What is the guidance on declaring tax electronically for individual businesses on e-commerce platforms in Vietnam in 2025?

What is the guidance on declaring tax electronically for individual businesses on e-commerce platforms in Vietnam in 2025?

The General Department of Taxation of Vietnam has officially announced the web portal for households and individual businesses to register, declare, and pay taxes for e-commerce and digital platform activities at the address: https://canhan.gdt.gov.vn

The portal will officially support taxpayers in fulfilling their tax obligations starting from December 19, 2024.

Below are the steps for declaring tax electronically for individual businesses on e-commerce platforms in 2025 as guided by the General Department of Taxation of Vietnam:

[1] Declaration of tax return for individual businesses

Step 1: Users access the web portal for households and individual businesses to register, declare, and pay taxes from e-commerce and digital platform activities. Log in with their electronic identification account at: https://canhantmdt.gdt.gov.vn/

Step 2: Users log in to the system and select Tax Declaration/Declare Tax for e-commerce business activities.

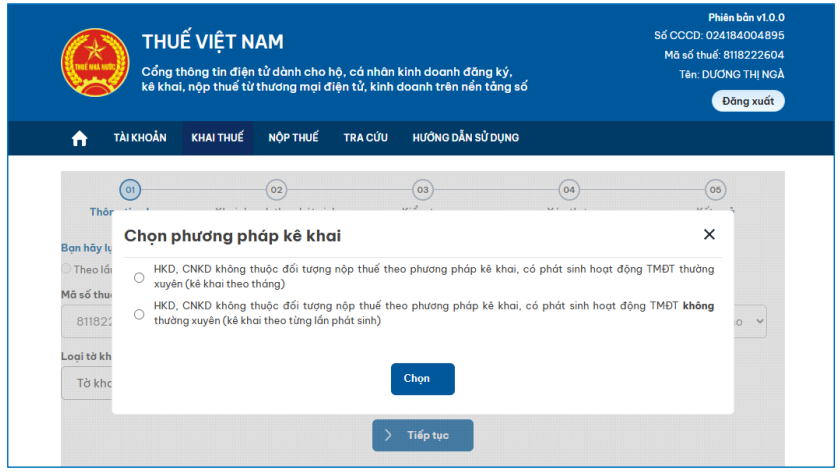

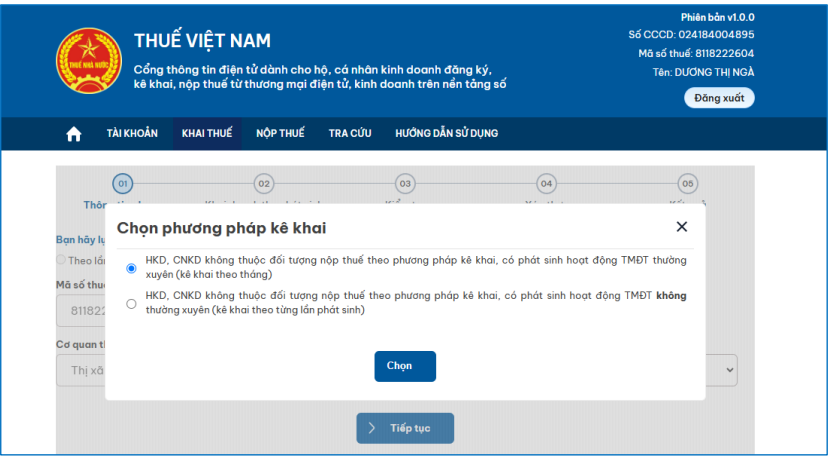

- The system displays the "Select declaration method" screen.

Step 3: The taxpayer selects one of the two options and presses "Select." The system automatically selects the tax calculation period as either Occurrence/Month according to the following constraints:

+ Select “Household business, individual business regularly engaged in e-commerce activities (monthly declaration),” the system automatically selects “Month.”

+ Select “Household business, individual business irregularly engaged in e-commerce activities (declare per occurrence),” the system automatically selects “Occurrence.”

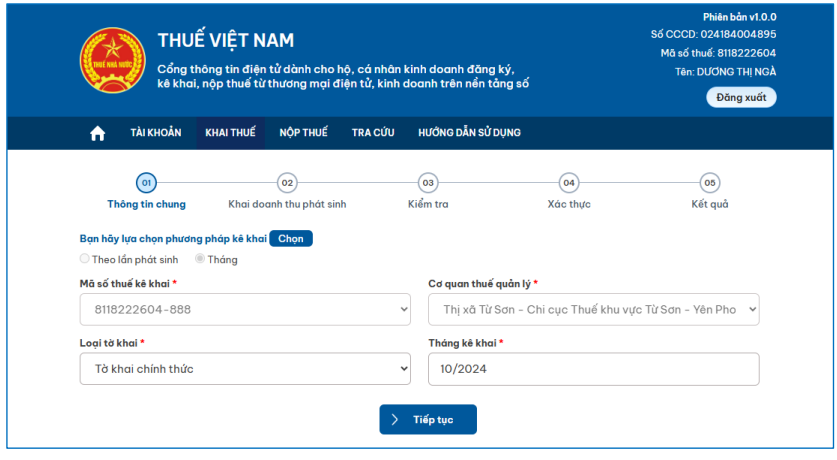

- The system displays the screen to select information for the tax return.

+ Tax declaration code: Default display of a 13-digit taxpayer identification number for e-commerce activities (Code 10-888).

+ Tax management agency: Default display of the tax management agency for the taxpayer identification number engaging in e-commerce.

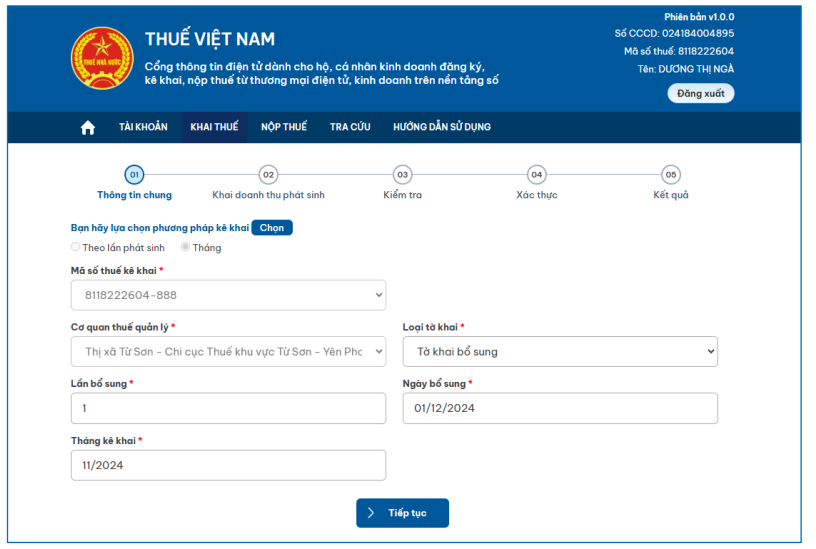

+ Type of tax return: Default display is the official return, allowing for selection from the following list: Official, Supplementary.

+ Declaration month: Default displays the current month allowing for editing (for monthly returns).

+ Occurrence date: Default displays the current date, allowing for editing ≤ the current date, and input in the format dd/mm/yyyy (for occurrence returns).

[1] In case the taxpayer selects the official tax return type

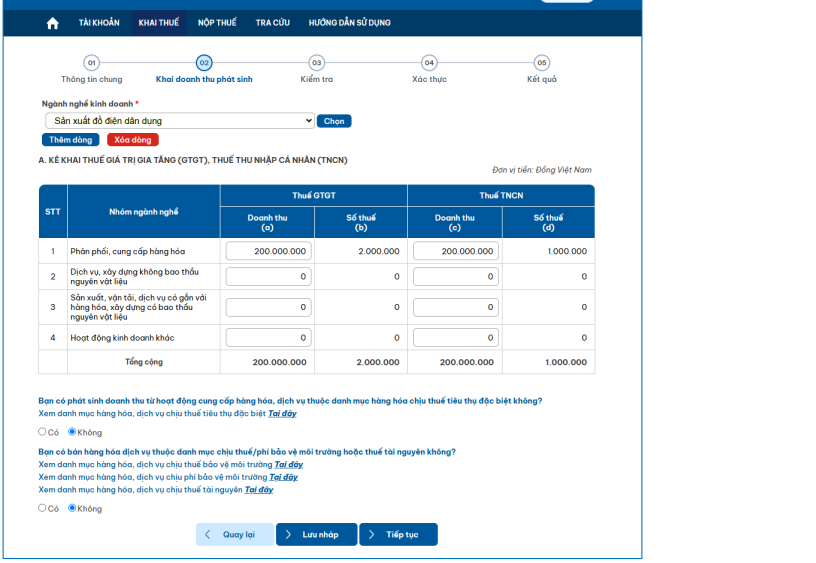

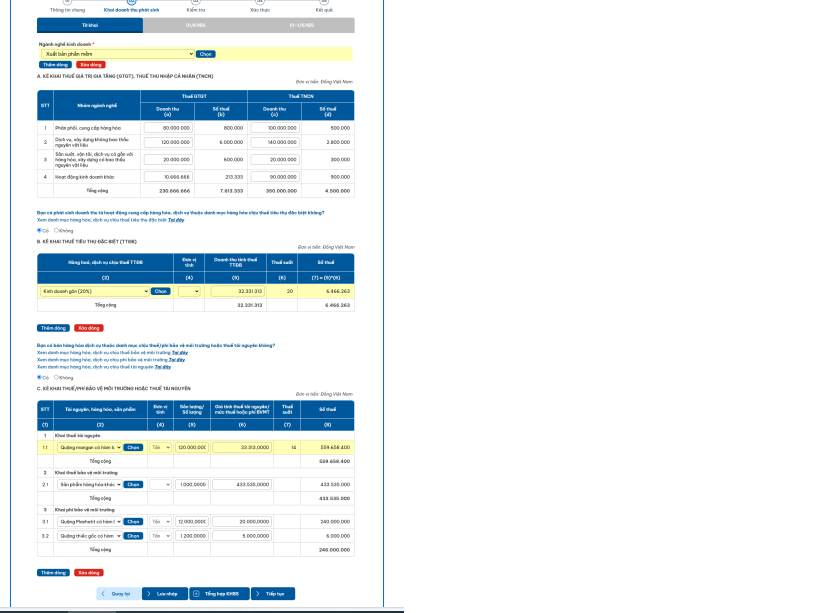

Step 1: The user enters information on the screen selecting tax return information, then proceeds. The system displays the screen for declaring generated revenue.

+ Question “Do you generate revenue from activities providing goods and services subject to special consumption tax?” Displays two choices "Yes", "No," the application automatically selects "No" and allows for adjustment.

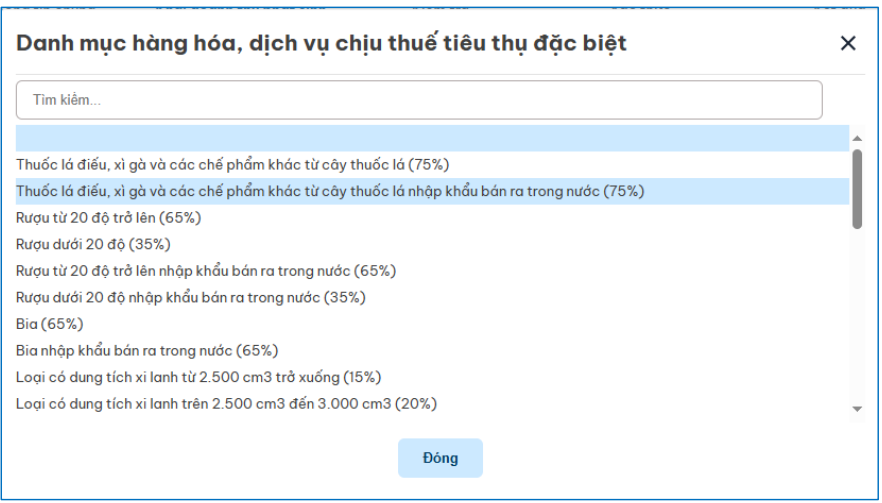

+ The taxpayer presses "Here" at the line: see the list of goods and services subject to special consumption tax Here, the system displays a popup of goods listings, allowing for quick search by the taxpayer.

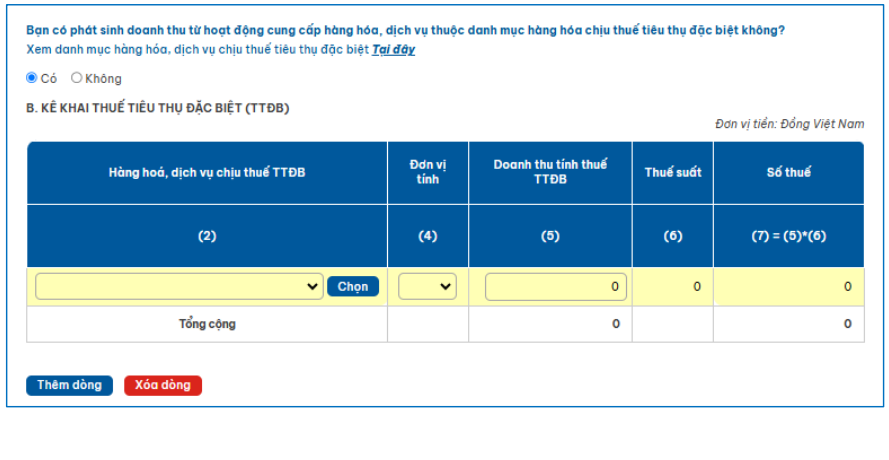

+ If selected yes, the system displays the excise tax declaration table.

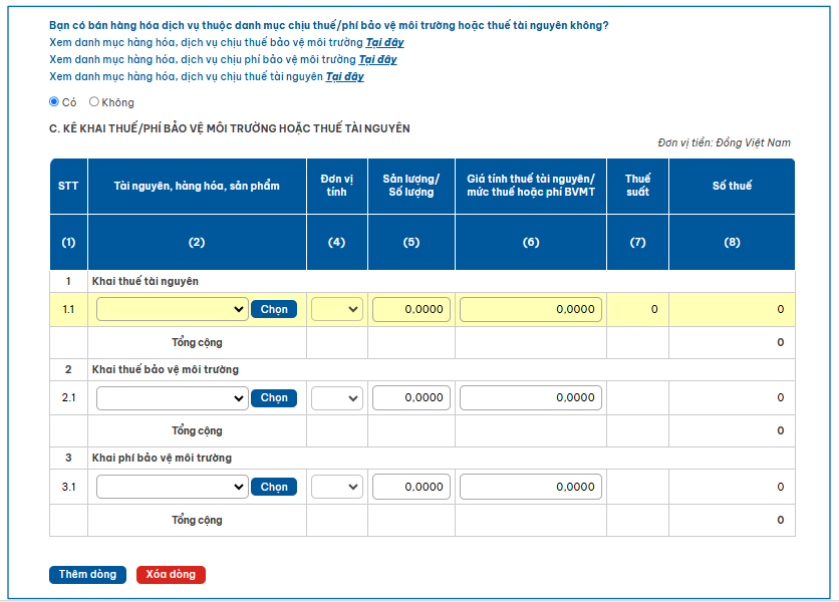

+ Question “Do you sell goods or services subject to environmental protection tax/fee or resource tax?” Displays two choices "Yes", "No," the application automatically selects "No" and allows for adjustment.

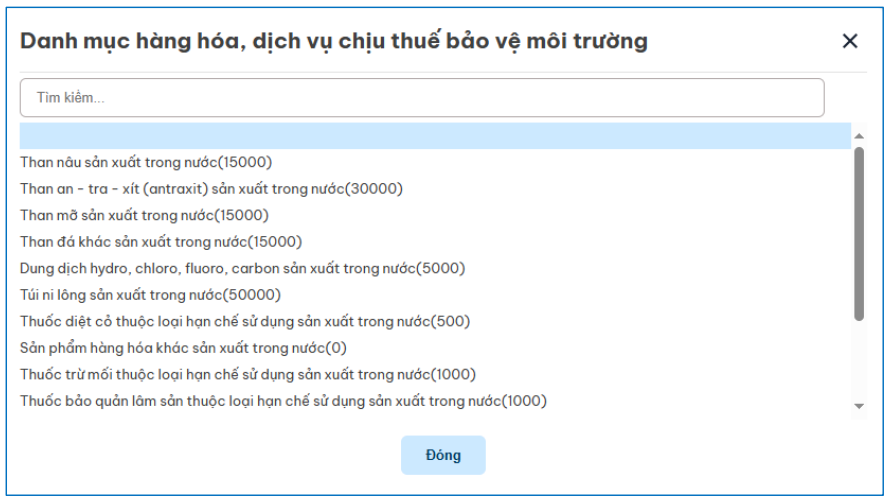

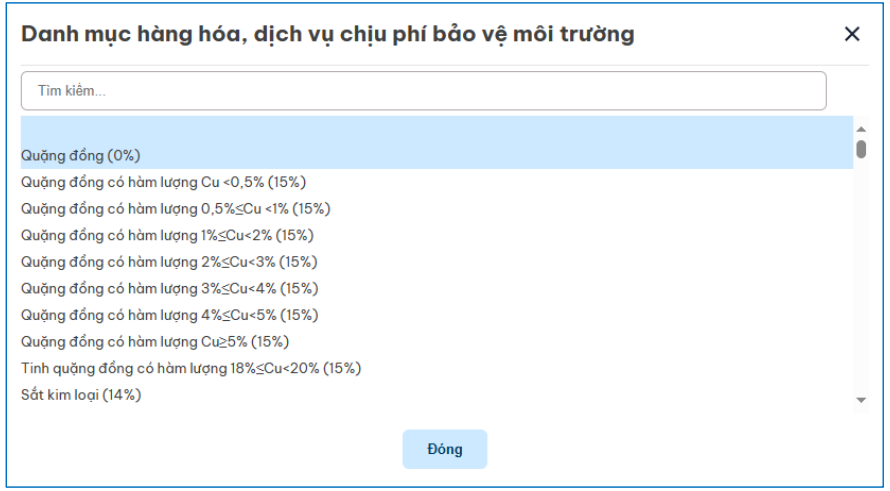

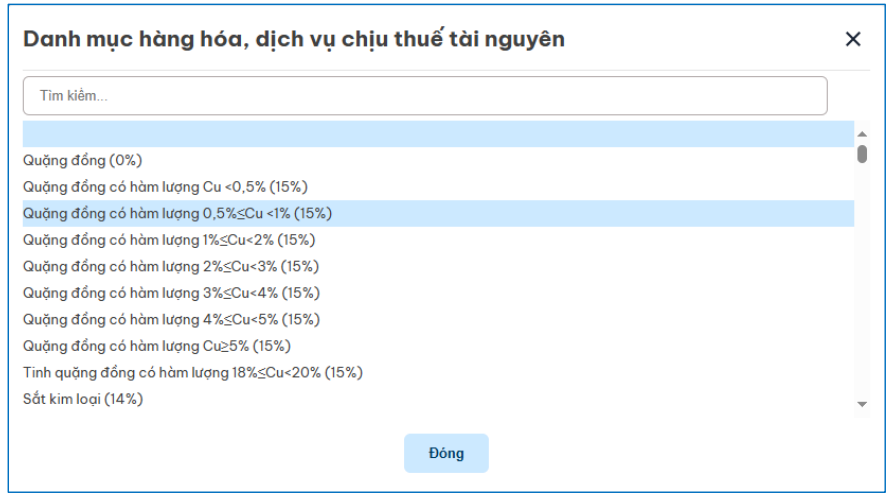

+ The taxpayer presses "Here" to view lists corresponding to each line: View the list of goods and services subject to environmental protection tax, View the list of goods and services subject to environmental protection fees, View the list of goods and services subject to resource tax.

+ If selected yes, the system displays the tax/fee declaration table for environmental protection or resource tax.

Step 2: The user declares criteria on the tax return, presses "Continue," and the system displays the review screen.

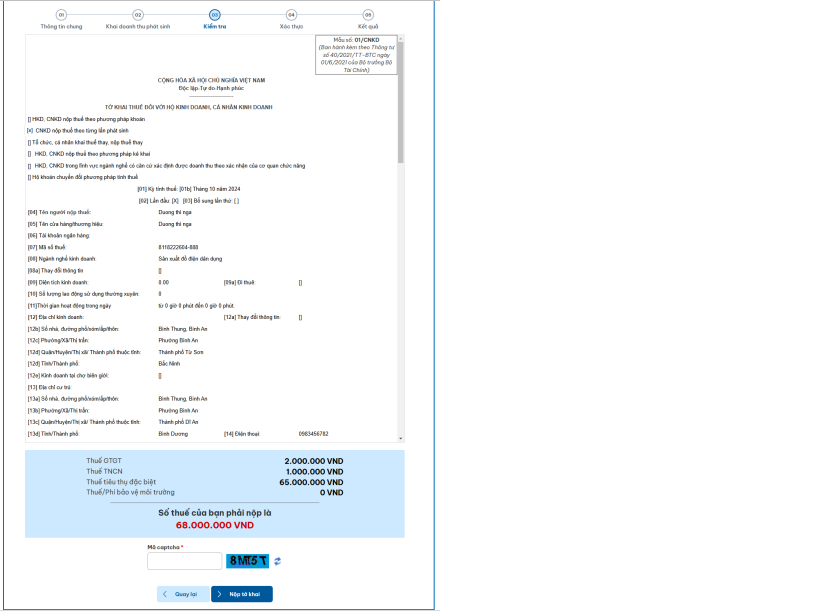

Step 3: The user checks the information on the tax return.

+ If errors are discovered, the user presses "Go back." The system displays the screen for declaring generated revenue. The user adjusts erroneous data.

+ If the declaration information is accurate, the user inputs "Captcha Code."

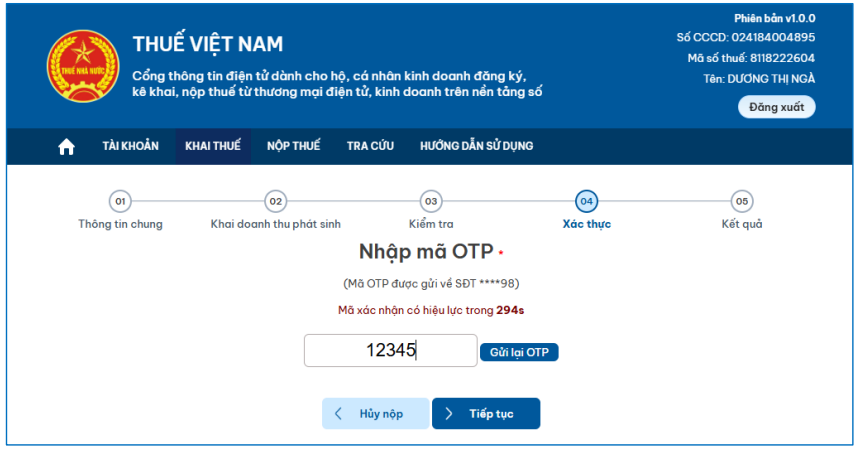

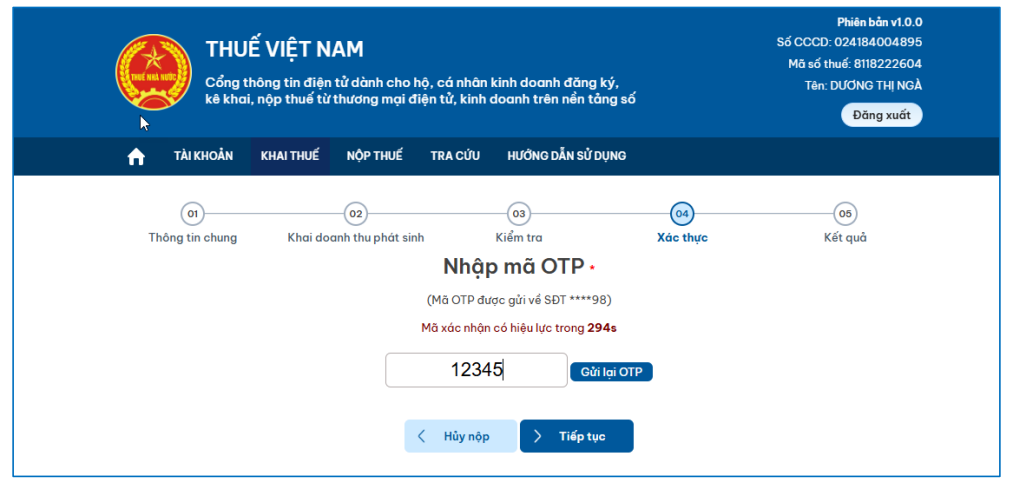

Step 4: The user selects "Submit return." The system displays the OTP entry screen.

- Enter the OTP sent to the user's registered phone number.

- Press "Cancel submission": to cancel the submission of the tax return.

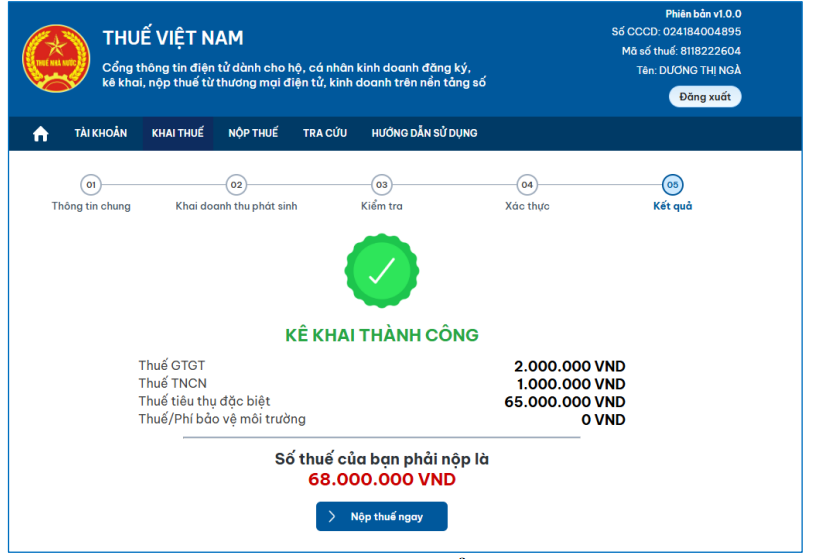

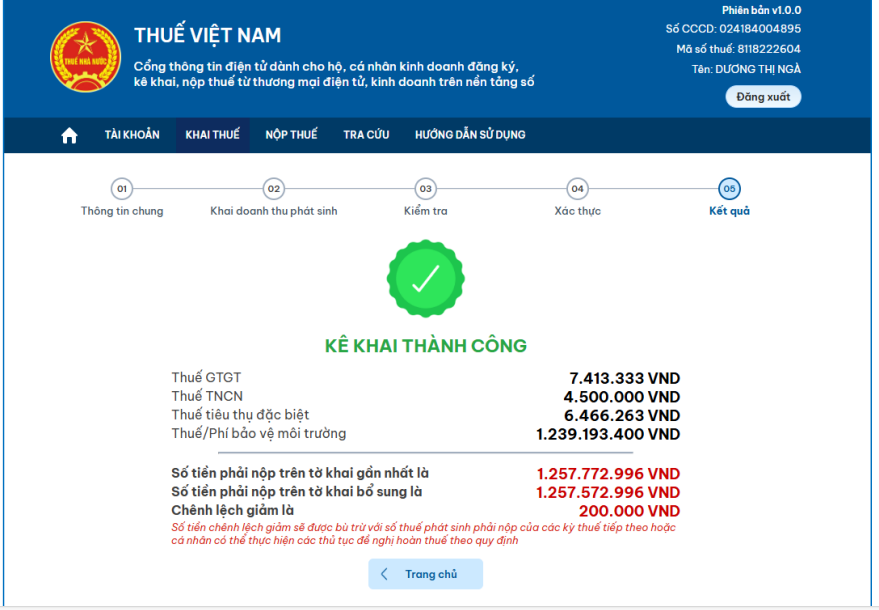

Step 5: Press "Continue," and the system displays the successful declaration screen.

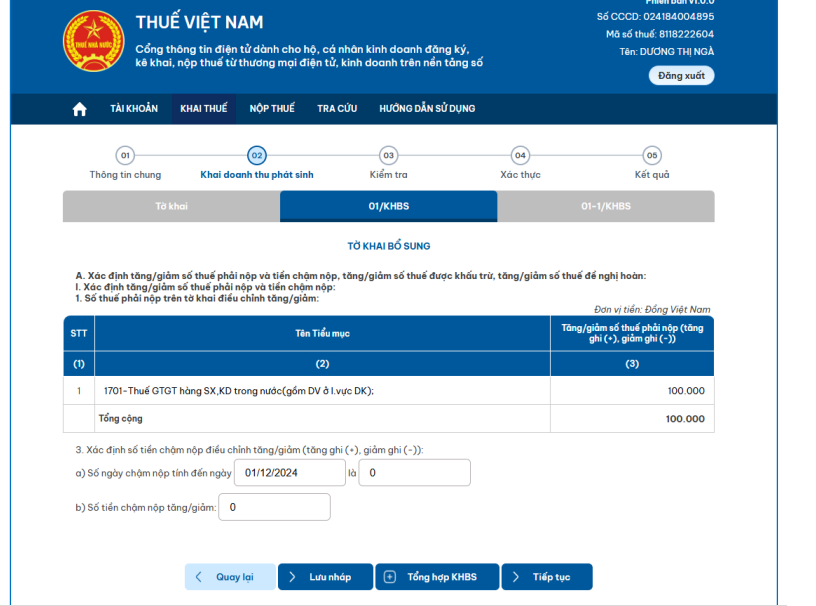

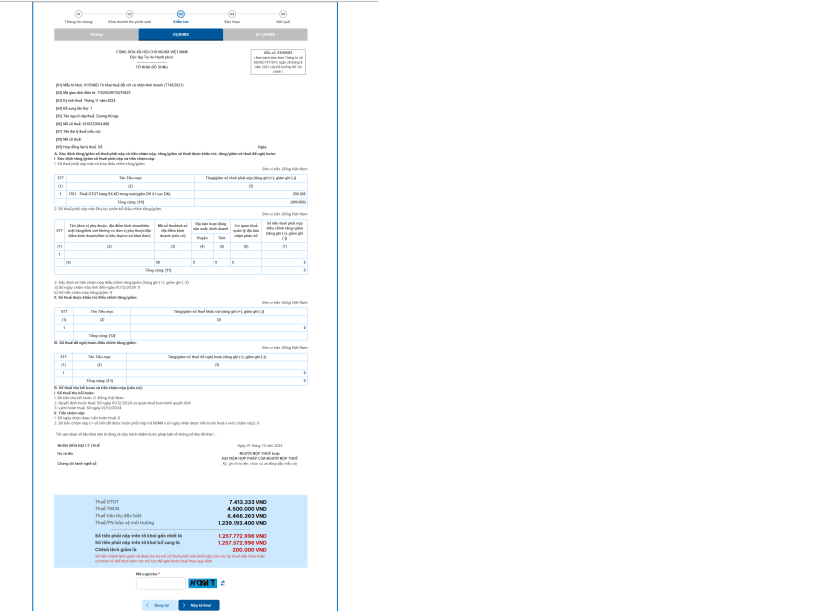

(2) In case the taxpayer selects the supplementary tax return type

Step 1: On the screen selecting tax return information, the user selects the supplementary tax return type.

Step 2: The user presses "Continue," and the system displays data from the nearest tax return for the same tax calculation period accepted by the tax authority.

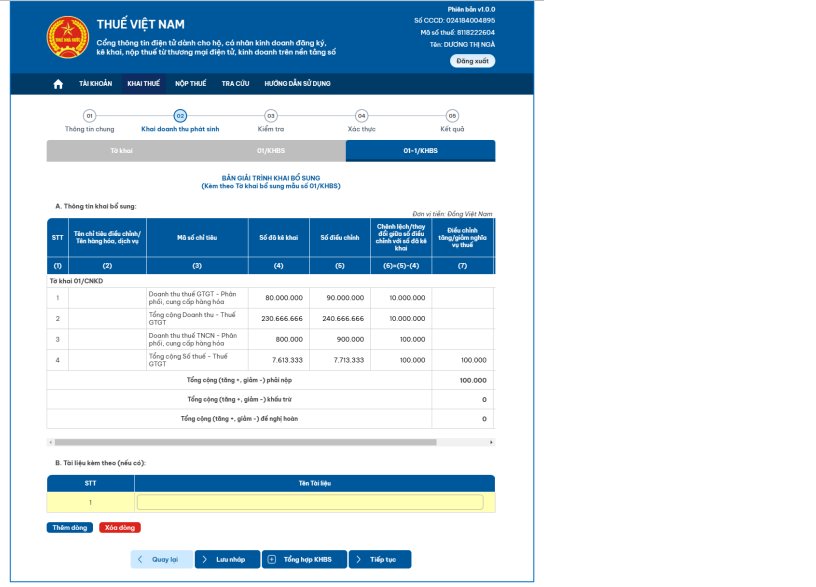

Step 3: The user adjusts information on the supplementary tax return, presses "Summarize Supplement," and the system compiles information onto 01-1/KHBS - Supplementary Explanation Form.

Step 4: The system compiles accounting items onto 01/KHBS – Supplementary Return.

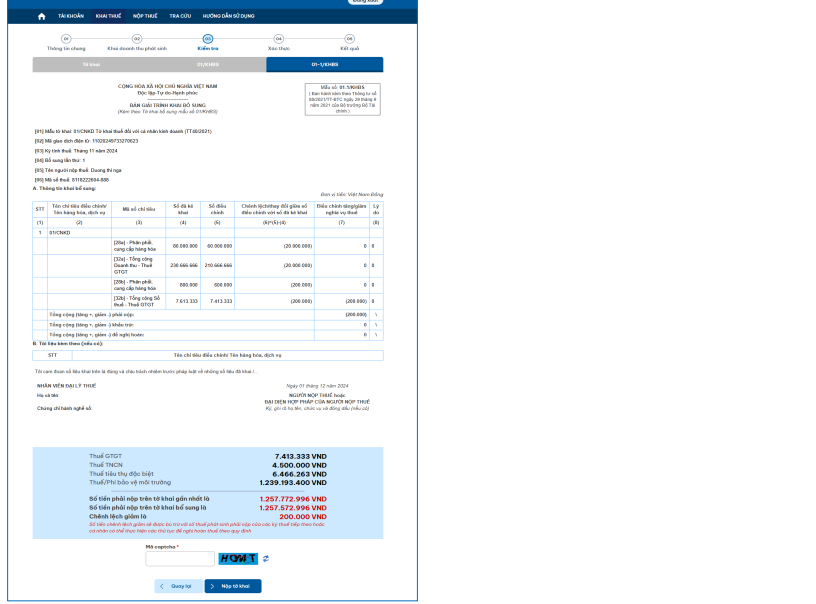

Step 5: The user presses "Continue," and the system displays the review screen + Tax return for household businesses, individual businesses.

+ Supplementary Explanation Form.

+ Supplementary Return.

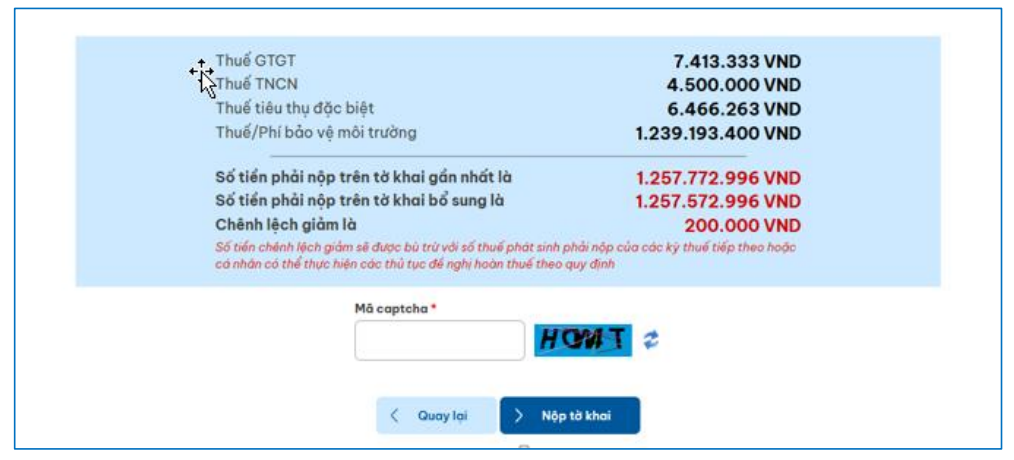

Step 6: The user checks the information on the tax return.

+ If errors are discovered, the user presses "Go back." The system displays the screen for declaring generated revenue. The user adjusts erroneous data.

+ If the declaration information is accurate, the user inputs "Captcha Code."

Step 7: The user selects "Submit return." The system displays the OTP entry screen.

- Enter the OTP sent to the user's registered phone number.

- Press "Cancel submission": to cancel the submission of the tax return.

Step 8: Press "Continue," and the system displays the successful declaration screen.

Note:

+ In case the payable amount on the supplementary tax return is less than the payable amount on the most recent return, the system does not display the "Pay Tax Now" button.

+ If the payable amount on the supplementary return is greater than the payable amount on the most recent return, the system displays the "Pay Tax Now" button, allowing the taxpayer to pay any positive amounts on the return.

[2] Searching for submitted tax returns

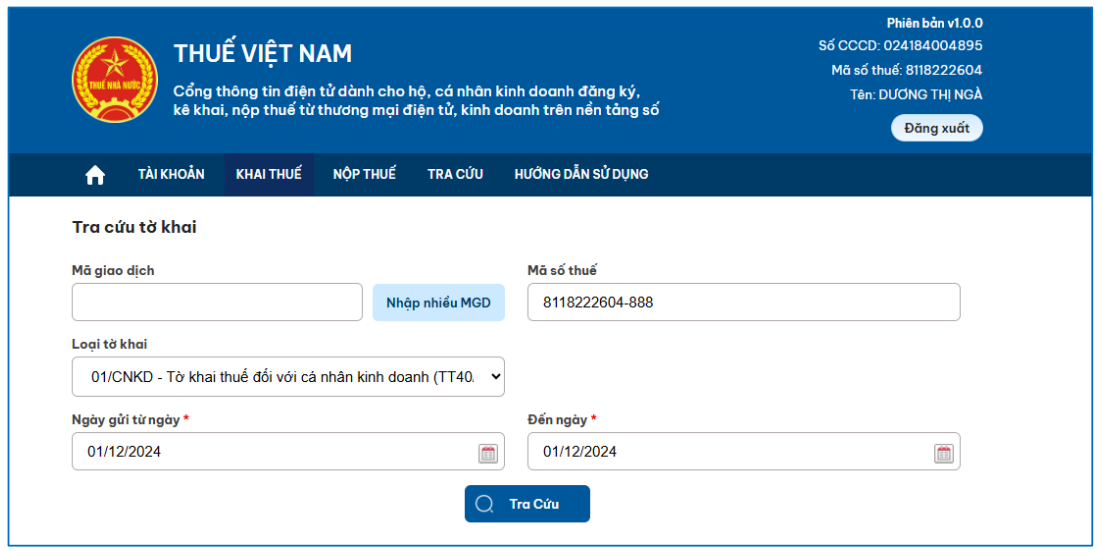

Step 1: The user logs into the system, selects the function Tax Declaration/Search for submitted tax returns to the Tax Authority.

Step 2: The system displays the search tax return screen.

*Taxpayer enters search information as follows:

- Transaction code: Allows searching for a single transaction code or multiple codes.

+ If searching for one transaction code, the taxpayer enters one transaction code.

+ If searching for multiple transaction codes, the taxpayer presses "Enter multiple TCs" to enter up to 10 transaction codes.

- Taxpayer identification number: Defaults to the number for e-commerce business activities (Code 10-888).

- Type of tax return: Defaults to the declaration 01/CNKD – Declaration for individual business (TT40/2021).

- Date sent from date…to date: Defaults to the current date, allowing for date selection.

Step 3: Press "Search."

- No matching data will result in the notification: "No tax return meets search conditions."

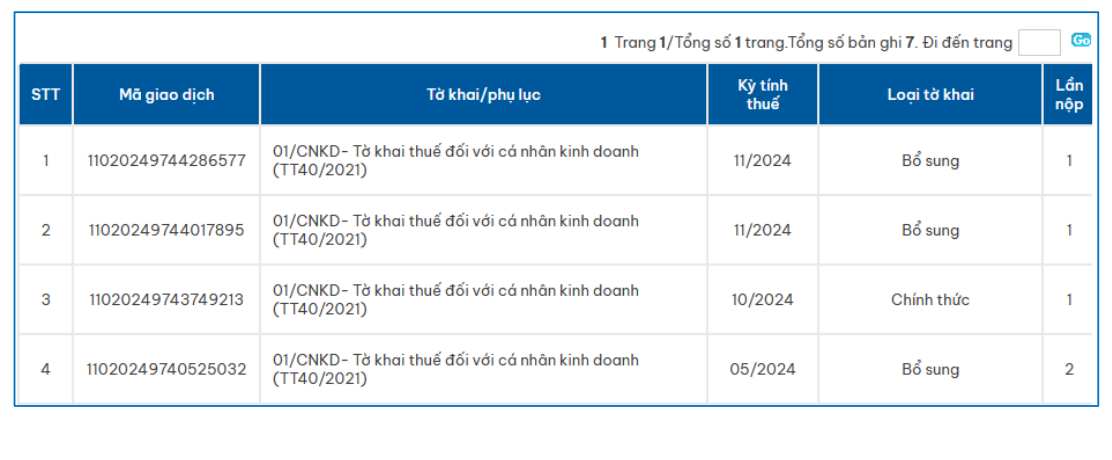

- If there is matching data, the system displays the results as follows:

The search results include the following information:

+ ordinal number: System automatically increases according to search results.

+ Transaction code: Displays the transaction code of the declaration.

+ Declaration/Appendix: Displays the declaration 01/CNKD – Tax declaration for individual business (TT40/2021).

+ Tax period: Displays the tax period by month or occurrence.

+ Type of tax return: Displays type as Official/Supplementary.

+ Submission count: Displays submission count of the return.

+ Submission date: Displays the date the return was submitted.

+ Submission location: Displays the tax authority receiving the return.

+ Status: Displays the return status.

+ Error details: Allows viewing of detailed errors if present.

+ Declaration details: Press "Details" to view the tax return sent to the Tax Authority.

+ Download: Allows downloading of the submitted tax return to the taxpayer’s workstation, format XML.

What is the guidance on declaring tax electronically for individual businesses on e-commerce platforms in Vietnam in 2025? (Image from the Internet)

What are the regulations on the deadline for submitting tax declaration dossiers in Vietnam?

According to Article 44 of the Law on Tax Administration 2019, the regulations on the deadline for submitting tax declaration dossiers are as follows:

(1) The deadlines for submitting tax declaration dossiers for taxes declared monthly, quarterly are as follows:

+ No later than the 20th of the month following the month in which the tax obligation arises for monthly declarations and payments;

+ No later than the last day of the first month of the quarter following the quarter in which the tax obligation arises for quarterly declarations and payments.

(2) The deadlines for submitting tax declaration dossiers for taxes with an annual tax period are as follows:

+ No later than the last day of the third month from the end of the calendar or financial year for annual tax finalization dossiers; no later than the last day of the first month of the calendar or financial year for annual tax declaration dossiers;

+ No later than the last day of the fourth month from the end of the calendar year for individual income tax finalization dossiers directly handled by an individual;

+ No later than December 15 of the preceding year for household business's fixed tax declaration dossiers, individual businesses paying tax under the fixed method; for new household businesses, individuals the deadline is no later than 10 days from the start of business operations.

(3) The deadline for submitting tax declaration dossiers for taxes declared and paid per tax obligation occurrence is no later than 10 days from the occurrence of the tax obligation.

(4) The deadline for submitting tax declaration dossiers in cases of cessation of operations, contract termination, or enterprise reorganization is no later than 45 days from the occurrence of the event.

(5) The Government of Vietnam prescribes the deadline for submitting tax declaration dossiers for agricultural land use tax; non-agricultural land use tax; land levy; land rent, water surface rent; mineral exploitation right fee; water resource exploitation fee; registration fee; business license tax; collection into the state budget as provided by law on the management, use of public assets; cross-border profit reporting.

(6) The deadline for submitting tax declaration dossiers for import and export goods shall follow the provisions of the Law on Customs.

(7) In case the taxpayer declares taxes through electronic transactions on the last day of the deadline for submitting tax declaration dossiers and the tax authority’s electronic portal experiences a failure, the taxpayer shall submit the tax declaration dossiers and electronic tax payment documents on the next day after the tax authority's electronic portal will resume operations.

What are the cases where the taxpayer is allowed to extend the deadline for submitting tax declarations in Vietnam?

According to Clause 1, Article 46 of the Law on Tax Administration 2019, it is provided as follows:

Extension of the deadline for submitting tax declarations

- Taxpayers unable to submit their tax declarations on time due to natural disasters, calamities, epidemics, fires, unexpected accidents are granted an extension to submit their tax declarations by the direct management tax authority head.

- The extension period shall not exceed 30 days for monthly, quarterly, annual tax declarations, tax declarations per tax obligation occurrence; 60 days for annual tax finalization declarations from the due date of submission of tax declarations.

...

Thus, the taxpayer is allowed to extend the deadline for submitting tax declarations if unable to submit on time due to natural disasters, calamities, epidemics, fires, unexpected accidents.