What is the template of the book of withholding VAT (Form No. S08-DNSN) for extra-small enterprises in Vietnam?

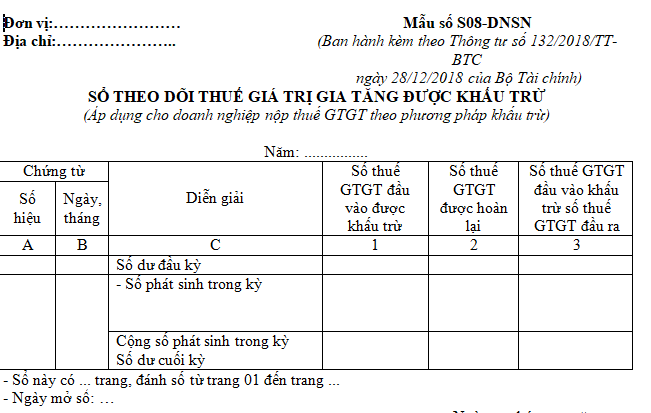

Template of the book of withholding VAT (Form No. S08-DNSN) for extra-small enterprises in Vietnam

The book of withholding VAT template for extra-small enterprises is implemented according to Form No. S08-DNSN issued together with Circular 132/2018/TT-BTC.

DOWNLOAD >>> Template of the book of withholding VAT (Form No. S08-DNSN) for extra-small enterprises in Vietnam

How to fill out the book of withholding VAT (Form No. S08-DNSN) for extra-small enterprises in Vietnam?

Based on Form No. S08-DNSN issued together with Circular 132/2018/TT-BTC, instructions for filling out the book of withholding VAT for extra-small enterprises are as follows:

This book is opened to record according to each voucher concerning deductible VAT and output VAT in the reporting period.

- Column A, B: Record the serial number and date, month of the voucher.

- Column C: Record the description of the economic transaction according to each voucher.

- Column 1: Record the opening balance of deductible input VAT, the deductible VAT arising during the period, and the remaining deductible VAT at the end of the period.

- Column 2: Record the amount of input VAT refunded during the period.

- Column 3: Record the amount of input VAT deducted against the output VAT arising during the period.

At the end of the period, the accountant closes the book, sums up the deductible VAT transactions, VAT that has been deducted, and calculates the remaining deductible VAT or the amount payable by the end of the reporting period.

What is the template of the book of withholding VAT (Form No. S08-DNSN) for extra-small enterprises in Vietnam? (Image from the Internet)

For extra-small enterprises currently applying Circular 133, how should they transfer the balance of accounts 1331 - Deductible VAT if switching to accounting policies under Circular 132?

Pursuant to the provisions of Clause 1, Article 19 of Circular 132/2018/TT-BTC as follows:

Transfer of balances on accounting books

1. For extra-small enterprises currently applying Circular No. 133/2016/TT-BTC, if switching to accounting policies as stipulated in Chapter II of this Circular, the transfer of balances of accounting accounts is as follows:

- The balance of account 112 - Bank deposits and the balance of account 1281 - Term deposits are transferred to account 111 - Cash.

- The balance of accounts 1331 - Deductible VAT of goods and services, account 1332 - Deductible VAT of fixed assets is transferred to account 1313- Deductible VAT;

- The balance of accounts 136 - Internal receivables, account 138 - Other receivables, account 141 - Advances is transferred to account 1318- Other receivables;

- The balance of accounts 152 - Materials, account 153 - Tools and equipment is transferred to account 1521- Materials, tools;

- The balance of account 154 - Incomplete production and business expenses is transferred to account 1524- Incomplete production and business expenses;

- The balance of accounts 155 - Finished products, account 156 - Goods and account 157 - Goods sent for sale is transferred to account 1526- Finished products, goods including details according to management requirements;

- The Debit balance of account 211 - Fixed assets after deducting the Credit balance of account 214 - Depreciation of fixed assets is transferred to Debit balance of account 211 - Fixed assets;

- The balance of account 334 - Payables to employees is transferred to account 3311- Payables to employees;

- The balance of accounts 3382 - Trade union funds, account 3383 - Social insurance, account 3384 - Health insurance, account 3385 - Unemployment insurance is transferred to account 3312- Deductions from wages;

- The balance of accounts 331 - Payables to sellers, account 335 - Payables, account 336 - Internal payables, account 3381 - Other payables and accrued liabilities, account 3386 - Deposits received, account 3387 - Deferred revenue, account 3388 - Other payables and accrued liabilities, account 3411 - Loans and account 3412 - Financial lease liabilities is transferred to account 3318 - Other payables;

- The balance of accounts 33311 - Output VAT, account 33312 - Import VAT is transferred to account 33131 - VAT payable;

- The balance of accounts 3332 - Special consumption tax, account 3333 - Import and export taxes, account 3335 - Personal income tax, account 3336 - Natural resource tax, account 3337 - Land tax, land rent, account 33381 - Environmental protection tax, account 33382 - Other taxes, account 3339 - Fees and other liabilities are transferred to account 33138 - Other taxes, fees, and charges payable to the state;

- The balance of account 4211 - Post-tax profit not distributed from the previous year, account 4212 - Post-tax profit not distributed this year is transferred to account 4118 - Post-tax profit not distributed.

Therefore, for extra-small enterprises currently applying Circular 133/2016/TT-BTC, if switching to accounting policies according to the provisions in Chapter II of Circular 132/2018/TT-BTC, the transfer of the balance of accounts 1331 - Deductible VAT of goods and services, account 1332 - Deductible VAT of fixed assets will be transferred to account 1313- Deductible VAT.