What is the latest payment request form in Vietnam (Form 05-TT)?

What is the latest payment request form in Vietnam (Form 05-TT)?

In accounting and financial management, payment is a crucial part that ensures transactions are executed transparently and reasonably. To carry out payments conformably, organizations, and enterprises need to use official forms.

Currently, the payment request form is applied according to Form No. 05-TT issued with Circular 200/2014/TT-BTC and Circular 133/2016/TT-BTC. Below are the specific payment request forms that you can choose to use depending on the purpose:

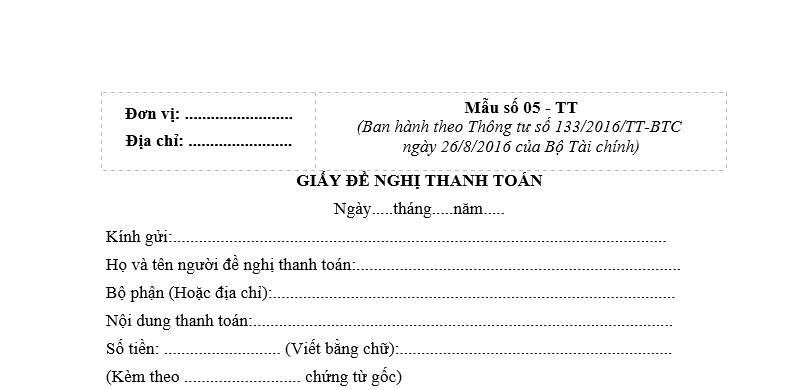

(1) Payment Request Form according to Form 05-TT issued with Circular 133/2016/TT-BTC

According to Article 2 of Circular 133/2016/TT-BTC, the payment request form under Circular 133/2016/TT-BTC will apply to:

- Small and medium-sized enterprises (including micro-enterprises) of all sectors and economic components (except state enterprises, enterprises with over 50% state-owned capital, public companies according to securities law, cooperatives, and cooperative unions).

- Small and medium-sized enterprises in specific sectors such as electricity, oil and gas, insurance, securities... allowed by the Ministry of Finance to apply special accounting policies.

Form No. 05-TT Payment Request Form stipulated in Appendix 3 List, explanation of content, and method of recording accounting documents issued with **** Circular 133/2016/TT-BTC...Download

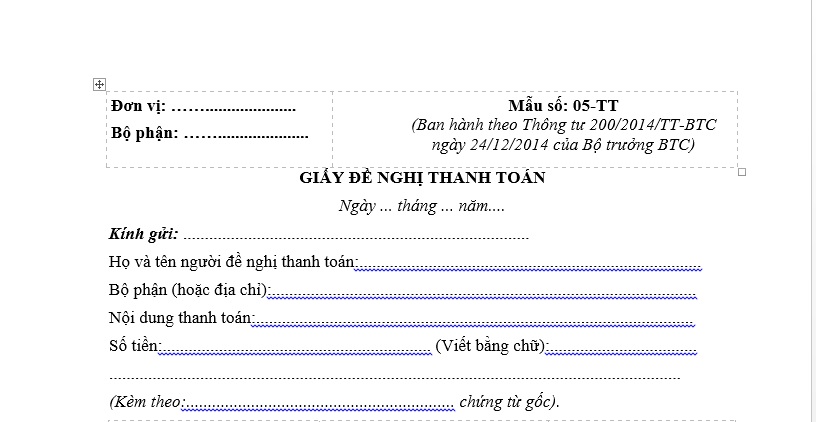

(2) Payment Request Form according to Form 05-TT issued with Circular 200/2014/TT-BTC

According to Article 1 of Circular 200/2014/TT-BTC, the payment request form under Circular 200/2014/TT-BTC will apply to enterprises of all sectors and economic components.

Form No. 05-TT Payment Request Form stipulated in Appendix 3 List and templates of accounting documents issued with Circular 200/2014/TT-BTC... Download

What is the latest payment request form in Vietnam (Form 05-TT)? (Image from the Internet)

Shall small and medium-sized enterprises in Vietnam apply accounting policies under Circular 200/2014/TT-BTC?

Based on Article 3 of Circular 133/2016/TT-BTC regarding the principles of applying accounting policies as follows:

General Principles

1. Small and medium-sized enterprises may choose to apply the Accounting Regime for enterprises issued under Circular No. 200/2014/TT-BTC dated December 22, 2015, by the Ministry of Finance and the documents for amendment, supplementation or replacement but must notify the tax authorities managing the enterprises and must maintain consistency throughout the financial year. In case of reverting to apply the accounting policies for small and medium-sized enterprises under this Circular, it must be implemented from the beginning of the financial year and must be re-notified to the Tax Authority.

- Small and medium-sized enterprises base on accounting principles, content, and structure of accounting accounts stipulated in this Circular to reflect and account for economic transactions in accordance with the characteristics of operations and management requirements of the unit.

- In case during the financial year the enterprise has changes leading to no longer being subject to the application under the provisions of Article 2 of this Circular, it is allowed to apply this Circular until the end of the current financial year and must apply the appropriate Accounting Regime according to the legal provisions starting from the next financial year.

Thus, small and medium-sized enterprises can apply accounting policies under Circular 200/2014/TT-BTC but must notify the tax authorities managing the enterprises and must maintain consistency within the financial year.

In case of reverting to apply accounting policies for small and medium-sized enterprises under Circular 133/2016/TT-BTC, it must be implemented from the beginning of the financial year and must be re-notified to the Tax Authority.

What is the deadline for submitting the financial statements for the year 2025 for small and medium-sized enterprises in Vietnam?

According to the provisions of clause 1, Article 80 of Circular 133/2016/TT-BTC guiding accounting policies for small and medium-sized enterprises on the deadline for preparing and sending financial statements:

Responsibility, deadline for preparing and sending financial statements

- Responsibility, deadline for preparing and sending financial statements:

a) All small and medium-sized enterprises must prepare and send annual financial statements no later than 90 days from the end of the financial year to relevant authorities as prescribed.

b) Besides preparing annual financial statements, enterprises may prepare monthly and quarterly financial statements to serve management and operational requirements of production and business activities of the enterprise.

...

Based on the provisions, all small and medium-sized enterprises must prepare and send annual financial statements no later than 90 days from the end of the financial year to relevant authorities as prescribed.

The accounting period for 2025 is from January 1, 2025, to December 31, 2025, so the deadline for submitting the financial statements for 2024 is March 30, 2026.