What is the latest confirmation form of actual working time in tax in Vietnam in 2024?

How many years of actual working time in the tax does an examinee need to obtain a tax procedure practicing certificate in Vietnam?

The conditions for taking the examination to obtain a tax procedure practicing certificate are provided in Article 4 of Circular 10/2021/TT-BTC. Specifically:

examinees for the tax procedure practicing certificate who are Vietnamese or foreign persons permitted to reside in Vietnam for 12 months or more must meet the following 04 conditions:

(1) Have full civil act capacity;

(2) Hold a university degree or higher in economics, tax, finance, accounting, auditing, or law, or hold a university degree or higher in other fields with a total number of economic, finance, accounting, auditing, tax, and financial activity analysis credits of 7% or more on the total credits for the entire course;

(3) Have actual working time in tax, finance, accounting, or auditing for 36 months or more. The actual working time is accumulated from the time recorded on the university (or postgraduate) degree up to the registration date for the exam;

(4) Submit a complete exam application and pay the exam fee as prescribed.

Thus, one of the conditions to take the exam for the tax procedure practicing certificate is that a Vietnamese or a foreigner permitted to reside in Vietnam for 12 months or more must have actual working time in tax, finance, accounting, or auditing for 36 months or more.

* Note: The actual working time is accumulated from the graduation date recorded on the university (or postgraduate) degree up to the registration date for the exam.

What is the latest confirmation form of actual working time in tax in Vietnam in 2024?

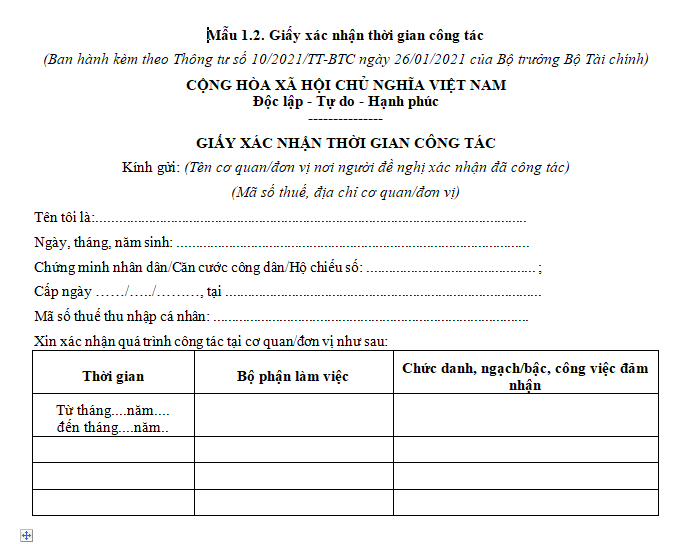

The latest Confirmation of actual working time in Tax 2024 follows Form 1.2 in the Annex issued with Circular 10/2021/TT-BTC.

DOWNLOAD >> Latest Confirmation of actual working time in tax 2024

What is the latest confirmation form of actual working time in tax in Vietnam in 2024? (Image from the Internet)

What does the application for taking the exam for the tax procedure practicing certificate include?

According to Article 5 of Circular 10/2021/TT-BTC, the application for taking the exam for the tax procedure practicing certificate includes:

Case 01: Candidates applying for the tax procedure practicing certificate must send their application to the Examination Council through the electronic portal of the General Department of Taxation. The application includes:

(1) Exam registration form according to Form 1.1 in the Annex issued with Circular 10/2021/TT-BTC;

(2) University or postgraduate diploma in economics, tax, finance, accounting, auditing, or law;

If the diploma is not in economics, tax, finance, accounting, auditing, or law, the candidate must submit a transcript clearly showing the number of credits for all courses (scan version);

(3) Confirmation of working time according to Form 1.2 in the Annex issued with Circular 10/2021/TT-BTC or a social insurance book proving actual working time in tax, finance, accounting, or auditing for 36 months or more (scan version);

(4) Identity card or citizen identification card (for Vietnamese) if the national population database is not yet operational, or passport (for foreigners) valid until the exam registration date (scan version);

(5) A color photo size 3x4 cm with a white background taken within 6 months until the application submission date (image file).

Case 02: For those re-taking the remaining subjects or re-taking failed subjects, the candidate sends the application to the Examination Council through the electronic portal of the General Department of Taxation including:

(1) Exam registration form according to Form 1.1 in the Annex issued with Circular 10/2021/TT-BTC;

(2) Identity card or citizen identification card (for Vietnamese) if the national population database is not yet operational, or passport (for foreigners) valid until the exam registration date (scan version);

(3) A color photo size 3x4 cm with a white background taken within 6 months until the application submission date (image file).

* Note: Candidates only need to send the documents specified in items (1) and (2) if there is a change compared to the previous exam.