What is the Perpetual Calendar 2025 - detailed Lunar and Gregorian calendars 2025? What is the tax return submission schedule in Vietnam for January 2025?

What is the Perpetual Calendar 2025 - detailed Lunar and Gregorian calendars 2025?

The year 2025, according to the 12 Zodiac cycle in the lunar calendar, is referred to as the year of At Ty, associated with the symbol of the Snake. This year holds special significance in Eastern culture, as the snake is considered a symbol of wisdom, mystery, and flexibility. The year of At Ty begins on January 29, 2025, in the Gregorian calendar, which corresponds to the 1st day of the lunar New Year, and will end on February 16, 2026, corresponding to the 29th day of the lunar December.

Notably, the year 2025 includes the occurrence of a leap month in the lunar calendar cycle. This leap month falls in the 6th lunar month, bringing the total number of months in the lunar year to 13 instead of the usual 12 months. The leap month not only serves the purpose of adjusting time in the lunar calendar to synchronize with the cycles of the Moon and the Sun but also affects cultural activities, festivals, and the calculation of auspicious days in the year.

View the Perpetual Calendar 2025 - specific and detailed Lunar and Gregorian calendars 2025 below:

Perpetual Calendar 2025 - Lunar and Gregorian calendar January 2025

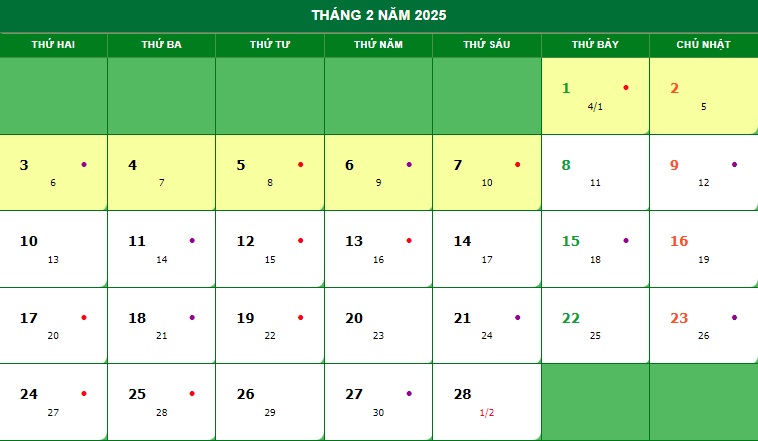

Perpetual Calendar 2025 - Lunar and Gregorian calendar February 2025

Perpetual Calendar 2025 - Lunar and Gregorian calendar March 2025

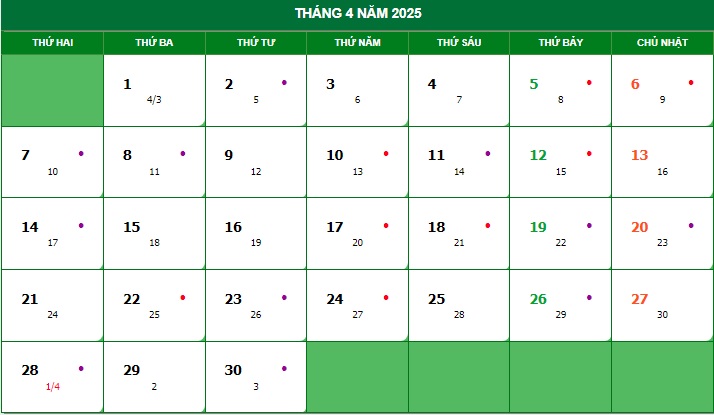

Perpetual Calendar 2025 - Lunar and Gregorian calendar April 2025

Perpetual Calendar 2025 - Lunar and Gregorian calendar May 2025

Perpetual Calendar 2025 - Lunar and Gregorian calendar June 2025

Perpetual Calendar 2025 - Lunar and Gregorian calendar July 2025

Perpetual Calendar 2025 - Lunar and Gregorian calendar August 2025

Perpetual Calendar 2025 - Lunar and Gregorian calendar September 2025

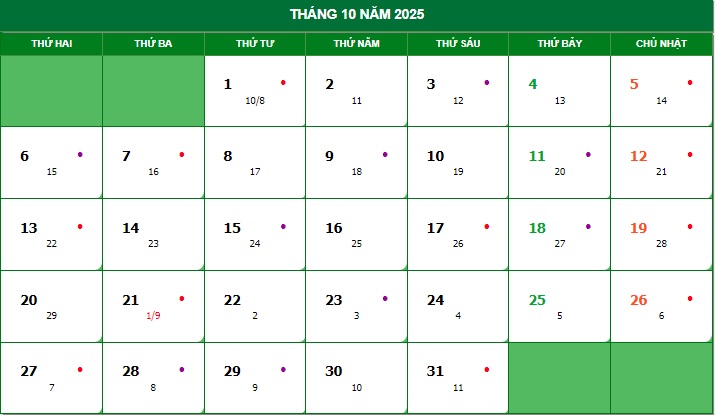

Perpetual Calendar 2025 - Lunar and Gregorian calendar October 2025

Perpetual Calendar 2025 - Lunar and Gregorian calendar November 2025

Perpetual Calendar 2025 - Lunar and Gregorian calendar December 2025

What is the Perpetual Calendar 2025 - detailed Lunar and Gregorian calendars 2025? (Image from the Internet)

What is the tax return submission schedule in Vietnam for January 2025?

Below is the tax report submission schedule for January 2025:

| Date | Type of Report | Deadline | Legal Basis |

| January 15, 2025 | Report on the operation status of tax agents for 2024 | No later than January 15 annually, tax agents must submit the operation status report according to Form 2.9 in the Appendix issued with Circular 10/2021/TT-BTC. | Based on Clause 8, Article 24 Circular 10/2021/TT-BTC |

| January 20, 2025 | - VAT return for December 2024 - Personal income tax return for December 2024 |

Deadline for monthly tax return filing is no later than the 20th day of the month following the month in which the tax obligation arises. | Based on Clause 1, Article 44 Law on Tax Administration 2019 |

| January 30, 2025 | Financial statements for 2024 (for state enterprises, private enterprises, partnerships) choosing the fiscal year 2024 as January 1, 2024 - December 31, 2024 | - The accounting unit must submit the annual financial report no later than 30 days from the end of the fiscal year; for parent companies and State Corporations no later than 90 days; - Private enterprises and partnerships accounting units must submit financial reports no later than 30 days from the end of the fiscal year; for other accounting units, the deadline is no later than 90 days; |

Based on Article 109 Circular 200/2014/TT-BTC |

| January 30, 2025 | Business license tax declaration (except for business households and individual businesses) | Business license fee payers (except for business households and individual businesses) newly established (including small and medium enterprises transformed from business households) or establishing additional dependent units, business locations or beginning production or business activities must submit the business license tax declaration no later than January 30 of the year following the year of establishment or commencement of production or business activities. | Based on Clause 1, Article 10 Decree 126/2020/ND-CP Based on Clause 9, Article 18 Decree 126/2020/ND-CP |

What is the penalty for late submission of the VAT return for January?

Based on Article 13 Decree 125/2020/ND-CP regarding the penalty for late submission of the tax return for January as follows:

(1) A warning for submitting the VAT return late from 01 to 05 days with mitigating circumstances.

(2) A fine ranging from 2,000,000 VND to 5,000,000 VND for submitting the VAT return late from 01 to 30 days, except as provided in Clause 1, Article 13 Decree 125/2020/ND-CP

(3) A fine ranging from 5,000,000 VND to 8,000,000 VND for submitting the VAT return late from 31 to 60 days.

(4) A fine ranging from 8,000,000 VND to 15,000,000 VND for any of the following acts:

- Submitting the VAT return late from 61 to 90 days;

- Submitting the VAT return late from 91 days or more without incurring tax liabilities;

- Not submitting the VAT return but without incurring tax liabilities;

(5) A fine ranging from 15,000,000 VND to 25,000,000 VND for submitting the VAT return more than 90 days late from the deadline for submission of the tax return, with tax liabilities incurred, and the taxpayer has paid the full amount of tax and late payment to the state budget before the tax authority announces the tax inspection or audit decision or before the tax authority makes a record of the late tax return submission according to the provision in Clause 11, Article 143 Law on Tax Administration 2019.

In the case where the fine if applied according to this clause exceeds the tax amount incurred on the tax return, then the maximum fine for this case is the amount of tax incurred to be paid on the tax return but not less than the average of the fine frame stipulated in Clause 4, Article 13 Decree 125/2020/ND-CP

Simultaneously, individuals committing such violations must implement measures to overcome the consequences:

- Be required to fully pay the late payment amount to the state budget for acts in Clause 1, 2, 3, 4, and 5, Article 13 Decree 125/2020/ND-CP in case the taxpayer's late submission of the VAT return leads to late payment of tax;

- Required to submit the tax return, supplementary annexes with the tax return for acts specified at Point c, d, Clause 4, Article 13 Decree 125/2020/ND-CP

Note: The penalty levels for late submission of the VAT return mentioned above apply to organizational violations. For individuals committing the same violations, the penalty amount is 1/2 of the monetary penalty for organizations (as per Clause 5, Article 5 Decree 125/2020/ND-CP)