What is the Official Dispatch template for registration to participate in the Tax Incentive Program for automobile production and assembly in Vietnam?

What is the Official Dispatch template for registration to participate in the Tax Incentive Program for automobile production and assembly in Vietnam?

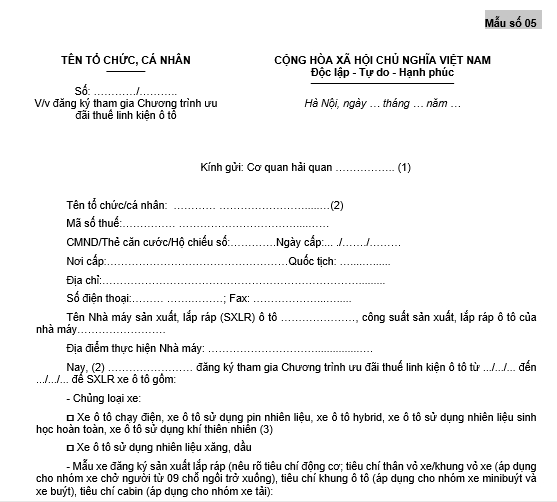

The Official Dispatch template for registration to participate in the Tax Incentive Program for automobile production and assembly is Form No. 05, Appendix 2, issued together with Decree 26/2023/ND-CP.

>> Download the Official Dispatch template for registration to participate in the Tax Incentive Program for automobile production and assembly.

What is the Official Dispatch template for registration to participate in the Tax Incentive Program for automobile production and assembly in Vietnam? (Image from the Internet)

Who is eligible to apply for the Tax Incentive Program for automobile production and assembly in Vietnam?

Based on the provisions of Clause 2, Article 8 Decree 26/2023/ND-CP as follows:

Preferential import tax rates for automobile components imported under the Tax Incentive Program for automobile production and assembly (Tax Incentive Program)

...

2. Subjects of application

Enterprises with a Certificate of Eligibility for automobile production and assembly issued by the Ministry of Industry and Trade.

3. Conditions of application

a) Imported automobile components must meet the following conditions:

a.1) Automobile components listed in group 98.49 that are not produced domestically and are used for automobile production and assembly during the incentive assessment period (including stock components from previous incentive assessment periods used for assembling automobiles in subsequent incentive assessment periods). The determination of components not produced domestically is based on the Ministry of Planning and Investment's regulations on the list of raw materials, supplies, and semi-finished products produced domestically.

a.2) Imported automobile components must be imported directly by the enterprises producing and assembling automobiles, or by authorized parties, or imported through consignment.

a.3) In the case of imported component kits (including imports from various sources and shipments), which include automobile bodies and frames, the following must be met:

The automobile body must consist of at least the following parts: roof assembly, floor assembly, left side assembly, right side assembly, front assembly, rear assembly, and connecting panels (if any) which are separate and have not been electrostatically painted;

Automobile frames: those under 3.7 meters long, whether connected or not, must not be electrostatically painted; those 3.7 meters or longer, whether connected or not, can be electrostatically painted before import.

a.4) Imported automobile components must not include items in group 87.07 (vehicle bodies, including cabins).

b) For enterprises producing and assembling electric vehicles, fuel cell vehicles, hybrid vehicles, vehicles using entirely biofuel, or vehicles using natural gas, there is no need to register the vehicle model when participating in the Tax Incentive Program.

b.1) Enterprises are not required to meet the minimum output condition in the first registration period for the Tax Incentive Program and the subsequent consecutive incentive assessment period; if the conditions specified in Clause 2, Point a Clause 3, Clause 4, Clause 6, Clause 7, Clause 8 of this Article are met, a 0% tax rate will be applied to all imported components used for producing and assembling vehicles that the enterprise has registered to participate in the Tax Incentive Program liberated during the incentive assessment period.

b.2) In subsequent incentive assessment periods, enterprises must meet the minimum output condition specified in Point b Clause 5 of this Article and satisfy the conditions specified in Clause 2, Point a Clause 3, Clause 4, Clause 6, Clause 7, Clause 8 of this Article to benefit from a 0% tax rate for all imported components used for producing and assembling vehicles that meet the minimum production conditions during the incentive assessment period.

...

The subjects eligible for the Tax Incentive Program for automobile production and assembly are enterprises that have a Certificate of Eligibility for automobile production and assembly issued by the Ministry of Industry and Trade. Additionally, these enterprises must meet the specified conditions.

What is the new preferential import tax rate for imported automobile components under the Tax Incentive Program in Vietnam?

Based on the provisions of Clause 1, Article 8 Decree 26/2023/ND-CP as follows:

Preferential import tax rates for automobile components imported under the Tax Incentive Program for automobile production and assembly (Tax Incentive Program)

1. The preferential import tax rate of 0% will be applied to automobile components in group 98.49 in Clause 3, Section II, Appendix II issued together with this Decree as follows:

a) At the time of customs declaration registration, the declarant must declare and calculate the tax on imported goods according to the usual import tax rate, preferential import tax rate, or special preferential import tax rate as regulated, without applying the 0% preferential import tax rate in group 98.49.

b) The 0% preferential import tax rate for automobile components in group 98.49 will be applied as specified in Clause 2, Clause 3, Clause 4, Clause 5, Clause 6, Clause 7, Clause 8 of this Article.

Thus, the new preferential import tax rate for imported automobile components under the Tax Incentive Program is determined to be 0% for automobile components in group 98.49 in Clause 3, Section 2, Appendix 2 issued together with Decree 26/2023/ND-CP when certain conditions are met.