What is the guidance on online tax declaration Form 01/CNKD - Tax registration for individual businesses without a digital signature in Vietnam in 2025?

What is the guidance on online tax declaration Form 01/CNKD - Tax registration for individual businesses without a digital signature in Vietnam in 2025?

Below are detailed instructions on the steps to declare online using form 01/CNKD tax registration for individual businesses without a digital signature:

(1) Login

Step 1: Access the link https://thuedientu.gdt.gov.vn, the taxpayer selects the "INDIVIDUAL" or "ORGANIZATION WITHOUT DIGITAL SIGNATURE" module.

The system displays the main page of the individual module:

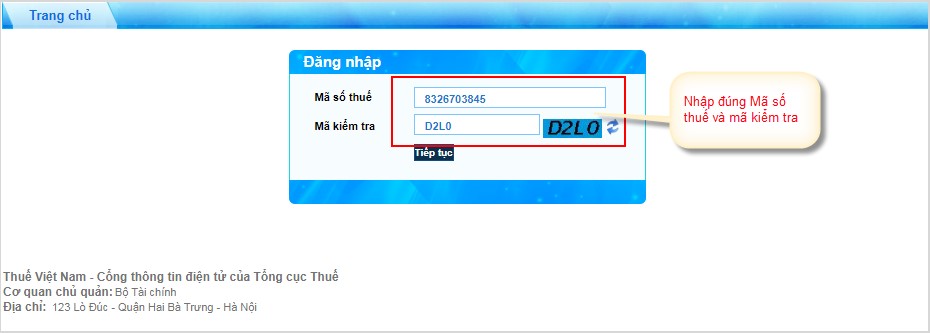

Step 2: Select "Login", the login screen is displayed.

The taxpayer enters:

- Tax code: Enter the tax code of the taxpayer.

- Verification code: Enter the correct displayed verification code (allows the taxpayer to change the verification code).

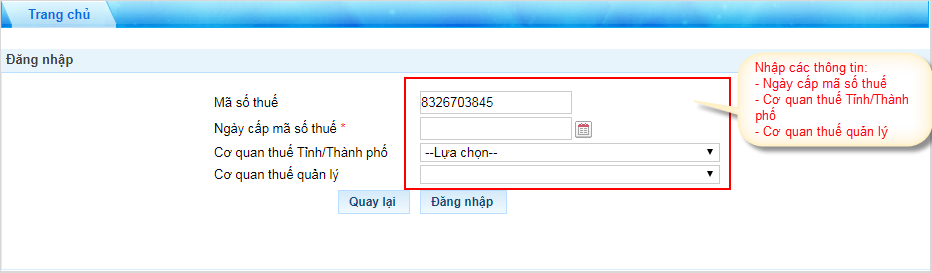

Step 3: Click "Continue", the screen to enter the issuance date of the tax code is displayed:

The taxpayer enters:

- Tax code: The tax code of the taxpayer is displayed by default.

- Issuance date of the tax code: Enter the correct issuance date of the tax code.

- Tax authority of Province/City: Choose from the provincial tax department list.

- Managing tax authority: Choose from the tax branch list.

Step 4: Click "Login"

The system displays the following function screen:

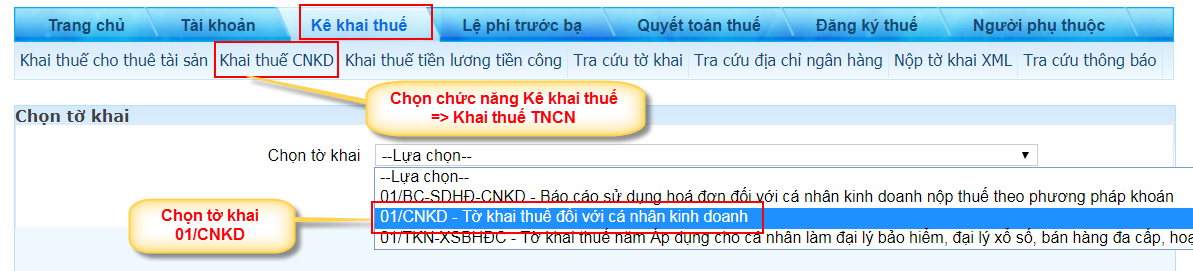

(2) Online Declaration of Form 01/CNKD

Step 1: Go to the "Tax Declaration" function, select "Declaration of Individual Business Tax", the system displays the declaration form selection screen:

In the list of personal income tax declaration forms, the taxpayer selects the form: 01/CNKD – Tax declaration form for individual businesses.

Note: If the taxpayer logs in using the issuance date when selecting forms 01/BC-SDHĐ-CNKD, 01/TKN-XSBHĐC, a warning "Tax code in a state not allowed for declaration" will be displayed.

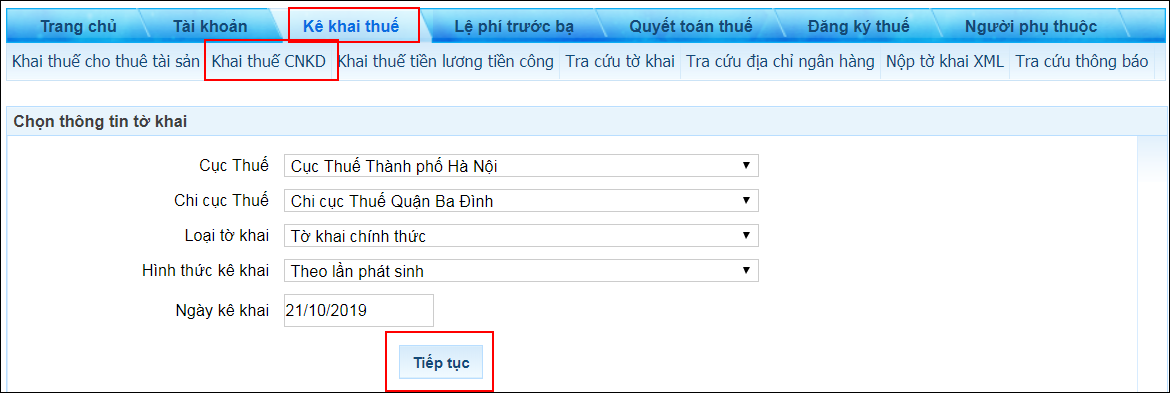

Step 2: Click "Continue", the system displays the declaration information selection screen:

The taxpayer enters the following information:

- Tax Department: Choose from the list of tax authorities.

- Tax Branch: Choose from the list of city/district tax branches under the selected tax department.

- Type of declaration: Choose from the list: Official or Supplementary.

- Declaration method: According to each occurrence.

- Declaration date: Automatically displayed as the current date, with the option to edit.

Step 3: Click "Continue"

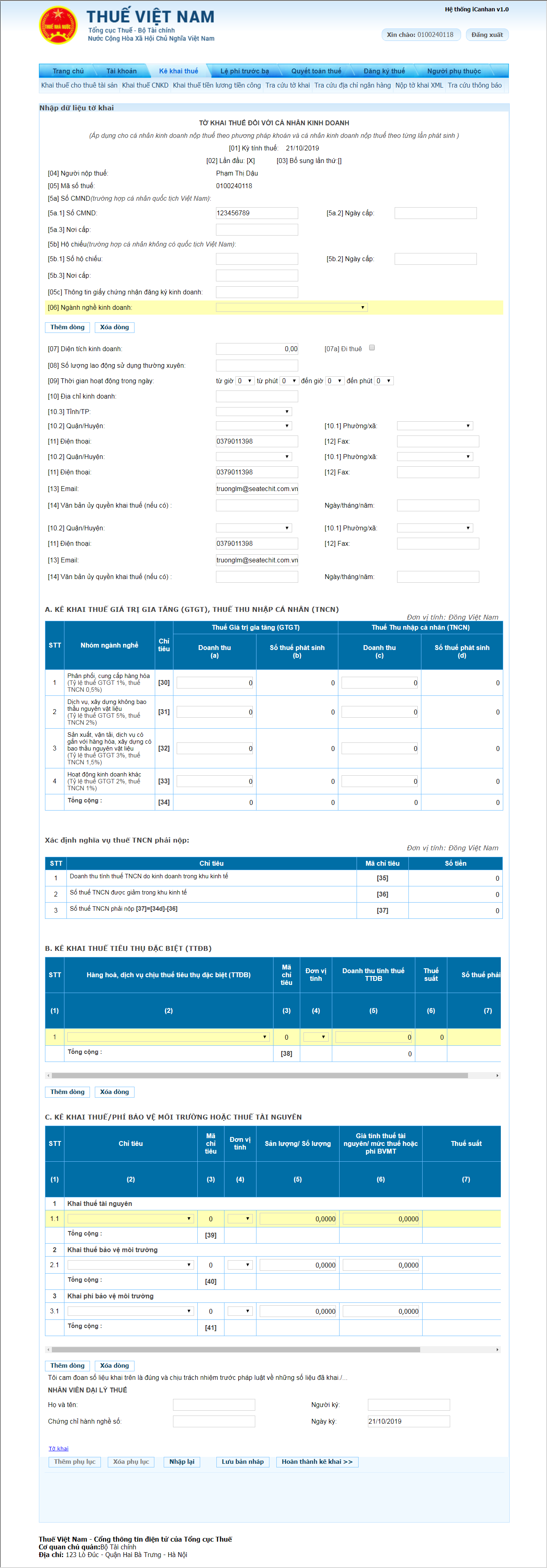

The system displays the detailed declaration screen for the criteria on form 01/CNKD.

The taxpayer performs the following actions:

- Click "Reset" to clear entered data.

- Click "Save Draft" to save the entered data.

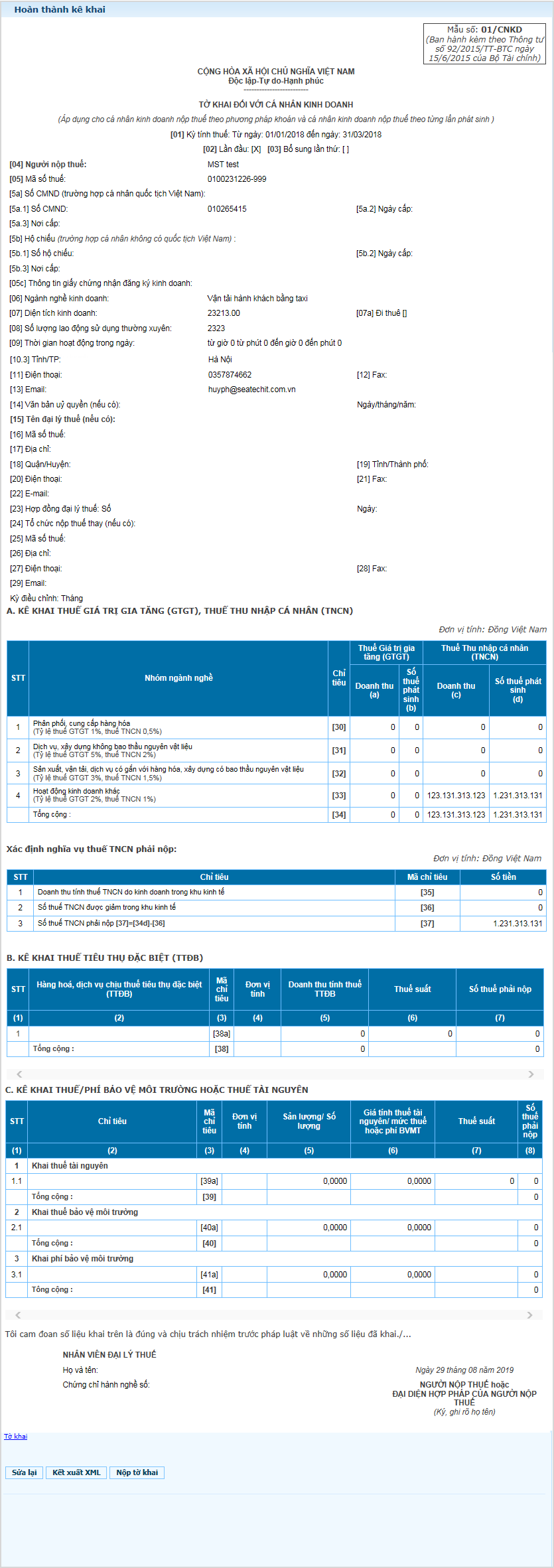

Step 4: Click "Complete Declaration", the system displays the completed declaration screen.

The taxpayer performs the following functions:

- Click "Edit" to modify details of the declaration criteria.

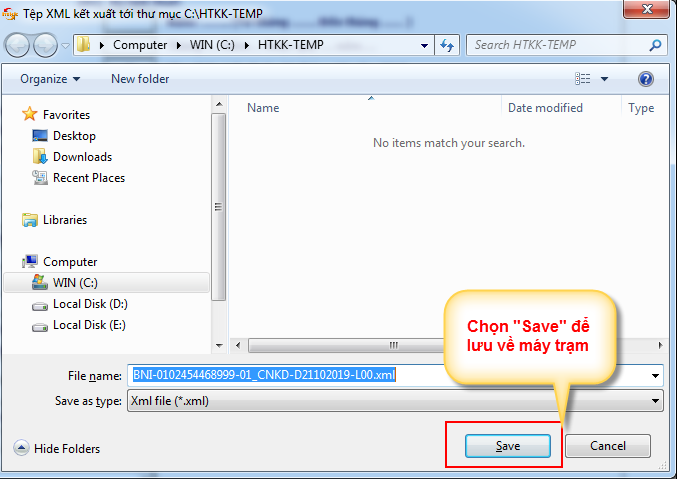

- Click "Export XML" to export the declaration form file in XML format to the workstation.

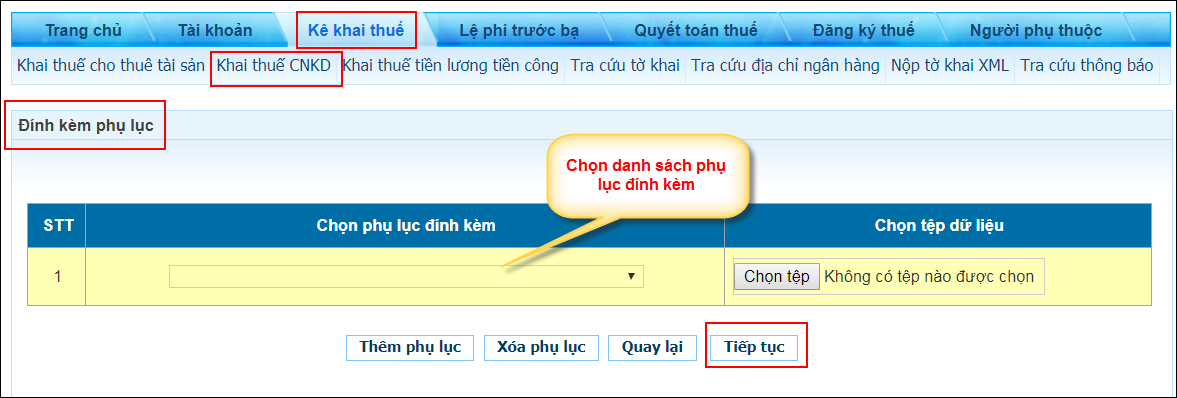

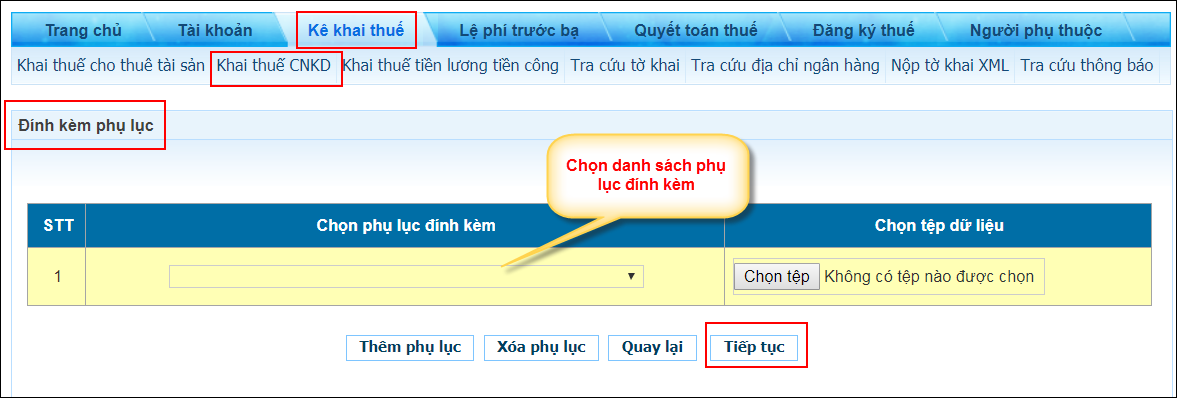

Step 5: Click "Submit Declaration", the system displays the attach appendix screen.

The taxpayer performs the following actions:

- Select the appendix from the following list:

+ Minutes of acceptance

+ Economic contract

+ Contract liquidation

+ Documents proving the origin

- Press "Select file": Allows the taxpayer to select file types: *png, *.jpg, *.pdf, *.doc, *.docx, *.xls, *.xlsx from the workstation's computer.

- Click "Add Appendix" to attach additional appendices.

- Click "Delete Appendix" to remove the selected appendix.

- Click "Go back" to return to the <Complete Declaration> screen.

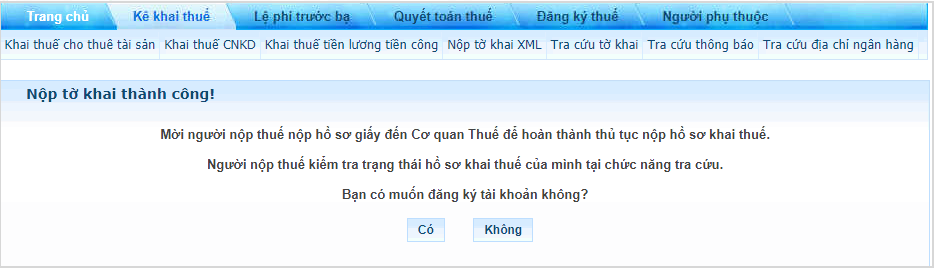

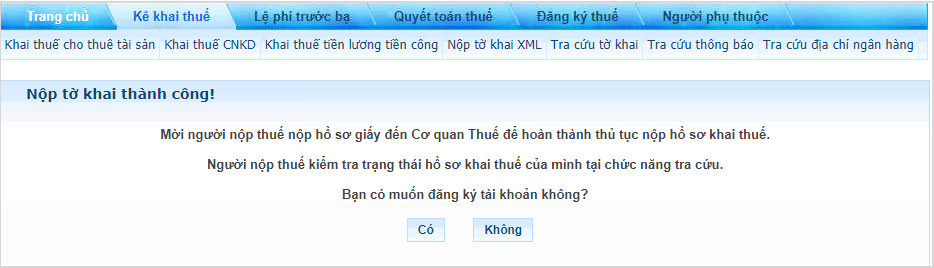

Step 6: Click "Continue", the system displays the successful submission of the declaration screen.

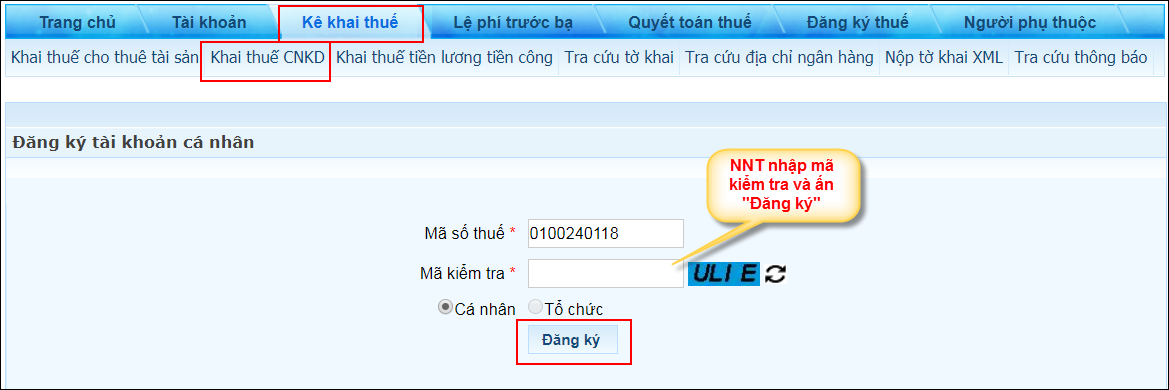

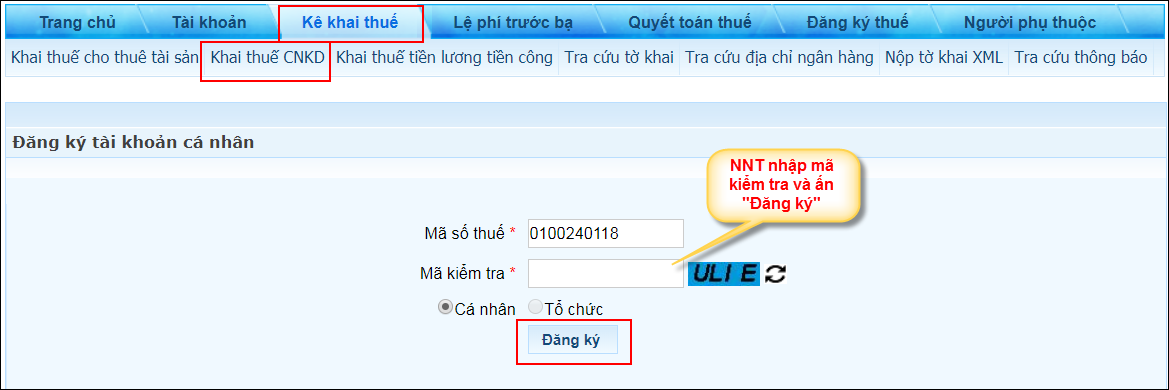

The taxpayer selects "Yes" if they wish to register for the icanhan service: Follow the registration steps as instructed in section 1.1.

The system displays the personal account registration screen, allowing the taxpayer to register an electronic interface account with the tax authority.

The taxpayer chooses "No" to not register for the service, the system displays a notification: "If you wish to use invoices, please contact the tax authority to be issued invoices!"

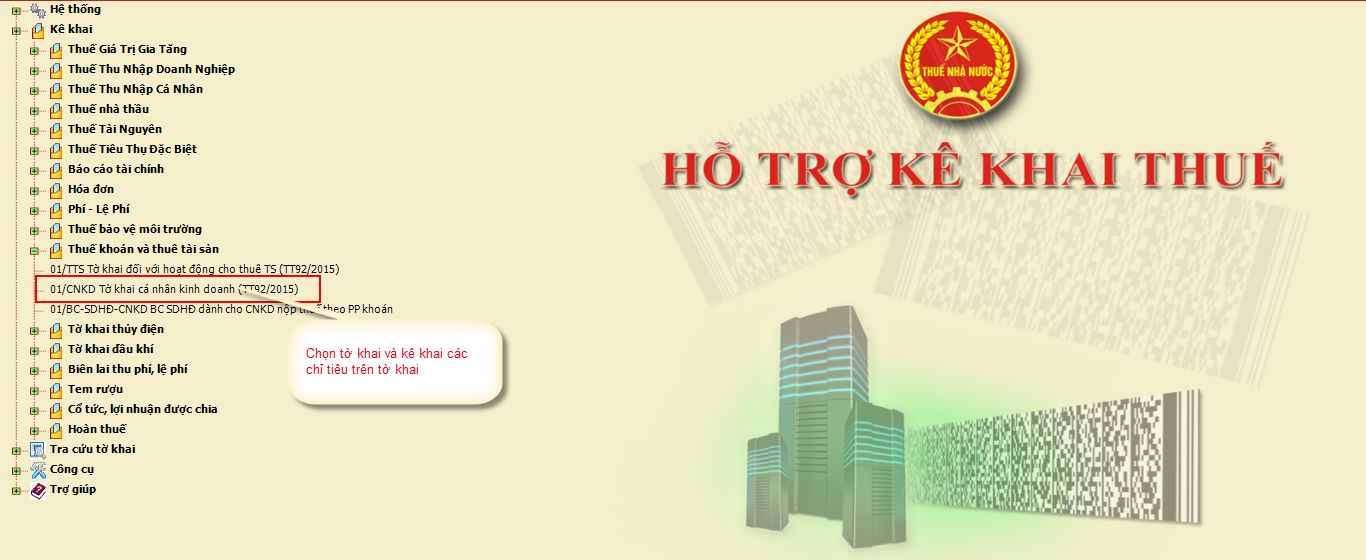

(3) Submit XML Declaration from HTKK System

The taxpayer uses the HTKK application with the latest version or a version that meets the latest declaration form needs for form 01/CNKD as required.

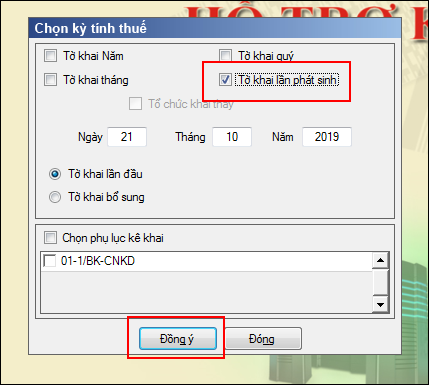

Step 1: The taxpayer accesses the HTKK application

- Select the declaration form needed: 01/CNKD – Tax declaration for individual businesses.

- Select the declaration period according to each occurrence

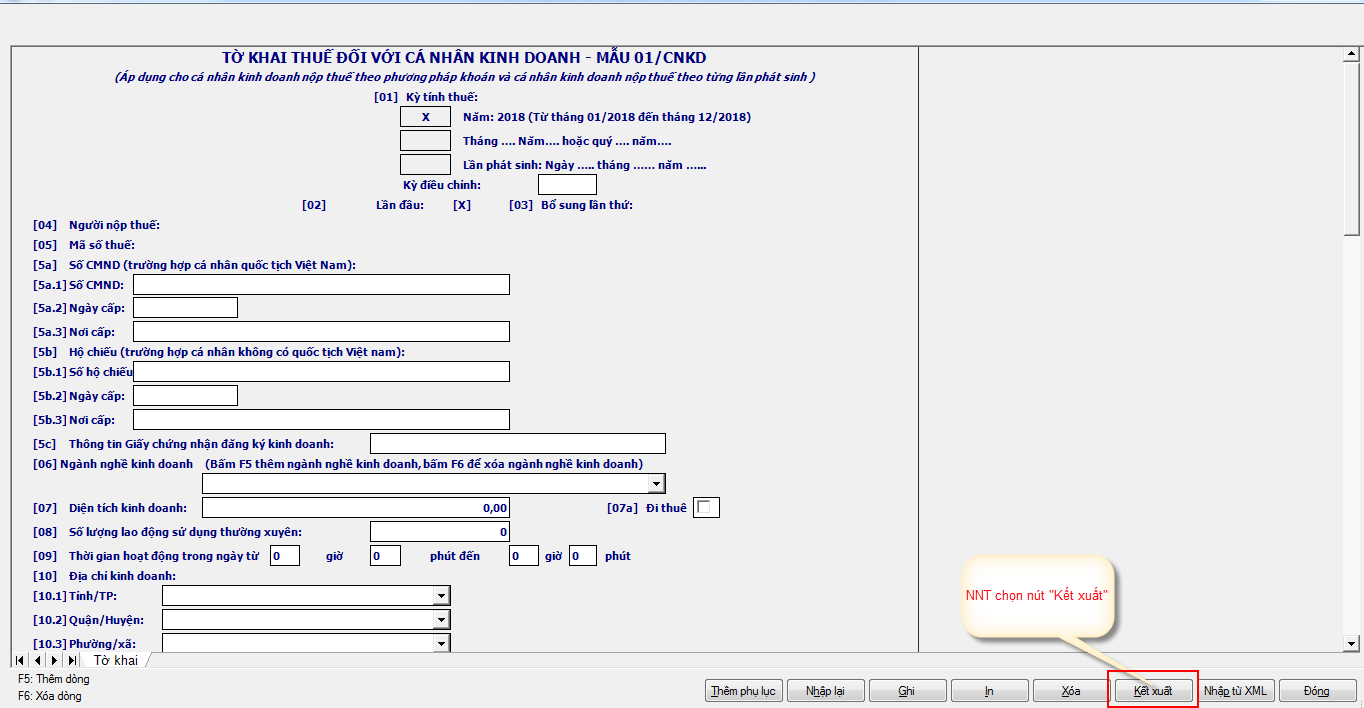

- Click "Export" on the declaration screen

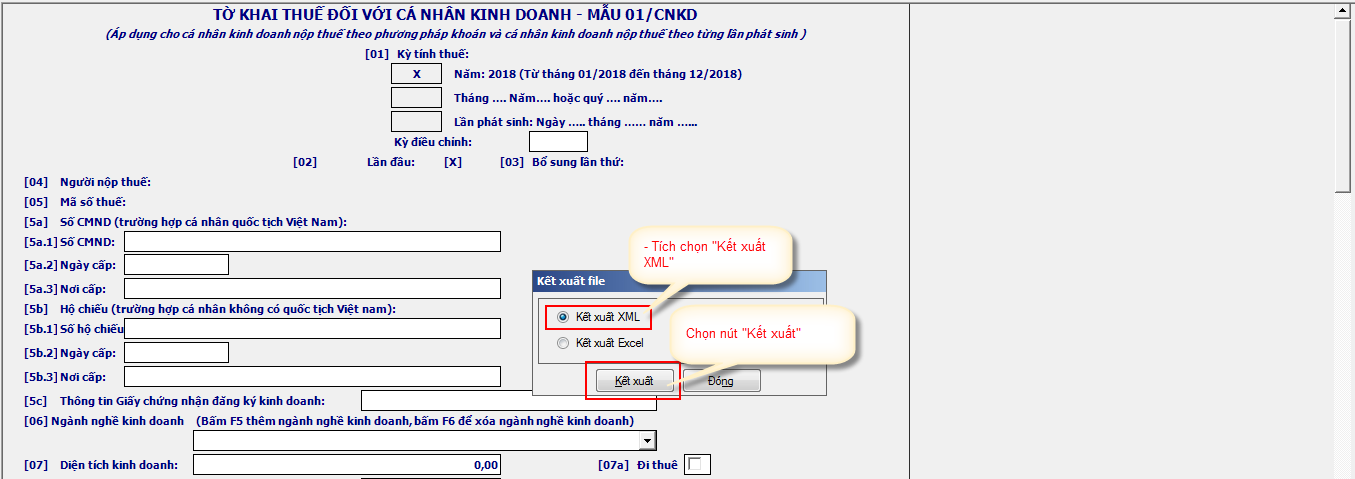

- Check "Export XML" and then select "Export"

- Click "Save" to save to the workstation

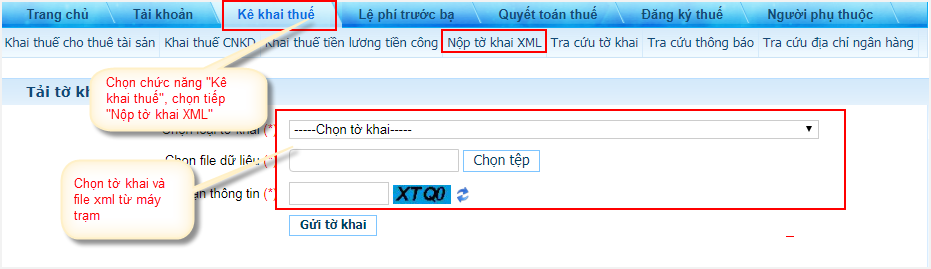

Step 2: Select the "Tax Declaration" function, then "Submit XML Declaration"

The system displays the XML declaration upload screen from the HTKK system.

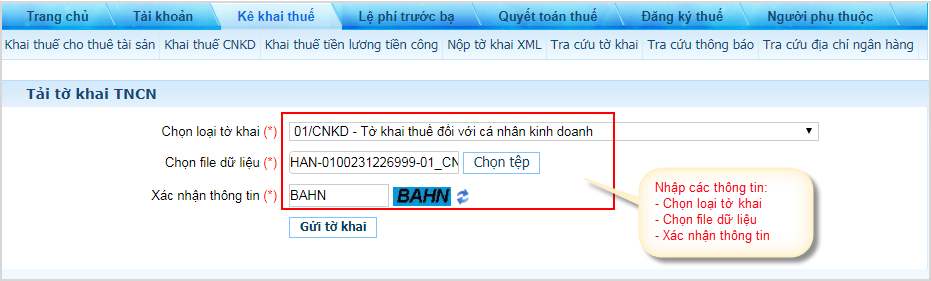

Step 3: The taxpayer enters declaration submission information

- Select declaration type: In the personal income tax declaration list, select form 01/CNKD – Tax declaration for individual businesses.

- Select file data: The taxpayer selects "Select file" to choose the data file exported from HTKK in Step 1.

- Enter information: Enter the correct verification code box.

Step 4: Click "Send declaration", the system displays the attach appendix screen.

The taxpayer performs the following actions:

- Select the appendix from the following list:

+ Minutes of acceptance

+ Economic contract

+ Contract liquidation

+ Documents proving the origin

- Press "Select file": Allows the taxpayer to select file types: *png, *.jpg, *.pdf, *.doc, *.docx, *.xls, *.xlsx from the workstation's computer.

- Click "Add Appendix" to attach additional appendices.

- Click "Delete Appendix" to remove the selected appendix.

- Click "Go back" to return to the <Complete Declaration> screen.

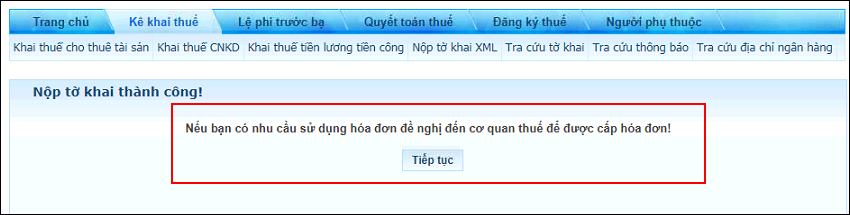

Step 5: Click "Continue", the system displays the successful submission of the declaration screen.

The taxpayer selects "Yes" if they wish to register for the icanhan service: The system displays the electronic transaction account registration screen. The taxpayer follows the registration steps as instructed in section 1.1.

The taxpayer selects "No" to not register for the service, the system displays a notification: "If you wish to use invoices, please contact the tax authority to be issued invoices!"

(4) Lookup Declaration

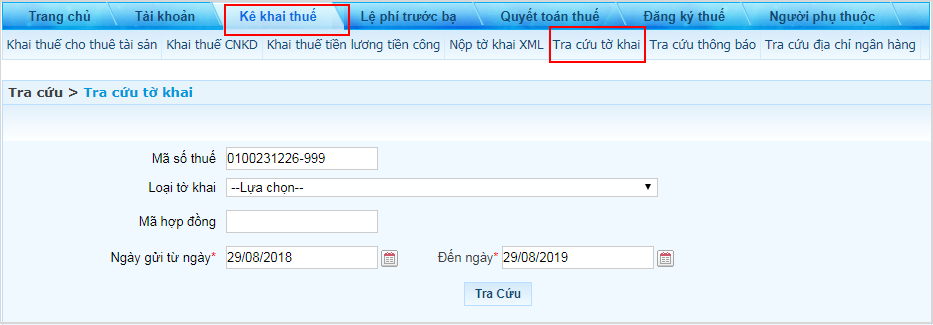

Step 1: Access the "Tax Declaration" function, then choose "Lookup Declaration"

The system displays the declaration lookup screen:

Step 2: Enter lookup conditions

- Tax code: Automatically displayed and not editable.

- Type of declaration: Select form 01/CNKD – Tax declaration for individual businesses.

- Contract code: Only enter when looking up form 01TTS - asset lease declaration.

- Send date from ... to ...: Enter in the format dd/mm/yyyy.

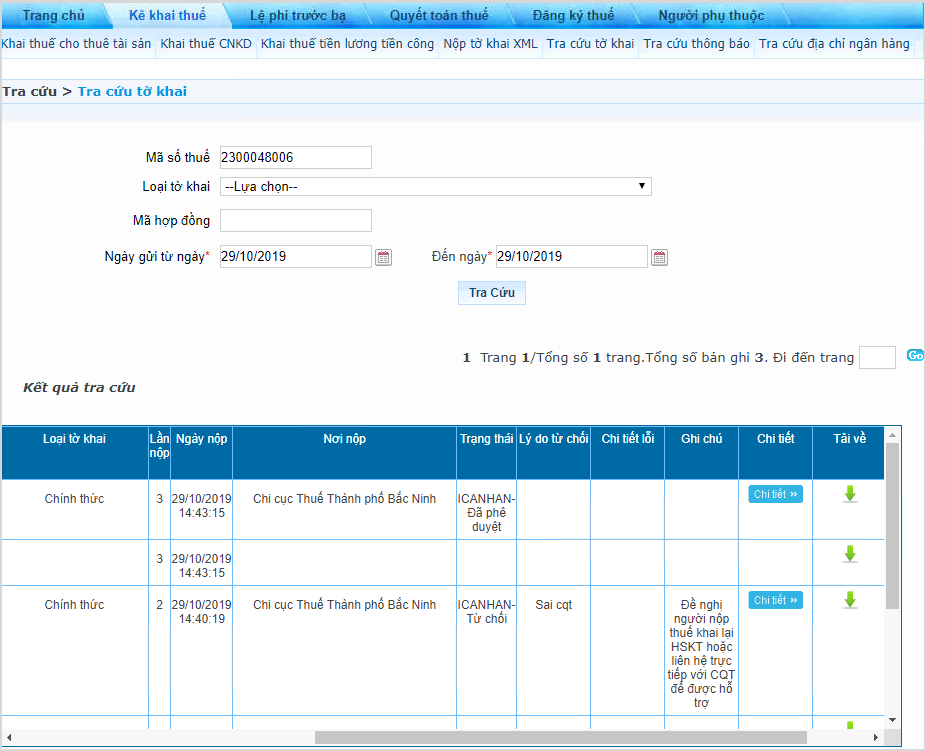

Step 3: Click "Lookup", the system displays the search result list:

The taxpayer performs the following actions:

- Select "Detail" to view details of the submitted declaration.

- Select "Download" to download the declaration sent to the tax authority to the workstation.

- The taxpayer monitors the processing result of the declaration in the Status column:

+ Declarations rejected by the tax authority have the status "Rejected" and the "Notes" column content: "The taxpayer is requested to re-declare or directly contact the tax authority for support". The reason for rejection column contains the content of the tax authority's rejection.

+ Declarations not yet approved have the status "Icanhan-pending approval".

+ Declarations approved by the tax authority have a status other than "Rejected" and "Icanhan-pending approval".

What is the guidance on online tax declaration Form 01/CNKD - Tax registration for individual businesses without a digital signature in Vietnam in 2025? (Image from Internet)

What are deadlines for submission of tax declaration dossiers for individual businesses declaring taxes under periodic declarations in Vietnam?

Based on Clause 3, Article 11 of Circular 40/2021/TT-BTC, it is prescribed as follows:

Tax administration for household businesses and individual businesses declaring taxes under periodic declarations

...

- deadlines for submission of tax declaration dossiers

The deadlines for submission of tax declaration dossierss for household businesses and individual businesses declaring taxes under periodic declarations is stipulated in Clause 1, Article 44 of the Tax Administration Law. To be specific:

a) The deadlines for submission of tax declaration dossierss for household businesses and individual businesses declaring taxes under periodic declarations on a monthly basis is no later than the 20th of the month following the month in which the tax obligation arises.

b) The deadlines for submission of tax declaration dossierss for household businesses and individual businesses declaring taxes under periodic declarations on a quarterly basis is no later than the last day of the first month of the following quarter after the quarter in which the tax obligation arises.

- Time Limit for Tax Payment

The time limit for tax payment for household businesses and individual businesses declaring taxes under periodic declarations follows the provisions in Clause 1, Article 55 of the Tax Administration Law, specifically: The tax payment deadline is at the latest on the last day of the tax declaration filing deadline. In case of supplemental tax declaration, the tax payment deadline is the deadline for filing the tax declaration for the tax period with errors or omissions.

...

The deadlines for submission of tax declaration dossierss for individual businesses declaring taxes under periodic declarations is as follows:

- For the declaration method on a monthly basis, no later than the 20th of the month following the month in which the tax obligation arises.

- For the declaration method on a quarterly basis, no later than the last day of the first month of the following quarter after the quarter in which the tax obligation arises.

What does the tax declaration dossier for individual businesses declaring taxes under periodic declarations include?

Based on Clause 1, Article 11 of Circular 40/2021/TT-BTC, the tax declaration dossier for individual businesses declaring taxes under periodic declarations includes:

- Tax declaration form for household businesses, individual businesses according to form number 01/CNKD issued together with Circular 40/2021/TT-BTC;

- Appendix of business activity listing during the period of household businesses, individual businesses (applies to household businesses, individual businesses declaring taxes under periodic declarations) according to form number 01-2/BK-HĐKD issued together with Circular 40/2021/TT-BTC.

In cases where household businesses or individual businesses declaring taxes under periodic declarations have grounds to determine revenue as confirmed by competent authorities, the Appendix of business activity listing according to form number 01-2/BK-HĐKD issued together with Circular 40/2021/TT-BTC is not required.