What is the guidance on writing the 2025 dependant registration application form in Vietnam?

What is the guidance on writing the 2025 dependant registration application form in Vietnam?

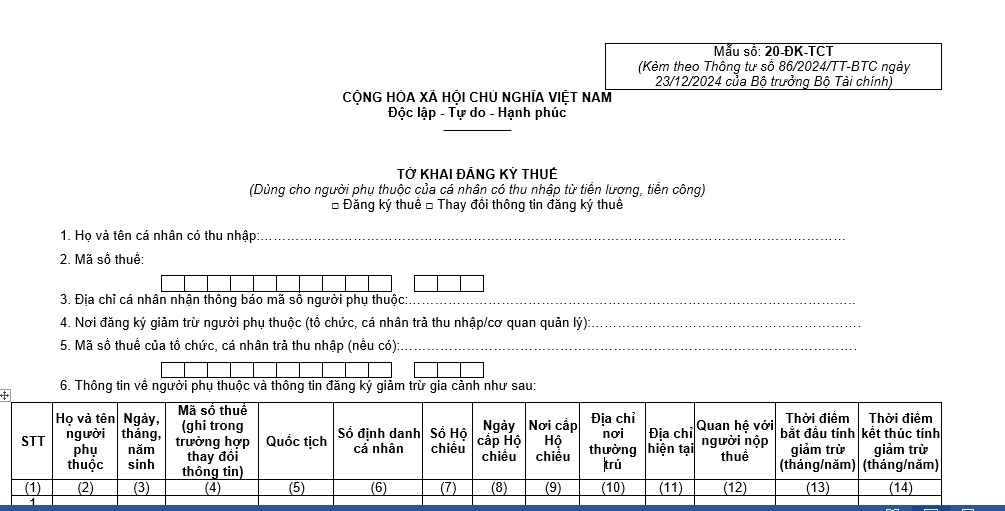

As of February 6, 2025, the dependant registration application form is Form 20-DK-TCT issued together with Circular 86/2024/TT-BTC. Accurately completing this form enables individuals to receive family circumstances deductions when calculating personal income tax.

The 2025 dependant registration application form is structured as follows:

Download the 2025 dependant registration application form...Download

Below is a detailed guide on how to complete the 2025 dependant registration application form:

Section for selecting the type of registration

- Tax registration: Select if registering a dependant for the first time

- Change taxpayer registration information: Select if wishing to change previously registered dependant information

Personal information of the taxpayer

- Full name of the income earner: Enter the full name as per identification documents.

- Tax code: Enter the tax code of the taxpayer (can be retrieved from the website of the General Department of Taxation).

- Address for receiving notifications of dependant codes: Provide an accurate contact address to receive notifications from the tax authority.

- Place of registration for dependant deduction: State the name of the company, income-paying unit, or direct tax management agency.

- Tax code of the organization or individual paying the income: If available, provide the tax code of the company or unit paying the income.

Table of dependant information

Notes when completing the table:

(1) **** STT: **** Serial number of each dependant.

(2) Full name: Enter the full name as per birth certificate or ID/CCCD.

(3) Date of birth: Record in the correct format DD/MM/YYYY.

(4) Tax code (if applicable): Fill in if the dependant already has a tax code, otherwise leave blank.

(5) Nationality: State the nationality of the dependant.

(6) Personal identification number: Enter if there is a new ID/CCCD.

(7), (8), (9): Passport (if available): If a foreigner or has a passport, provide the passport number, issue date, and place of issue.

(10) Permanent address and (11) Current address: Fill as per household registration book or actual place of residence.

(12) Relationship with the taxpayer: Specify, for example, biological child, father/mother, spouse, grandparent, etc.

(13) Start date of deduction: Record the month/year from when the deduction begins (e.g., 01/2024).

(14) End date of deduction: If the end date is not specified, leave blank or use a "-".

Commitment and signature section

- Date of declaration: Record the correct submission date.

- Sign and print full name: The declarant signs to confirm the information.

Notes when completing the 2025 dependant registration form

- Only select one of the two boxes "Tax registration" or "Change taxpayer registration information" depending on the purpose of the declaration.

- If the dependant has a personal identification number (chip-embedded CCCD), there is no need to declare passport number, permanent address, and current address (the tax authority will automatically retrieve from the National Database).

- For changes in taxpayer registration information:

+ dependant's tax code (column 4) must be filled in if there is any change in the information.

+ Only fill in the columns where information has changed, leave others blank if unchanged.

What is the guidance on writing the 2025 dependant registration application form in Vietnam? (Image from the Internet)

What are the documents to prove dependants for personal exemption in Vietnam?

According to point g, clause 1, Article 9 of Circular 111/2013/TT-BTC, amended by Article 1 of Circular 79/2022/TT-BTC, the proof documentation for dependants for personal exemption includes:

* For children:

- Children under 18 years old: Proof documentation includes a copy of the birth certificate and a copy of the National ID or Citizen ID card (if available).

- Children from 18 years old and disabled, unable to work, the documentation includes:

+ A copy of the birth certificate and a copy of the National ID or Citizen ID (if available).

+ A copy of the disability certification as prescribed by law regarding disabled persons.

- Children studying at educational levels as guided in sub-point d.1.3, point d, clause 1, Article 9 of Circular 111/2013/TT-BTC, proof documentation includes:

+ A copy of the birth certificate.

+ A copy of the student card or a certificate from the school or other documents proving enrollment at universities, colleges, professional and vocational schools, or high school.

- In the case of adopted children, extra-marital children, or step-children, in addition to the documents for each of the aforementioned scenarios, proof documentation needs additional documents to prove the relationship such as: a copy of the adoption recognition decision, a decision to recognize biological children, parents, or from the competent State agency...

* For spouse, the proof documentation includes:

- A copy of the National ID or Citizen ID.

- A copy of the resident information certificate or Notice of personal identification number and information from the national population database or other documents issued by the Police Department proving the marital relationship or a copy of the Marriage Certificate.

In cases where the spouse is of working age, the proof documentation needs additional documents proving the dependant’s inability to work, such as a copy of the disability certification as prescribed by law for disabled persons unable to work, or a copy of medical records for those with illnesses that prevent work ability (such as AIDS, cancer, chronic kidney failure, etc.).

* For biological parents, parents-in-law, stepparents, adoptive parents, legal foster parents, proof documentation includes:

- A copy of the National ID or Citizen ID.

- Legal documents proving the dependant's relationship with the taxpayer like a copy of the resident information certificate or Notice of personal identification number and information from the national database or other documents issued by the Police Department, birth certificates, decision on recognition by the competent State agency...

In the case of those of working age, the proof documentation needs additional documents proving disability from work like a copy of the disability certification as prescribed by law for disabled persons, or a hospital medical record for those with illnesses that prevent work ability (such as AIDS, cancer, chronic renal failure, etc.).

* For other individuals as guided in sub-point d.4, point d, clause 1, Article 9 of **** Circular 111/2013/TT-BTC the proof documentation includes:

- A copy of the National ID or Citizen ID or birth certificate.

- Legal documents proving the duty of care as prescribed by law.

In the case of dependants of working age, the proof documentation needs additional documents proving the inability to work like a copy of the disability certification as prescribed by law for disabled persons, or a hospital medical record for illnesses that prevent work ability (such as AIDS, cancer, chronic renal failure, etc.).

Legal documents at sub-point g.4.2, point g, clause 1, Article 9 of Circular 111/2013/TT-BTC are any legal documents determining the taxpayer’s relationship with the dependant, such as:

- A copy of documents determining support obligations as prescribed by law (if available).

- A copy of the resident information certificate or Notice of personal identification number and information from the national database or other documents issued by the Police Department.

- A self-declaration by the taxpayer as per the form issued under Circular 80/2021/TT-BTC and Decree 126/2020/ND-CP with confirmation from the communal People's Committee where the taxpayer resides about the dependant staying together.

- A self-declaration by the taxpayer as per the form issued under Circular 80/2021/TT-BTC and Decree 126/2020/ND-CP with confirmation from the communal People's Committee where the dependant resides about the dependant currently living at the local area without any support (in the case of not living together).

* For resident foreigners:

Resident foreigners, if lacking documentation as guided for each specific case above, must have equivalent legal documents as proof for dependants.

* For taxpayers working in economic organizations, administrative, and career agencies with parents, spouse (or husband), children, and others classified as dependants stated in the taxpayer’s record:

The proof documentation for dependants follows guidance in sub-points g.1, g.2, g.3, g.4, g.5, point g, clause 1, Article 9 of Circular 111/2013/TT-BTC or simply requires a dependant registration application as per the form issued together with Circular 80/2021/TT-BTC and Decree 126/2020/ND-CP with confirmation from the unit head on the left side of the declaration.

The unit head is only responsible for the following contents: dependant's name, birth year, and relationship to the taxpayer; other contents, the taxpayer self-declares and is responsible for.

Note: From the date the tax department announces the completion of connection with the National Database, taxpayers are not required to submit the above proof documents if such information is already in the National Database.

What are 2025 personal exemption regulations in Vietnam?

According to Article 1 of Resolution 954/2020/UBTVQH14, the personal exemption regulation for 2025 is stipulated as follows:

- The deduction for taxpayers is 11 million VND per month (132 million VND per year);

- The deduction for each dependant is 4.4 million VND per month.