What is the Pi Network price in VND today? Does the Ministry of Finance of Vietnam lead the research on legal documents concerning taxes related to virtual currencies?

What is the Pi Network price in VND today?

As of the morning of February 27, 2025 (around 10:30 AM Vietnam time), there is no officially unified price for Pi Network (PI) from all sources, as this price depends on trading on decentralized exchanges and markets.

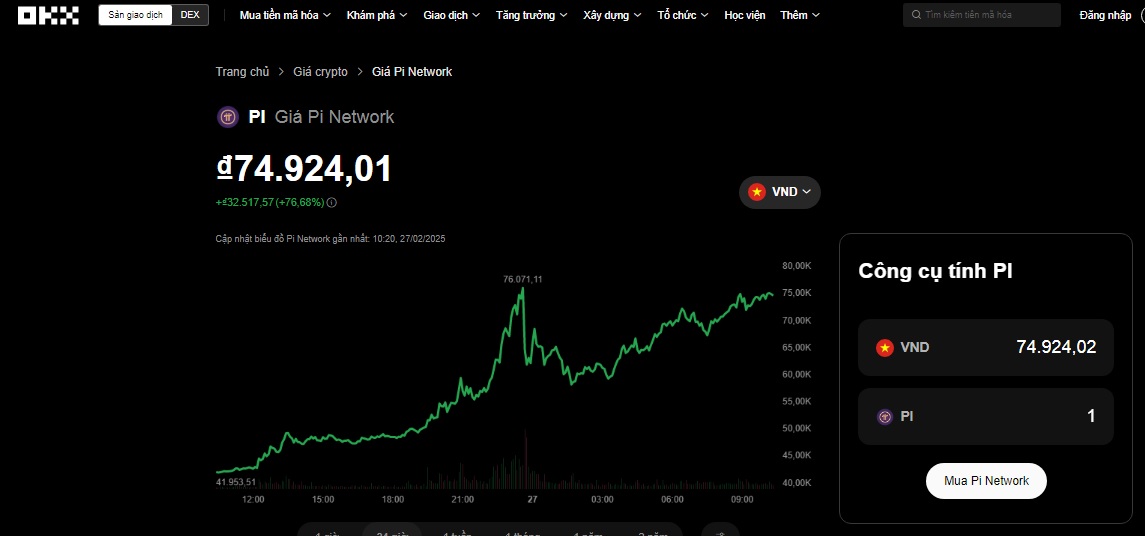

However, based on information from the OKX exchange, where Pi Network was listed after the mainnet officially opened on February 20, 2025, today's Pi Network price chart is listed on OKX as follows:

Accordingly, if converted to VND (with an average exchange rate of about 25,000 VND/USD at this time), the Pi Network price today could be approximately 75,000 VND/1 Pi.

After the mainnet opened on February 20, 2025, the starting price of Pi was around 1.97 USD, then it sharply dropped to 0.65-0.8 USD on the first day, and gradually recovered. By February 26-27, the price rose again due to expectations from the listing vote on Binance (results expected to be announced today, February 27) and reduced selling pressure.

Note: The cryptocurrency market frequently experiences strong fluctuations, so investors should closely monitor exchanges and market information to update the current value of Pi Network.

What is the Pi Network price in VND today? (Image from the Internet)

Is income from Pi Network taxable in Vietnam?

Based on Clause 1, Article 3 of the Personal Income Tax Law 2007, amended by Clause 1, Article 2 of the Law on Amendments to Various Tax Laws 2014, which states:

Taxable Income

Taxable personal income includes the following types of income, excluding tax-exempt income specified in Article 4 of this Law:

- Income from business, including:

a) Income from production and business activities of goods and services;

b) Income from independent practice activities of individuals with licenses or practicing certificates as prescribed by law.

The business income specified in this clause does not include income of individuals with business revenue of 100 million VND/year or less.

...

In addition, based on Official Dispatch 5747/NHNN-PC 2017 of the State Bank of Vietnam which guides as follows:

Based on the above-mentioned regulations, virtual currencies in general and Bitcoin, Litecoin in particular are not currencies and are not legal payment instruments as per the laws of Vietnam. The issuance, provision, and use of virtual currencies in general and Bitcoin, Litecoin in particular (illegal payment instruments) as currency or payment means is prohibited. Sanctions against such acts are stipulated in Decree 96/2014/ND-CP by the Government of Vietnam on dealing with administrative violations in the monetary and banking sector and Ciminal Code 2015 (as amended and supplemented). Additionally, regarding investment in virtual currencies, the State Bank of Vietnam has repeatedly warned that such investment carries significant risks for investors.

Simultaneously, according to Clause 6, Article 26 of Decree 88/2019/ND-CP, amended by point d, Clause 15, Article 1 of Decree 143/2021/ND-CP, which regulates violations of regulations on payment activities as follows:

Violations of regulations on payment activities

...

- A fine ranging from 50,000,000 VND to 100,000,000 VND shall be imposed for one of the following violations:

...

d) Issuing, providing, using illegal payment instruments that have not yet reached the level of criminal liability;

...

Thus, it can be seen that Pi Network is not a currency and not a legal payment instrument according to Vietnamese law, so trading in Pi Network is illegal. Therefore, income from Pi Network is not subject to personal income tax.

However, note that if trading Pi Network without reaching a level warranting criminal liability, one may be fined from 50,000,000 VND to 100,000,000 VND.

Note: The above-mentioned fine applies to individuals; the fine for organizations is 2 times the fine for individuals (point b, Clause 3, Article 3 of Decree 88/2019/ND-CP).

Does the Ministry of Finance of Vietnam lead the research on legal documents concerning taxes related to virtual currencies?

According to Section 4, Part 2 of Decision 1255/QD-TTg 2017 concerning the approval of the Scheme for Completing the Legal Framework to Manage and Address Virtual Assets, Electronic Currencies, and Virtual Currencies issued by the Prime Minister of the Government of Vietnam, the following is specified:

TASKS

...

- Research, propose amendments, supplements, and issue new legal documents on taxation concerning virtual assets, virtual currencies

a) Activity: Research, propose amendments, supplements, enact new legal documents on taxation relating to virtual assets, virtual currencies.

b) Output: Dossier requesting the formulation of legal documents on taxation related to virtual assets, virtual currencies in accordance with the Law on Promulgation of Legal Documents 2015.

c) Completion time: June 2019.

d) Lead agency: Ministry of Finance.

đ) Co-agencies: Ministry of Justice, Ministry of Information and Communications, Ministry of Industry and Trade, Ministry of Public Security, Ministry of Science and Technology, Ministry of Planning and Investment, State Bank of Vietnam, Supreme People's Procuracy, Supreme People's Court, Vietnam Chamber of Commerce and Industry, Vietnam Small and Medium Enterprise Association and other ministries and central authorities concerned.

Thus, the Ministry of Finance is tasked with researching, proposing amendments, supplements, and issuing new legal documents concerning taxes related to virtual assets and virtual currencies.