What is the input difference explanation form to tax authorities in Vietnam?

What is the input difference explanation form to tax authorities in Vietnam?

The input difference explanation form sent to tax authorities is typically used by businesses and accountants to clarify to tax authorities when discrepancies are detected in the reconciliation of invoice data and VAT invoices.

Currently, there is no specific legal rule regarding the input difference explanation form, but generally, the Explanation Form will include the following sections:

- Introduction: Date of form creation; Explanation of what issue; Sent to which agency, organization, or individual...

Information of the individual making the Explanation Form (company name, legal representative's information including name, position..., phone number...)

- Content of the Explanation Form: Clearly state what is being explained, according to which request or Official Dispatch number; contents of the explanation and attached documents (if any).

- Conclusion of the Explanation Form: Commitment that the content presented above is accurate and acceptance of full legal responsibility.

Businesses and accountants can refer to the input difference explanation form sent to the tax authorities here: Download

What is the input difference explanation form to tax authorities in Vietnam? (Image from Internet)

Shall tax authorities notify individual of their TIN in Vietnam?

According to Clause 2, Article 8 of Circular 105/2020/TT-BTC, the regulation is as follows:

Issuance of Taxpayer Registration Certificate and Notification of TIN

2. Taxpayer Registration Certificate for individuals

a) The "Taxpayer Registration Certificate for individuals" form number 12-MST issued with this Circular is granted by the tax authority to individuals who submit taxpayer registration documents directly to the tax authority as stipulated in Points b.1, b.2, b.4, b.5, Clause 9, Article 7 of this Circular.

b) The "Notification of personal TIN" form number 14-MST issued with this Circular is notified by the tax authority to the income-paying organization performing taxpayer registration following the regulation at Point a, Clause 9, Article 7 of this Circular.

The income-paying organization is responsible for notifying the TIN or the reason for not being issued a TIN to each individual to adjust and supplement the individual's information. The income-paying organization resubmits the taxpayer registration dossier to the tax authority to be issued a TIN for the individual according to regulations.

...

Referring to point a, clause 9, Article 7 of Circular 105/2020/TT-BTC, the regulation is as follows:

Location for submitting the first-time taxpayer registration documents

...

9. For taxpayers who are individuals as specified at Points k, n, Clause 2, Article 4 of this Circular.

a) The individual pays personal income tax through the income-paying organization and authorizes the income-paying organization to perform taxpayer registration, the taxpayer submits the registration dossier at the income-paying organization. If paying personal income tax at multiple income-paying organizations in the same tax period, the individual only authorizes taxpayer registration at one income-paying organization to have the tax authority issue a TIN. Individuals announce their TIN to other income-paying organizations for use in tax declaration and payment.

The individual's taxpayer registration dossier includes: the authorization document and one of the individual's papers (copy of the Citizen Identity Card or a copy of the still valid Identification Card for individuals with Vietnamese nationality; copy of a valid Passport for individuals with foreign nationality or Vietnamese nationals living abroad).

The income-paying organization is responsible for summarizing the taxpayer registration information of individuals into the taxpayer registration declaration form number 05-DK-TH-TCT issued with this Circular and sending it to the tax authority directly managing the income-paying organization.

...

Thus, the tax authority does not notify each individual of their TIN but will notify the income-paying organization.

How to lookup personal TIN in Vietnam?

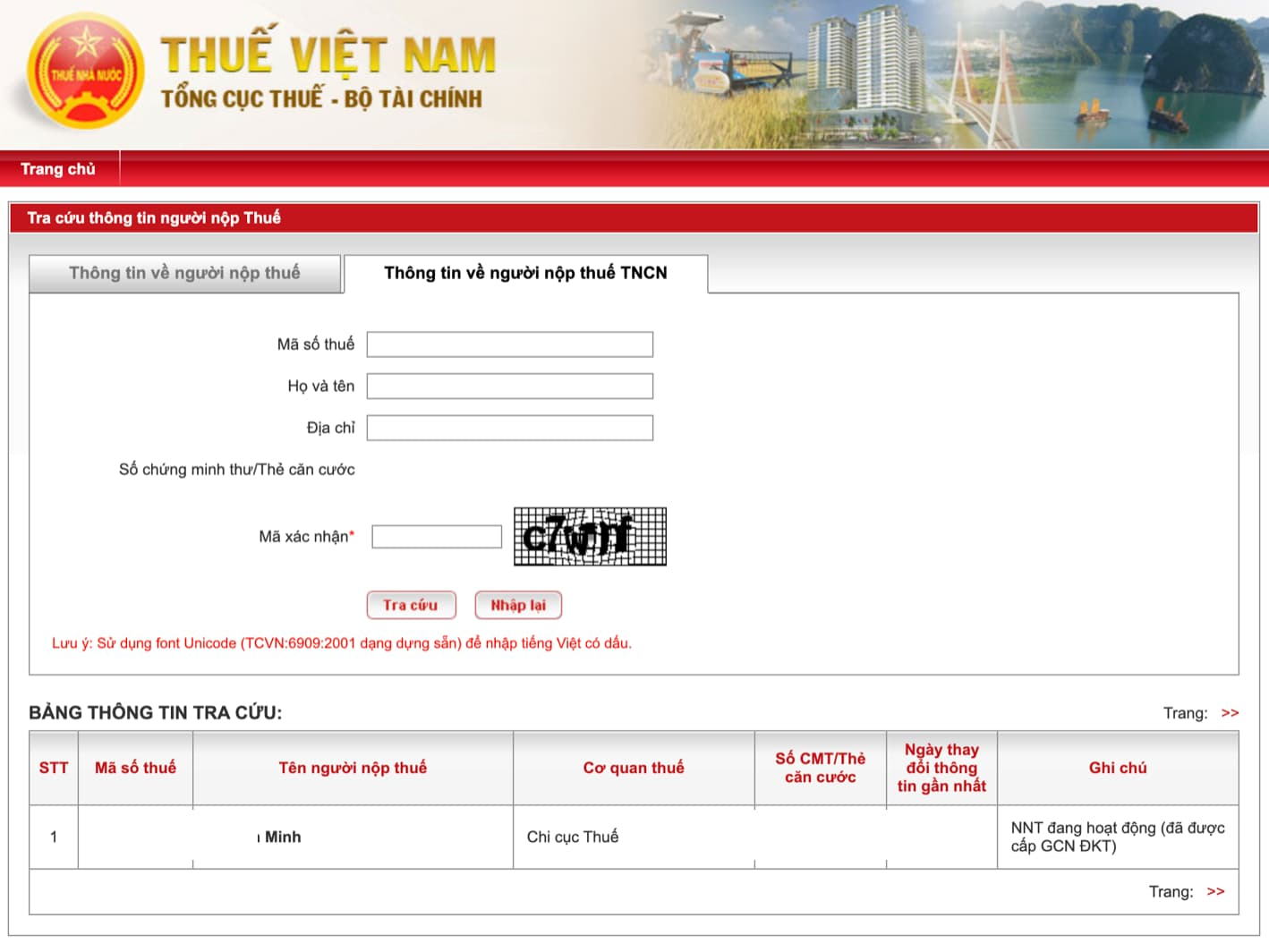

Below is a detailed guide for searching for a personal TIN performed on the General Department of Taxation's electronic portal.

Step 1: Access https://tracuunnt.gdt.gov.vn/tcnnt/mstcn.jsp

Step 2: Enter one of the following information:

- TIN

- Full name

- Address

- Identity card number/Citizen identification number

Enter the verification code and search.

Step 3: Click on the taxpayer's name to view details and review the tax information