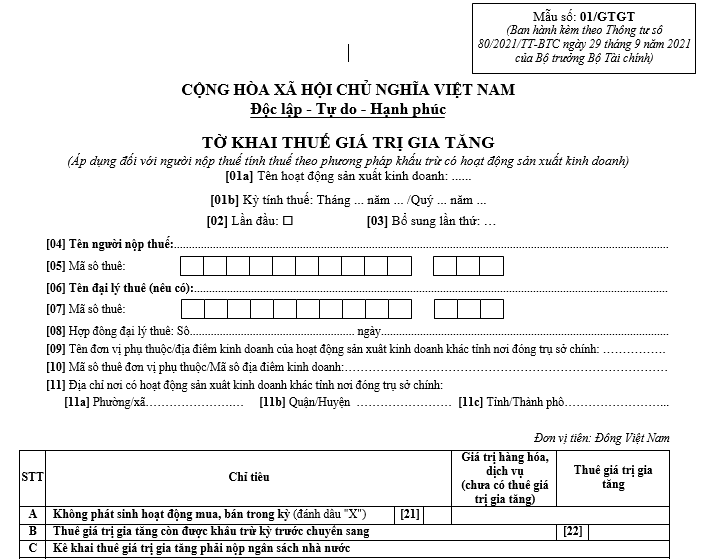

The VAT declaration form used for taxpayers engaging in business operations using the credit-invoice method is form 01/GTGT based on the annex issued with Circular 80/2021/TT-BTC as follows:

Download the VAT declaration form used for taxpayers engaging in business operations using the credit-invoice method.

What is the VAT declaration form for taxpayers engaging in business operations using the credit-invoice method in Vietnam? (Image from Internet)

Which entities are VAT payers in Vietnam under current regulations?

According to the provisions of Article 3 of Circular 219/2013/TT-BTC, VATpayers are organizations and individuals involved in the production and business of goods and services subject to VAT in Vietnam, regardless of the industry, form, or business organization (hereinafter referred to as business establishments) and organizations and individuals importing goods and purchasing services from abroad subject to VAT (hereinafter referred to as importers), including:

(1) Business organizations established and registered under the Law on Enterprises, the Law on State Enterprises (now the Law on Enterprises), the Law on Cooperatives, and other specialized business legislation;

(2) Economic organizations of political organizations, socio-political organizations, social organizations, professional-societal organizations, armed forces units, professional organizations, and other organizations;

(3) Enterprises with foreign investment and foreign parties participating in business cooperation under the Law on Foreign Investment in Vietnam (now the Law on Investment); foreign organizations and individuals conducting business in Vietnam but not forming a legal entity in Vietnam;

(4) Individuals, households, groups conducting independent business activities, and other entities involved in production, business, or import activities;

(5) Organizations and individuals conducting business in Vietnam purchasing services (including services accompanied by goods) from foreign organizations without a permanent establishment in Vietnam, foreign individuals who are non-residents in Vietnam, thereby making the purchasing organization or individual the taxpayer, except for cases not required to declare, calculate, and pay VAT as instructed in clause 2, Article 5 of Circular 219/2013/TT-BTC.

Provisions regarding permanent establishments and non-resident entities are implemented in accordance with the laws on corporate income tax and personal income tax.

(6) Branches of export processing enterprises established to engage in the sale of goods and activities directly related to the sale of goods in Vietnam in accordance with the law on industrial zones, export processing zones, and economic zones.

What is the fine for late submission of a VAT declaration by 45 days in Vietnam?

According to the provisions of Article 13 of Decree 125/2020/ND-CP, late submission of a tax declaration will be subject to fines as follows:

(1) A warning is issued for late submission of tax returns from 01 day to 05 days with mitigating circumstances.

(2) A monetary fine ranging from 2,000,000 VND to 5,000,000 VND for late submission of tax returns from 01 day to 30 days, except in cases specified in Clause 1, Article 13 of Decree 125/2020/ND-CP.

(3) A monetary fine ranging from 5,000,000 VND to 8,000,000 VND for late submission of tax returns from 31 days to 60 days.

(4) A monetary fine ranging from 8,000,000 VND to 15,000,000 VND for any of the following actions:

- Late submission of tax returns from 61 days to 90 days;

- Late submission of tax returns from 91 days and above but with no tax payable;

- Failure to submit tax returns but with no tax payable;

- Failure to submit annexes as required for tax management involving enterprises with related transactions accompanying corporate income tax finalization returns.

(5) A monetary fine ranging from 15,000,000 VND to 25,000,000 VND for late submission of tax returns beyond 90 days from the tax declaration filing deadline, leading to payable taxes, and if the taxpayer has paid the full tax amount, including late payment, into the state budget before the tax authority announces the decision to inspect or audit the tax, or before the tax authority records the delinquent act as per Clause 11, Article 143 of the Tax Administration Law 2019.

Note: The monetary fines mentioned above apply to organizations. The fines for individuals are half those for organizations. For taxpayers who are households or household businesses, penalties similar to those for individuals apply.

Moreover, according to Clause 6, Article 13 of Decree 125/2020/ND-CP, remedial measures for late submission of tax declarations are as follows:

- Requirement to pay the full amount of late tax payment into the state budget in violation cases as stated in Clauses 1, 2, 3, 4, and 5 of Article 13 of Decree 125/2020/ND-CP, where the taxpayer’s late submission results in late tax payments;

- Requirement to submit tax declarations along with the annexes specified at point c and d, clause 4, Article 13 of Decree 125/2020/ND-CP.

Thus, the fine for a delay in submitting a tax declaration by 45 days is from 5,000,000 VND to 8,000,000 VND.