What is the royalty-liable price of natural water 2025 in Binh Duong province?

What is the royalty-liable price of natural water 2025 in Binh Duong Province?

The People’s Committee of Binh Duong Province promulgated Decision 70/2024/QD-UBND regarding the table of royalty-liable price within Binh Duong Province, effective from February 1, 2025.

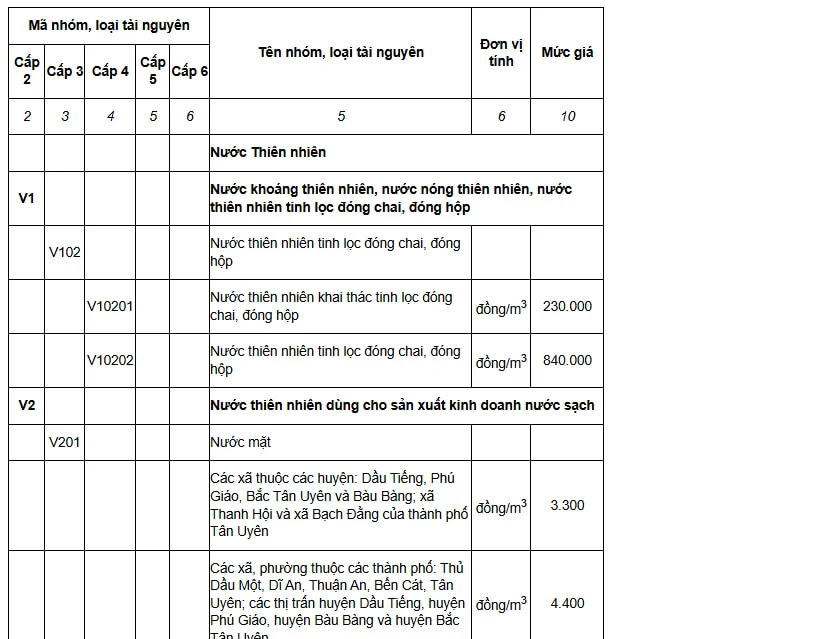

The royalty-liable price for natural water resources is stipulated in Appendix II issued with Decision 70/2024/QD-UBND.

Download the table of royalty-liable price s for natural water resources.

What is the royalty-liable price of natural water 2025 in Binh Duong province? (Image from the Internet)

Is natural water subject to royalties in Vietnam?

According to Article 2 of the 2009 Law on royalties, the object of royalties is defined as follows:

Objects of Taxation

Metallic minerals.

Non-metallic minerals.

Crude oil.

Natural gas, coal gas.

Products of natural forests, excluding animals.

Natural aquatic resources, including marine animals and plants.

7. Natural water, including surface water and groundwater.

Natural bird's nests.

Other resources as prescribed by the Standing Committee of the National Assembly.

Thus, natural water, including surface and groundwater, is subject to royalties.

What is the basis for royalty calculation on natural water in Vietnam?

According to Article 4 of the 2009 Law on royalties, the basis for royalties calculation is the taxable resource output, royalty-liable price , and tax rate. Specifically:

(1) Taxable Resource Output of Natural Water

Based on Clauses 4 and 5, Article 5 of the 2009 Law on royalties, it is stipulated as follows:

Taxable Resource Output

For resources extracted with identifiable quantity, weight, or volume, the taxable output is the actual extracted quantity, weight, or volume in the tax period.

For resources with unsettled quantity, weight, or volume due to various contents and impurities, the taxable output is determined by the quantity, weight, or volume of each obtained substance after sorting and classifying.

Resources not sold but used for producing other products without direct quantification are based on the production output in the tax period and the resource utilization norm per product unit.

For natural water used for hydropower, the taxable output is the electricity output sold to the purchaser as per purchase agreements or in the absence of such agreements, determined according to the Vietnamese standards of measurement, certified by both parties.

For natural mineral water, natural hot water, or water for industrial purposes, the taxable output is measured in cubic meters (m³) or liters (l) in accordance with Vietnamese measurement quality standards.

Thus, the taxable output of natural water resources is determined as follows:

- For natural water used for hydropower, it is the electricity output sold as per purchase contracts or as determined by Vietnamese standards in cases without such contracts, certified by all relevant parties.

- For natural mineral water, natural hot water, or water used industrially, it is measured in cubic meters (m³) or liters (l) according to Vietnamese standards.

(2) royalty-liable price of natural water

According to Article 6 of the 2009 Law on royalties, the royalty-liable price of natural water is determined as follows:

- The royalty-liable price of natural water is the selling price of the unit resource product of the exploiting organizations or individuals, excluding value-added tax.

- If the selling price of natural water resources is not determined, the royalty-liable price is determined by one of the following bases:

+ Actual selling prices in the regional market for the same type of resource product but not lower than the royalty-liable price set by the People’s Committee at the provincial level.

+ For resources with multiple substances, the royalty-liable price is based on the selling price of each substance and its concentration in the extracted resources, not lower than the price set by the provincial authorities.

For natural water used for hydropower, the royalty-liable price is the average commercial electricity selling price.

(3) Tax Rate

According to Article 7 of the 2009 Law on royalties, the schedule of tax rates on natural water resources is as follows:

| No. | Category, Resource Type | Tax Rate (%) |

|---|---|---|

| VII | Natural Water | |

| 1 | Natural mineral water, natural hot water, purified bottled or canned water | 8 - 10 |

| 2 | Natural water used for hydropower | 2 - 5 |

| 3 | Natural water used for production and business, except for the water specified at items 1 and 2 of this group | |

| 3.1 | Surface water | 1 - 3 |

| 3.2 | Groundwater | 3 - 8 |