What is the notice template of non-adjustment of fixed tax payable - Template No. 01/TBKDC-CNKD in Vietnam?

What is the notice template of non-adjustment of fixed tax payable - Template No. 01/TBKDC-CNKD in Vietnam?

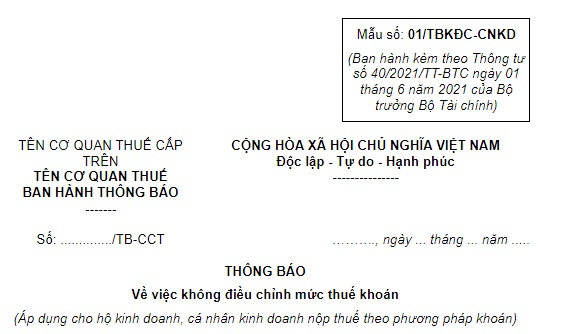

The notice template of non-adjustment of fixed tax payable - Template No. 01/TBKDC-CNKD applicable to household and individual businesses paying fixed taxes is Template No. 01/TBKDC-CNKD, issued in conjunction with Circular 40/2021/TT-BTC as follows:

>> Download Template No. 01/TBKDC-CNKD: Download

What is the definition of fixed tax payment in Vietnam?

Under Article 3 of Circular 40/2021/TT-BTC:

Definitions

...

7. “fixed tax payment” means payment of a fixed amount of proportional tax on a fixed amount of revenue determined by the tax authority as prescribed by Article 51 of the Law on Tax Administration.

8. “household businesses and individual businesses paying fixed tax” are household businesses and individual businesses that fail to comply with or fully comply with regulations on accounting, invoices and documents, except household businesses and individual businesses paying tax under periodic or separate declarations.

9. “fixed tax” means a fixed amount of tax and other amounts payable to state budget by household businesses and individual businesses that have to pay fixed tax determined by tax authorities as prescribed in Article 51 of the Law on Tax Administration.

According to this regulation, the fixed tax payment is understood as the method of calculating VAT and PIT by the proportional tax on a fixed amount of revenue determined by the tax authority to calculate the fixed tax payable.

Thus, fixed tax payment can be understood as household or individual businesses paying VAT and PIT by the proportional tax on a fixed amount of revenue determined by the tax authority.

Household businesses and individual businesses paying fixed tax are household businesses and individual businesses that fail to comply with or fully comply with regulations on accounting, invoices and documents, except household businesses and individual businesses paying tax under periodic or separate declarations.

What is the notice template of non-adjustment of fixed tax payable - Template No. 01/TBKDC-CNKD in Vietnam? (Image from the Internet)

Are household businesses and individual businesses paying fixed taxes in Vietnam required to do accounting?

Under Article 7 Circular 40/2021/TT-BTC on the method and basis for calculating fixed tax payable by household businesses and individual businesses:

Article 7. Method and basis for calculating fixed tax payable by household businesses and individual businesses

1. Fixed tax shall be paid by household businesses and individual businesses other than those paying tax under periodic declarations and separate declarations prescribed in Article 5 and Article 6 of this Circular.

2. Household businesses and individual businesses paying fixed tax (hereinafter referred to as “fixed tax payers”) are not required to do accounting. Fixed tax payers shall retain and present to tax authorities the invoices, contracts, documents proving the legality of their goods and services when applying for issuance or sale of separate invoices. Fixed tax payers having business operation at bordering markets, checkpoint markets, markets within border-gate economic zones in Vietnam shall retain invoices, contracts, documents proving the legality of their goods and present them at the request of competent authorities.

...

Thus, household businesses and individual businesses paying fixed tax (hereinafter referred to as “fixed tax payers”) are not required to do accounting.

What is the determination of fixed tax payable in Vietnam?

The fixed tax payable is regulated by Article 51 of the Tax Administration Law 2019 as follows:

Fixed tax payable by household businesses and individual businesses

1. Tax authorities shall determine the fixed tax payable by household businesses and individual businesses who fail to comply with or fully comply with regulations on accounting, invoices and documents, except for the cases in Clause 5 of this Article.

2. Tax authority shall impose fixed tax according to declarations of household businesses and individual businesses, the database of tax authorities, and comments of Tax Advisory Council of the commune.

3. Fixed tax shall be imposed by calendar year (or by month for seasonal business). Fixed tax shall be published in the commune. The taxpayers shall inform the tax authority when changing their business lines or scale, suspend or shut down the business in order to adjust the fixed tax.

4. The Minister of Finance shall specify the bases and procedures for determination of fixed tax payable by household businesses and individual businesses.

5. Household businesses and individual businesses whose revenues and employees reach the upper limit for extra-small enterprises prescribed by regulations of law on small and medium enterprises shall do accounting and declare tax.

The fixed tax shall be imposed by calendar year (or by month for seasonal business).