What is the notice form of invoice destruction result in Vietnam?

Does the invoice destruction dossier include a notice of invoice destruction result in Vietnam?

According to Article 27 of Decree 123/2020/ND-CP, it is stipulated as follows:

- Enterprises, economic organizations, households, and individual businesses with invoices that are no longer used must carry out the destruction of the invoices. The deadline for invoice destruction is no later than 30 days from the date of notification to the tax authority. In cases where the tax authority has notified that the invoice is no longer valid (except in cases of notification due to enforcement measures for tax debt), the enterprise, economic organization, household, or individual business must destroy the invoice within no later than 10 days from the date the tax authority notifies it is no longer valid or from the date the lost invoice is found.

Additionally, invoices already issued by accounting units are destroyed according to the provisions of the accounting law.

Invoices that have not yet been issued but are evidence in cases are not destroyed and are handled according to the law.

- The destruction of invoices by enterprises, economic organizations, households, and individual businesses is carried out as follows:

+ Enterprises, economic organizations, households, and individual businesses must prepare an inventory list of invoices to be destroyed.

+ Enterprises, economic organizations must establish an Invoice Destruction Council. The council must include representation from the leadership and the accounting department of the organization. Households and individual businesses are not required to establish a council when destroying invoices.

+ Members of the Invoice Destruction Council must sign the invoice destruction record and are legally responsible for any errors.

Simultaneously, the invoice destruction dossier includes:

- Decision to establish the Invoice Destruction Council, except for households and individual businesses;

- Detailed inventory list of invoices to be destroyed: Name of invoice, sample number symbol, invoice symbol, number of invoices to be destroyed (from number... to number... or listing each invoice number if the numbers are not consecutive);

- Record of invoice destruction;

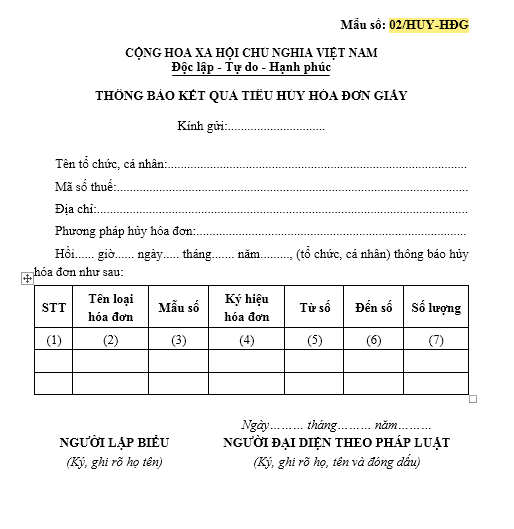

- notice of invoice destruction result must include: type, symbol, number of invoices from number... to number, reason for destruction, date and time of destruction, method of destruction according to Sample No. 02/HUY-HDG Appendix IA issued with this Decree.

The invoice destruction dossier is retained at the enterprise, economic organization, household, or individual business using invoices. Specifically, the notice of invoice destruction result is made in 2 copies, one is kept, and one is sent to the direct managing tax authority no later than 5 days from the invoice destruction date.

* The invoice destruction by the tax authority is executed as follows:

- The Tax Authority carries out the destruction of invoices printed by the Tax Department that have issued notifications without sale or distribution but are no longer used.

- The General Department of Taxation is responsible for defining the invoice destruction procedure for invoices printed by the Tax Department.

Thus, it can be seen that the invoice destruction file needs to include the following 4 types of documents, among which must be the notification form for the invoice destruction result:

[1] Decision to establish the Invoice Destruction Council, except for households and individual businesses;

[2] Detailed inventory list of invoices to be destroyed.

[3] Record of invoice destruction;

[4] notice of invoice destruction result must comply with Form No. 02/HUY-HDG of this Decree.

What is the notice form of invoice destruction result in Vietnam? (Image from the Internet)

What is the notice form of invoice destruction result in Vietnam?

According to Appendix IA issued with Decree 123/2020/ND-CP, the notice form of invoice destruction result is Form No. 02/HUY-HDG as follows:

Download Form notification of paper invoice destruction result 02/HUY-HDG.

Vietnam: Shall the tax authority-ordered printed invoices be destroyed by shredding?

According to Clause 11, Article 3 of Decree 123/2020/ND-CP, it is stipulated as follows:

Definitions

In this Decree, the following terms are understood as:

1. Invoice is an accounting document created and recorded by the organization or individual selling goods or providing services. The invoice may be in the form of electronic invoices or those printed by tax authorities.

...

11. Invoice, document destruction:

a) Destroying electronic invoices and documents means rendering them non-existent in the information system, inaccessible and unreferenceable.

b) Destroying invoices printed by the tax authorities, self-printed or ordered documents, is conducted by burning, cutting, shredding, or other destruction measures ensuring such documents cannot be reused.

...

Thus, based on the above regulation, completely shredding tax authority-ordered printed invoices is permissible.