What is the purpose of a balance sheet? What are regulations on the principles for preparing and presenting a balance sheet in Vietnam?

What is the purpose of a balance sheet?

Pursuant to point 1.1, clause 1, Article 112 of Circular 200/2014/TT-BTC, the regulation regarding the purpose of a balance sheet is as follows:

- A balance sheet is a comprehensive financial report that provides an overview of the total value of assets available and the sources from which these assets are formed by the enterprise at a specific point in time. The data on the balance sheet provides information about the total current value of the enterprise's assets according to the structure of assets and the structure of capital sources forming these assets. Based on the balance sheet, one can make a general assessment of the financial situation of the enterprise.

What is the purpose of a balance sheet? What are regulations on the principles for preparing and presenting a balance sheet in Vietnam? (Image from the Internet)

What are regulations on the principles for preparing and presenting a balance sheet in Vietnam?

The principles for preparing and presenting a balance sheet are stipulated at point 1.2, clause 1, Article 112 of Circular 200/2014/TT-BTC as follows:

According to the accounting standard "Presentation of Financial Statements," when preparing and presenting the balance sheet, one must adhere to the general principles of preparing and presenting Financial Statements. Moreover, on the balance sheet, Asset and Liability items must be separately presented as short-term and long-term, depending on the normal business cycle period of the enterprise. Specifically:

- For enterprises with a normal business cycle of 12 months, Assets and Liabilities are classified as short-term and long-term based on the following principles for preparing and presenting the balance sheet:

+ Assets and Liabilities expected to be recovered or settled within no more than 12 months from the reporting date are classified as short-term;

+ Assets and Liabilities expected to be recovered or settled from 12 months onwards from the reporting date are classified as long-term.

- For enterprises with a normal business cycle longer than 12 months, Assets and Liabilities are classified as short-term and long-term based on the following conditions:

+ Assets and Liabilities expected to be recovered or settled within one normal business cycle are classified as short-term;

+ Assets and Liabilities expected to be recovered or settled over a period longer than one normal business cycle are classified as long-term.

In this case, the enterprise must clearly disclose the characteristics determining the normal business cycle, the average duration of the normal business cycle, evidence of the production and business cycle of the enterprise as well as the industry and field of business operation.

- For enterprises whose nature of activities does not rely on the business cycle to differentiate between short-term and long-term, Assets and Liabilities are presented in decreasing order of liquidity.

When preparing a combined balance sheet between parent units and subsidiary units without legal status, the parent unit must eliminate all balances of items arising from internal transactions, such as receivables, payables, inter-company loans, etc., between the parent unit and the subsidiary unit, and among the subsidiary units themselves.

Indicators without data are exempted from presentation on the balance sheet. Enterprises proactively reorder the indices in a continuous sequence in each section.

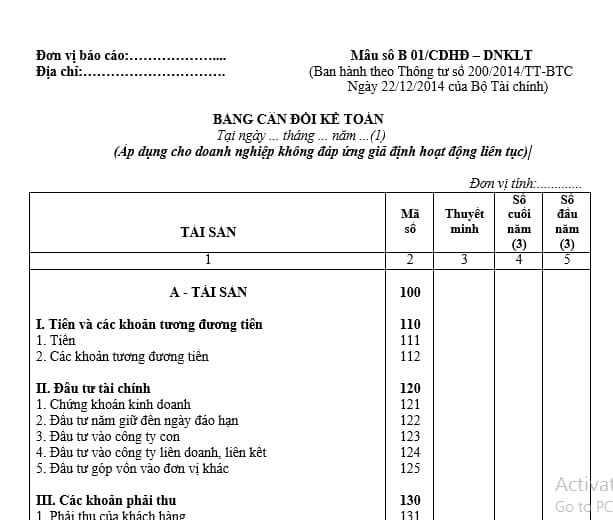

What is the balance sheet template for enterprises failing to meet assumption of continuous operation in Vietnam?

According to Appendix 2 issued with Circular 200/2016/TT-BTC, enterprises failing to meet assumption of continuous operation will use balance sheet Sample No. 01/CDHD – DNKLT.

Download the sample balance sheet for enterprises failing to meet assumption of continuous operation here.

When is an enterprises considered failing to meet assumption of continuous operation?

Pursuant to clause 1, Article 74 of Circular 133/2016/TT-BTC, an enterprise is considered failing to meet assumption of continuous operation in the following case:

- An enterprise is considered failing to meet assumption of continuous operation if, by the end of the operation period, there is no extension application, dissolution, bankruptcy, cessation of operations (specific documentation must be sent to the competent authority) within no more than 12 months from the date of preparing the Financial Statements. For enterprises with a usual production and business cycle longer than 12 months, it should not exceed one usual production and business cycle.