What is the latest form for public employee classification and assessment in Vietnam at the end of 2024? Who shall pay PIT when statutory pay rate increases from July 01, 2024?

What is the form for public employee classification and assessment in Vietnam in 2024?

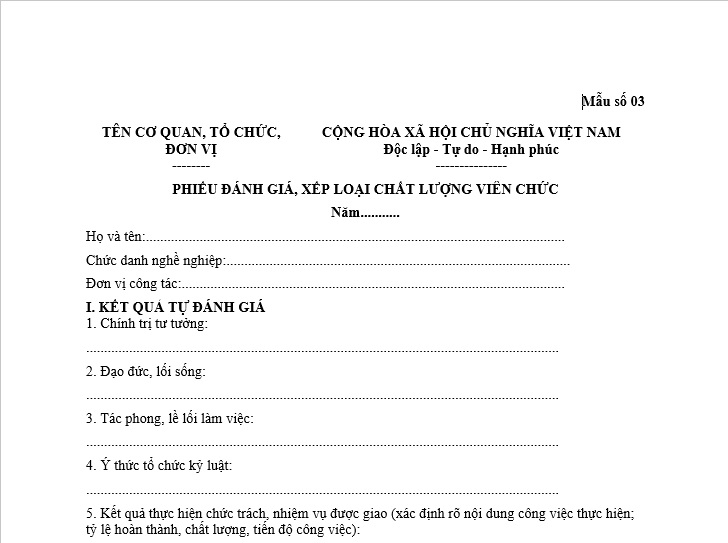

The form for public employee classification and assessment in 2024 is implemented according to Form No. 03 issued with Decree 90/2020/ND-CP.

The latest form for public employee classification and assessment at the end of 2024 is as follows

The latest form for public employee classification and assessment at the end of 2024... Download

What is the latest form for public employee classification and assessment in Vietnam at the end of 2024? (Image from the Internet)

When is the time for annual assessment and classification for public employees in Vietnam?

Based on Article 20 of Decree 90/2020/ND-CP, the annual assessment and classification time for the quality of officials and public employees is stipulated as follows:

Annual assessment and classification Time for the Quality of Officials and Public Employees

- The assessment and classification of the quality of officials and public employees are conducted annually.

For those transitioning work places, the new agency, organization, or unit is responsible for the assessment and classification. If the employee has worked at the old agency, organization, or unit for 6 months or more, feedback from the old workplace must be combined, unless the old agency, organization, or unit no longer exists.

2. The assessment and classification time for the quality of officials and public employees shall take place before December 15 each year, prior to the assessment and classification of the quality of party members and the annual review for commendations and awards of the agency, organization, or unit.

For public service providers operating in education, training, and some other sectors ending their working year before December annually, the head of the public service provider determines the assessment and classification time for public employee quality.

- At the time of assessment and classification, in cases of justified absence or absence due to illness, maternity leave according to legal provisions, the officials and public employees are responsible for self-assessment reports, receiving classification results for their roles and assigned duties, and sending them to the agency, organization, or unit for assessment and classification as regulated by this Decree.

Based on clauses 1 and 2 of this Article and the nature of their agency, organization, or unit, the leadership collectively agrees with respective party committees on organizing assessment and classification meetings within their entity, ensuring seriousness, effectiveness, and avoiding formality or waste.

Thus, the assessment and classification time for officials and public employees are conducted before December 15 each year, before the assessment and classification of the quality of party members and the annual review for commendations and awards of the agency, organization, or unit.

For public service providers operating in education, training, and some other areas which conclude their working year before December annually, the head of the public service provider determines the assessment and classification time for public employee quality.

Which public employee shall pay personal income tax when the statutory pay rate increases from July 1, 2024?

According to clause 2 of Article 3 of Decree 73/2024/ND-CP officials and public employees see an increase in statutory pay rates from 1.8 million VND/month to 2.34 million VND/month starting from July 1, 2024.

Consequently, some officials and public employees who previously were exempt from personal income tax now fall under taxable income following the pay rate increase.

Additionally, according to Article 1 of Resolution 954/2020/UBTVQH14, the regulation on family circumstance deduction is specified as follows:

Family Circumstance Deduction

Adjust family circumstance deductions as stipulated in clause 1 of Article 19 of the Law on Personal Income Tax No. 04/2007/QH12, amended and supplemented under Law No. 26/2012/QH13 as follows:

- The deduction for the taxpayer is 11 million VND/month (132 million VND/year);

- The deduction for each dependent is 4.4 million VND/month.

Therefore, officials and public employees without registered dependents must pay personal income tax if their salary exceeds 11 million VND/month (132 million VND/year) post statutory pay rate increase. This income has already subtracted compulsory insurance contributions, humanitarian fund contributions, charitable donations, certain allowances, grants, etc.

What is the personal income tax period for public employees with income from salaries in Vietnam?

According to Article 7 of the 2007 Law on Personal Income Tax (amended by clause 3 of Article 1 of the 2012 Law on Amendments to Law on Personal Income Tax) the tax period is regulated as follows:

Tax Period

1. The tax period for residents is defined as follows:

a) The annual tax period applies to income from business; income from salaries, wages;

b) The tax period on each occurrence of income applies to income from capital investments; income from capital transfers, excluding income from securities transfers; income from real estate transfers; income from winnings; income from copyright; income from franchising; income from inheritance; income from gifts;

c) The tax period is on each transfer or annually for income from securities transfers.

2. The tax period for non-residents is calculated by each occurrence of income for all taxable income.

Thus, the personal income tax period for resident public employees with income from salaries is calculated annually.