What is the latest Hanoi land price list for 2024? Which entities are land use taxpayers in Vietnam?

What is the latest Hanoi land price list for 2024?

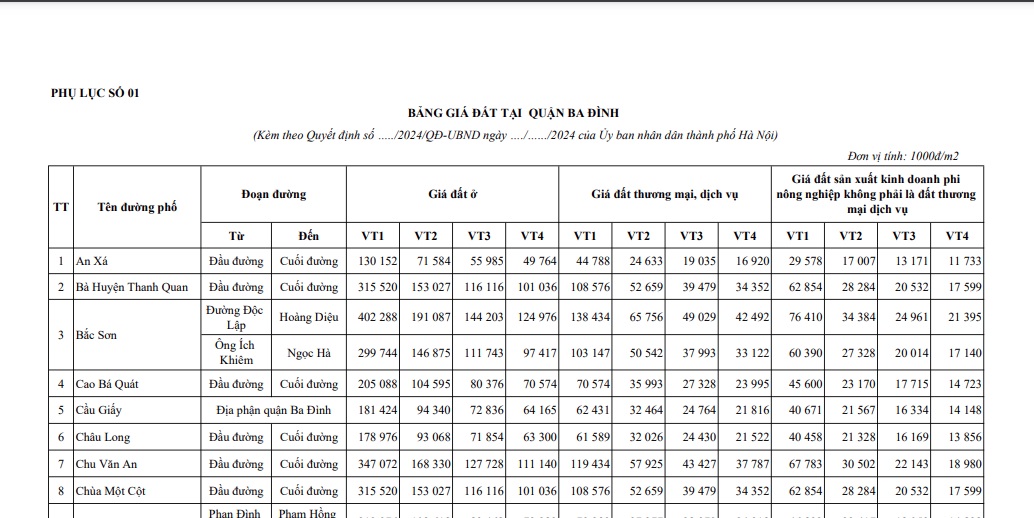

The People's Committee of Hanoi City has recently issued Decision 71/2024/QD-UBND, amending Decision 30/2019/QD-UBND, which stipulates the land price list in the area of Hanoi City, applicable from January 1, 2020, to December 31, 2024.

The latest 2024 Hanoi land price list adjusted according to Decision 71/2024/QD-UBND as follows:

The latest 2024 Hanoi land price list... Download

Additionally, new points in Decision 71/2024/QD-UBND amending Decision 30/2019/QD-UBND regarding the land price list in Hanoi City include the addition and amendment of regulations related to the principles of determining land location, land prices according to parcel depth, and reducing prices based on distance. Specifically, as follows:

(1) Amending the principle of determining the location of non-agricultural land as follows:

In Clause 4, Article 1 Decision 71/2024/QD-UBND, amending Section 2.1, Clause 2, Article 3 of the Regulations attached to Decision 30/2019/QD-UBND regarding the principle of determining land location as follows:

- Location 1: applied to parcels with at least one side (face) adjoining a street listed in the price table attached to this Decision;

- Location 2: applied to parcels with at least one side (face) adjoining an alley, lane, or path (hereinafter collectively referred to as alley) with the narrowest width of the alley (measured from the pavement boundary of the street listed in the land price list to the first boundary of the parcel adjoining the alley) being 3.5 meters or more.

- Location 3: applied to parcels with at least one side (face) adjoining an alley with the narrowest width of the alley (measured from the pavement boundary of the street listed in the land price list to the first boundary of the parcel adjoining the alley) from 2 meters to under 3.5 meters.

- Location 4: applied to parcels with at least one side (face) adjoining an alley with the narrowest width of the alley (measured from the pavement boundary of the street listed in the land price list to the first boundary of the parcel adjoining the alley) under 2 meters.

(2) Amending regulations on prices of homestead land, commercial land, and non-commercial production land in rural areas (including areas bordering urban areas, areas near main thoroughfares, and rural communes) as follows:

In Clause 8, Article 1, and Clause 9, Article 1 amending Decision 71/2024/QD-UBND have amended Clause 3, Article 6; Clause 6, Article 6 Decision 30/2019/QD-UBND regarding prices of homestead land, commercial land, and non-commercial production land in rural areas (including areas bordering urban areas, areas near main thoroughfares, and rural communes) as follows:

- Prices of homestead, commercial, and non-commercial production land in rural areas are specified for each commune in Section 4 - Appendix Nos. 13, 14, 15, 21, 23, 24, 25, 26, 30 Decision 30/2019/QD-UBND applied to residential areas within communes located beyond 200 meters from named main streets specified in Section 3 - Appendix Nos. 14 to 30 Decision 30/2019/QD-UBND.

- For cases where the State allocates or leases land in rural residential areas: production business, industrial clusters, industrial zones, new urban areas, auction sites, resettlement areas connected to roads named in the Price Table, the current road will be used as the basis to apply land prices according to the 4 position categories of the nearest named street in the Price Table and the rural residential area land prices specified in Section 4 - Appendix Nos. 13, 14, 15, 21, 23, 24, 25, 26, 30 Decision 30/2019/QD-UBND are not applicable.

What is the latest Hanoi land price list for 2024? (Image from the Internet)

Who is currently required to pay land use tax in Vietnam?

Land use tax includes: Agricultural land use tax and non-agricultural land use tax.

(1) Subjects liable for agricultural land use tax

According to Article 1 of Decree 74-CP and Article 1 of the Agricultural Land Use Tax Law of 1993, individuals and organizations currently using agricultural production land are responsible for paying agricultural land use tax, including:

+ Individuals, households, and private owners.

+ Individuals and organizations using agricultural land allocated for the community service needs of the commune.

+ Enterprises engaged in agriculture, forestry, and fisheries, including forestry stations, farms, stations, enterprises, and other businesses, public service providers, state agencies, social organizations, armed forces units, and other entities using land for aquaculture, agricultural and forestry production.

(2) Payers of non-agricultural land use tax

Based on Article 4 of the Non-agricultural Land Use Tax Law 2010, payers of non-agricultural land use tax in specific circumstances are as follows:

- Taxpayer is an organization, household, or individual with the right to use land subject to non-agricultural land use tax mentioned above.

- In cases where organizations, households, or individuals have not been granted Certificates of Land Use Rights, Home Ownership, and other assets attached to the land (hereinafter referred to as "Certificate"), the current land user is responsible for paying tax.

- Taxpayers in certain cases are specified as follows:

+ In case the State leases land to perform an investment project, the lessee of homestead land is the taxpayer;

+ In the case where the land rightholder leases land under a contract, the taxpayer is determined according to the agreement in the contract. If the contract does not specify a taxpayer, the rightholder is the taxpayer;

+ In cases where land has been granted a Certificate but is under dispute, until the dispute is resolved, the current land user is the taxpayer. Paying tax is not a basis for resolving land use rights disputes;

+ In cases where multiple people have the right to use a parcel, the taxpayer is the legal representative of those co-using the parcel;

+ In cases where the land rightholder contributes business capital by land use rights and a new legal entity is formed with land rights subject to tax above, the new legal entity is the taxpayer.

How to calculate the non-agricultural land use tax in Vietnam?

According to Article 6 of the Non-agricultural Land Use Tax Law 2010, the calculation of non-agricultural land use tax is specified as follows:

(1) The tax base for land is determined by the taxable land area multiplied by the price per 1m² of land.

(2) The taxable land area is stipulated as follows:

- The taxable land area is the actual land area in use.

If one has the right to use multiple residential parcels, the taxable land area is the total area of all taxable parcels.

If the State allocates or leases land for the construction of an industrial zone, the taxable land area does not include the land area used for shared infrastructure construction;

- For homestead land of multi-layer houses, multi-house dwellings, and apartments, including mixed-use for living and business, the taxable land area is determined by an allocation coefficient multiplied by each organization's, household's, or individual's used area.

The allocation coefficient is determined by dividing the land area for multi-layer, multi-house dwellings, and apartments by the total floor area used by organizations, households, and individuals.

If multi-layer multi-house dwellings or apartment buildings have basements, 50% of the basement area used by organizations, households, and individuals is added to their used area to calculate the allocation coefficient;

- For underground constructions, an allocation coefficient of 0.5 of the land area used is applied, divided by the total area of the structure used by organizations, households, and individuals.

(3) Price per 1m² of land is according to the land price list corresponding to the purpose of use and is stable for a cycle of 5 years.