What is the table of risk classification indicators of taxpayers that are enterprises in Vietnam?

What is the table of risk classification indicators of taxpayers that are enterprises in Vietnam?

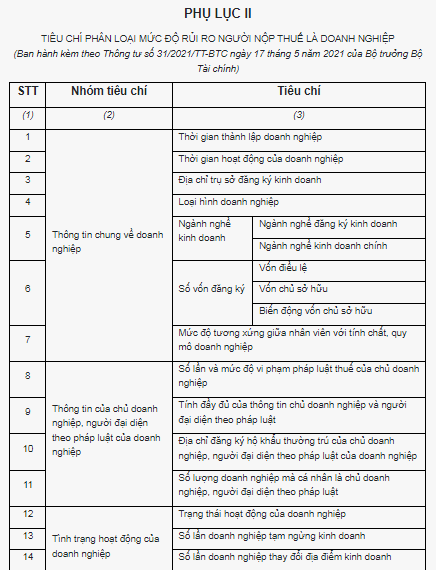

According to Appendix 2, the Table of risk classification indicators of taxpayers that are enterprises, issued together with Circular 31/2021/TT-BTC, as follows:

Download Table of risk classification indicators of taxpayers that are enterprises.

Table of risk classification indicators of taxpayers that are enterprises in Vietnam (Image from Internet)

What are regulations on classification of levels of risks of taxpayers that are enterprises in Vietnam?

Classification of risk levels of taxpayers that are enterprises according to Article 11 of Circular 31/2021/TT-BTC as follows:

- Overall Risk Level Classification

+ Taxpayers as enterprises are classified into one of the following risk levels:

++ Level 1: Very low-risk taxpayers.

++ Level 2: Low-risk taxpayers.

++ Level 3: Medium-risk taxpayers.

++ Level 4: High-risk taxpayers.

++ Level 5: Very high-risk taxpayers.

+ The risk level of taxpayers is classified based on the results of tax law compliance evaluations in Article 10 and the criteria specified in Appendix II of Circular 31/2021/TT-BTC.

+ Handling results of enterprise taxpayer risk level classifications:

++ For taxpayers in the very high-risk and high-risk categories, management measures are applied according to regulations in Article 22 of Circular 31/2021/TT-BTC;

++ Depending on the tax administration needs in each period, taxpayers of other risk levels might continue to be classified for risk in tax administration operations as specified in Clause 2, Article 11 of Circular 31/2021/TT-BTC.

- Classification of Risk Levels in tax administration Operations:

+ The risk level of taxpayers that are enterprises in tax administration operations is classified into one of the following levels:

++ High risk.

++ Medium risk.

++ Low risk.

+ The risk level of taxpayers in tax administration operations is classified based on the risk level rankings of taxpayers specified in Clause 1 of this Article and the criteria defined in Appendix II of Circular 31/2021/TT-BTC.

+ Handling results of risk level classifications:

The results of risk level classification of taxpayers are applied through tax administration measures in each tax administration operation specified in Chapter IV of Circular 31/2021/TT-BTC.

What are the 7 principles of risk management in tax administration in Vietnam?

The principles of risk management in tax administration according to Article 4 of Circular 31/2021/TT-BTC are as follows:

- Apply risk management to ensure the effectiveness and efficiency of tax administration; encourage and facilitate taxpayers' voluntary compliance with tax laws and tax administration while promptly preventing, detecting, and addressing violations of tax laws and tax administration.

- Risk management information is collected from internal and external sources of the tax authority (including information from abroad) as regulated by law; managed centrally at the General Department of Taxation through the information technology system and processed, shared, and provided to tax authorities at all levels and other state management agencies to serve tax administration purposes as stipulated by law.

- Evaluating and classifying tax law compliance levels and taxpayer risk levels are performed automatically, periodically, using one or a combination of the methods specified in Circular 31/2021/TT-BTC, based on legal regulations, tax administration procedures, and methods, based on taxpayer segmentation, criteria, and taxpayer databases.

- Based on the results of tax law compliance evaluations, taxpayer risk level classification, information on tax administration support applications of the tax agency, violation signals, and other risk signals provided at decision-making time, the tax authority performs:

+ Decides on inspection, audit, surveillance, and applies suitable professional measures.

+ Develops an overall compliance improvement plan suitable with the tax agency's resources based on the analysis results of behavior characteristics, causes, and scale of each tax law compliance level and risk level.

- In cases where legal regulations, Circular 31/2021/TT-BTC, and risk management instructions are correctly followed, the tax official is exempted from personal liability as per the law.

- If the risk management application malfunctions or does not meet the requirements for risk management application as specified in Circular 31/2021/TT-BTC, risk management will be manually applied through approved proposals or documents signed by authorized individuals using professional tax administration measures under the Law on Tax Administration and guiding documents.

- When there are changes in information leading to changes in tax law compliance evaluation results and taxpayer risk level classifications, and the risk management application does not automatically adjust compliance and risk levels, the changes in evaluation results are manually updated by the tax official after approval from the authorized person.

- The results of applying professional measures corresponding to risk ranking levels must be fully and accurately updated into the tax administration support applications of the tax authority or the risk management application for each specific case to serve the assessment and classification of taxpayer risk levels in the next period.