What is the request form for fulfillment of the guarantor's obligation in Vietnam? What are cases of exemption or termination of guarantee obligations?

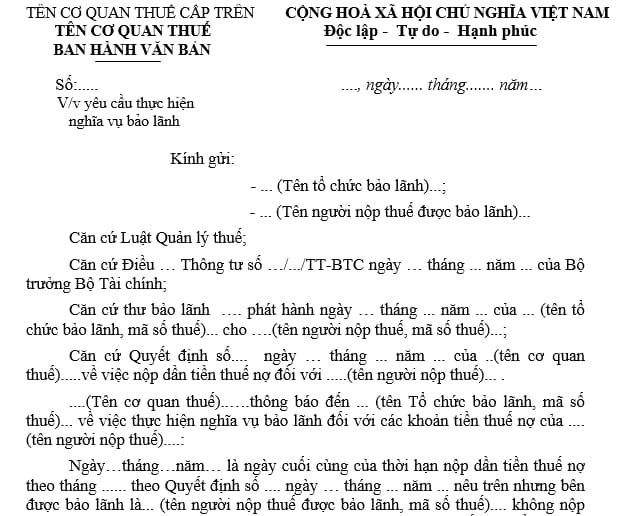

Request form for fulfillment of the guarantor's obligation in Vietnam under Circular 80

Request for fulfillment of the guarantor's obligation is a demand that the guarantor must fulfill commitments to the guarantee recipient in the event the guaranteed party fails to execute or incorrectly executes their obligations.

The request form for fulfillment of the guarantor's obligation is executed according to Form No. 02/NDAN issued with Circular 80/2021/TT-BTC:

Download: Form 02/NDAN - Request form for fulfillment of the guarantor's obligation here.

What are the cases for exemption from fulfillment of the guarantor's obligation in Vietnam?

According to the provisions in Article 21 of Circular 11/2022/TT-NHNN, cases for exemption from fulfillment of the guarantor's obligation include:

- In cases where the guarantee recipient exempts the guarantor or the confirming party from fulfilling their obligations, the guaranteed party must still fulfill their committed obligations to the guarantee recipient, unless otherwise agreed by the parties or according to joint obligation fulfillment as per the law.

- In cases where one or several co-guarantors are exempted from fulfilling their part of the guarantee obligation as per the agreements among relevant parties, other members must still fulfill their part of the guarantee obligation as per the guarantee commitment, unless otherwise agreed by the parties.

What is the request form for fulfillment of the guarantor's obligation in Vietnam according to (Form No. 02/NDAN)?

What are cases for the termination of guarantee obligations?

According to Article 23 of Circular 11/2022/TT-NHNN, the cases for the termination of guarantee obligations include:

- The obligation of the guaranteed party is terminated.

- The guarantee obligation has been fulfilled according to the guarantee commitment.

- The guarantee is canceled or replaced by another security measure as agreed by the guarantee recipient and the guarantor, along with other related parties (if any).

- The guarantee commitment has expired.

- The guarantee recipient exempts the guarantor from fulfilling the guarantee obligation.

- As agreed by the parties.

- The guarantee obligation terminates in other cases as provided by law.

What are the rights of the guarantor in Vietnam?

According to Article 27 of Circular 11/2022/TT-NHNN, the rights of the guarantor are specified as follows:

- Accept or reject the proposal for granting a guarantee.

- Request the confirming party to confirm the guarantee for their guarantee to the guaranteed party.

- Request the guaranteed party or the counter-guarantor and relevant parties to provide information and documents related to guarantee appraisal and secured assets (if any).

- Request the guaranteed party or the counter-guarantor to implement measures to secure the obligation being guaranteed (if necessary).

- Conduct inspection and supervision of the financial status of the customer within the validity of the guarantee.

- Collect guarantee fees, adjust guarantee fees; apply, adjust interest rates, penalty interest rates.

- Refuse to fulfill the guarantee obligation when the request dossier for fulfilling the guarantee obligation is invalid or if there is evidence proving that the presented documents or materials are counterfeit.

- Request the counter-guarantor to fulfill their committed obligation.

- Debit the replacement payment for the guaranteed party (in case of a bank guarantee) immediately upon fulfilling the guarantee obligation according to State Bank regulations; or for the counter-guarantor (in case of a guarantee based on counter-guarantee) immediately when the counter-guarantor fails to fulfill or adequately fulfill their commitment. Request the guaranteed party or counter-guarantor to reimburse the sum paid under commitment.

- Request other co-guarantors to reimburse amounts paid on behalf of the guaranteed party corresponding to the co-guarantee participation ratio agreed upon if the leading co-guarantor fulfills the guarantee obligation.

- Dispose of secured assets as per agreement and legal provisions.

- Transfer their rights and obligations to other credit organizations, foreign bank branches per the agreements from relevant parties in compliance with legal provisions.

- Initiate legal actions as provided by the law when the guaranteed party, counter-guarantor violates their commitments.

- Other rights as per agreements of the parties in accordance with legal provisions.

- Shall the TIN of dependant be changed to a personal TIN in Vietnam?

- Shall an employee with a contract of less than 6 months be subject to enforcement by deduction of money from the taxpayer’ salary or income in Vietnam?

- How long is the tax enforcement decision effective in Vietnam?

- What is the deadline for submitting taxes of the fourth quarter in Vietnam? What types of taxes are declared quarterly in Vietnam?

- Do Lunar New Year gifts valued at 2 million for employees subject to personal income tax in Vietnam?

- What are cases where non-refundable ODA project owners are entitled to refund of VAT in Vietnam?

- What is the form for notification of payment of land and housing registration fee by tax authority in Vietnam according to Decree 126?

- What are 03 conditions for VAT deduction in Vietnam from July 1, 2025?

- Is the e-tax transaction code generated uniformly in Vietnam?

- What crime will be imposed for tax evasion with an amount of from VND 100,000,000 in Vietnam?