What is the tax declaration form for personal income tax on incomes from transfer, inheritance, or gifts of real estate in Vietnam?

What is the tax declaration form for personal income tax on incomes from transfer, inheritance, or gifts of real estate in Vietnam?

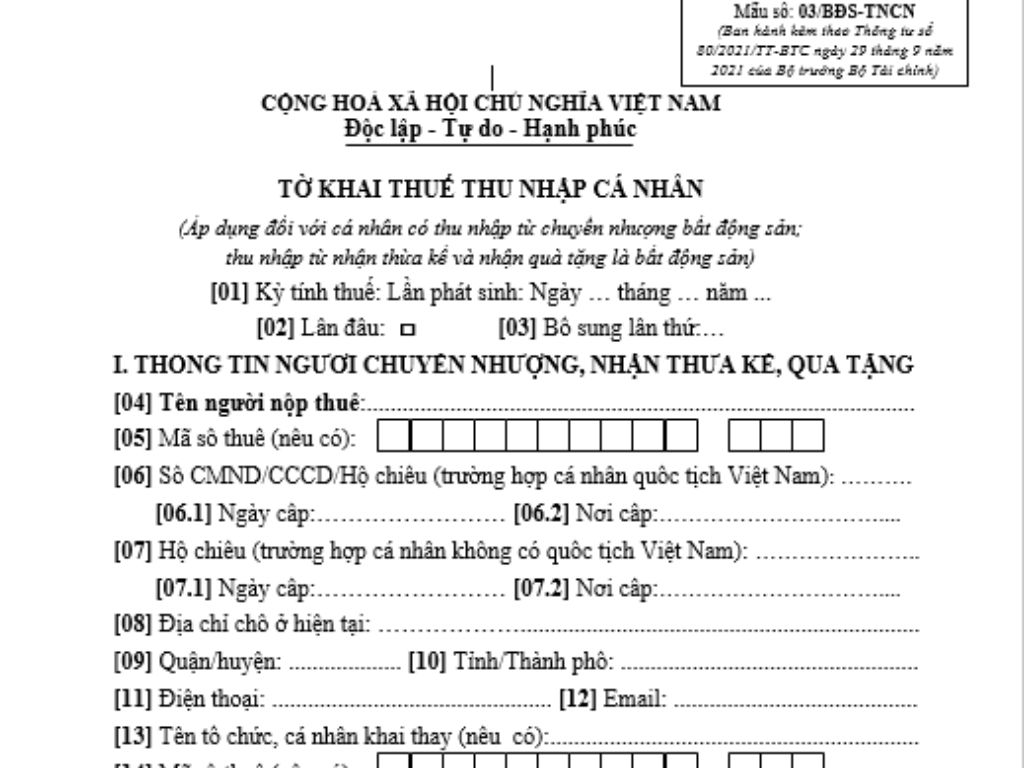

The tax declaration form for personal income tax on incomes from transfer, inheritance, or gifts of real estate is Form No. 03/BDS-TNCN, issued with Appendix II of Circular 80/2021/TT-BTC.

Tax declaration form for personal income tax on incomes from transfer, inheritance, or gifts of real estate Download

What is the tax declaration form for personal income tax on incomes from transfer, inheritance, or gifts of real estate in Vietnam? (Image from the Internet)

When is personal income tax calculated from real estate transfer in Vietnam?

Based on Clause 3, Article 12 of Circular 111/2013/TT-BTC amended by Article 17 of Circular 92/2015/TT-BTC, the basis for calculating personal income tax from real estate transfer income is specified as follows:

The basis for tax calculation on income from real estate transfer

The basis for tax calculation on income from real estate transfer is the transfer price for each transaction and the tax rate.

...

- Tax rate

The tax rate for real estate transfer is 2% of the transfer price or rental price.

3. The time for tax calculation from real estate transfer is determined as follows:

- In the case where the transfer contract does not stipulate that the buyer is the taxpayer on behalf of the seller, the time for tax calculation is the time when the transfer contract becomes effective according to the law;

- In the case where the transfer contract stipulates that the buyer is the taxpayer on behalf of the seller, the time for tax calculation is when the procedures for registration of ownership or use rights for the real estate are completed. In the case of individuals acquiring future housing or land use rights attached to future construction projects, the time is when the individual submits the tax declaration dossier to the tax authority.

...

The time for personal income tax calculation from real estate transfer is determined as follows:

- In the case where the transfer contract does not stipulate that the buyer is the taxpayer on behalf of the seller, the time for tax calculation is the time when the transfer contract becomes effective according to the law;

- In the case where the transfer contract stipulates that the buyer is the taxpayer on behalf of the seller, the time for tax calculation is when the procedures for registration of ownership or use rights for real estate are completed.

In the case of individuals acquiring future housing or land use rights attached to future construction projects, the time is when the individual submits the tax declaration dossier to the tax authority.

Where is the place to declare personal income tax when transferring real estate in Vietnam?

According to Clause 7, Article 11 of Decree 126/2020/ND-CP, it is stipulated:

Place for submitting the tax declaration dossier

...

7. The place for submitting the tax declaration dossier for taxpayers arising with tax obligations regarding land income under Point c, Clause 4, Article 45 of the Tax Administration Law as follows:

...

d) Land rent, water surface rent: Taxpayers submit files determining financial obligations regarding land rent and water surface rent through the one-stop-shop mechanism, which simultaneously serves as the tax declaration dossier (except for cases stipulated in Clause 12, Article 13 of this Decree) at the agency receiving dossiers according to the one-stop-shop mechanism where the land is subject to taxation. In cases where the one-stop-shop mechanism does not apply, submitting dossiers to the tax agency where the land is subject to taxation is applicable.

d) Personal income tax from transferring real estate, inheriting, or gifting real estate:

d.1) Individuals acquiring income from real estate transfer, inheritance, or gifts submit the tax declaration dossier at the agency receiving dossiers on land following the one-stop-shop mechanism where the real estate is located.

d.2) Individuals acquiring income from transferring, inheriting, or receiving gifts in the form of housing, commercial housing, or future construction projects; construction works, housing that have been handed over but not yet issued with Land Use Rights Certificates, House Ownership, and other assets attached to the land following housing law regulations; individuals submitting supplementary tax declaration dossiers in cases where the initial tax declaration dossiers have completed Land Use Rights Certificates procedures; individuals authorizing real estate management as taxpayers under the personal income tax law submit tax declaration dossiers at the tax agency where the real estate is located.

d.3) Individuals having income from transferring, inheriting, or receiving gifts on incomes from overseas real estate submit tax declaration dossiers at the tax agency where the individual resides.

e) Registration fee for houses and land: Organizations and individuals registering Land Use Rights, house ownership, and other assets attached to the land (including cases exempt from registration fees) submit the registration fee declaration dossier at the agency receiving dossiers according to the one-stop-shop mechanism where the real estate is located.

...

According to the above regulations, the place for submitting personal income tax declaration dossiers when transferring real estate is at the agency receiving dossiers on incomes from land where the real estate is located.

Additionally, in cases where individuals transfer real estate but have not yet been issued a Land Use Rights Certificate, House Ownership, and assets attached to the land, the tax declaration dossier is submitted at the tax agency where the real estate is located.