What is the general declaration form of non-agricultural land use tax - Form No. 03/TKTH-SDDPNN in Vietnam?

What is the general declaration form of non-agricultural land use tax - Form No. 03/TKTH-SDDPNN in Vietnam?

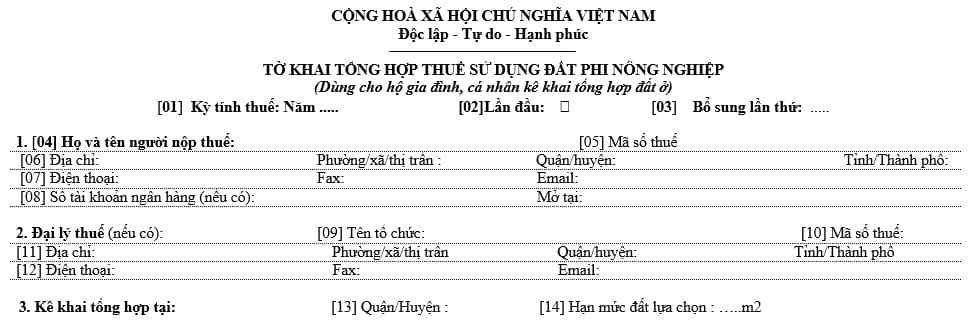

The general declaration form of non-agricultural land use tax - Form No. 03/TKTH-SDDPNN applies to households and individuals aggregately declaring residential land and is issued together with Circular 153/2011/TT-BTC as follows:

Download the general declaration form of non-agricultural land use tax - Form No. 03/TKTH-SDDPNN: Here

What is the general declaration form of non-agricultural land use tax - Form No. 03/TKTH-SDDPNN in Vietnam? (Image from the Internet)

What types of land are subject to non-agricultural land use tax in Vietnam?

According to Article 2 of the Non-agricultural Land Use Tax Law 2010, the types of land subject to non-agricultural land use tax include:

- Residential land in rural and urban areas.

- Non-agricultural production and business land, including land for the construction of industrial parks; land for the construction of production and business establishments; land for mineral exploitation and processing; and land for the production of construction materials and pottery articles.

- Non-agricultural land specified in Article 3 of Non-agricultural Land Use Tax Law 2010 which is used for commercial purposes.

What are the cases of non-agricultural land use tax exemption in Vietnam?

According to Article 10 of Circular 153/2011/TT-BTC, supplemented by Article 4 of Circular 130/2016/TT-BTC, the eligible for non-agricultural land use tax exemption include:

(1) Land of investment projects in the sectors eligible for special investment promotion (special investment incentives); investment projects in geographical areas with extreme socio-economic difficulties; investment projects in the sectors eligible for investment promotion (investment incentives) in geographical areas with socio-economic difficulties; and land of enterprises with over 50% of their employees being war invalids or diseased soldiers.

Lists of sectors eligible for investment promotion; sectors eligible for special investment promotion; areas with socioeconomic difficulties; and areas with extreme socio-economic difficulties comply with the investment law.

Employees being war invalids and diseased soldiers must be regularly employed in the year as specified in the Ministry of Labor, War Invalids and Social Affairs' Circular No. 40/ 2009/TT-BLDTBXH of December 3, 2009, and its amending documents.

(2) Land of establishments carrying out socialized activities in education, vocational training, health, culture, sports and environmental protection. These establishments include:

- Non-public establishments set up and qualified for carrying out socialized activities under regulations of competent state agencies;

- Organizations and individuals operating under the Enterprises Law that have investment projects, joint-venture or associated activities or establish establishments qualified for carrying out socialized activities under regulations of competent state agencies;

- Public non-business establishments that contribute capital to, or raise capital for jointly setting up independent cost-accounting units or enterprises carrying out socialized activities under decisions of competent slate agencies;

- Tax exemption for foreign-investment projects carrying out socialized activities shall be decided by the Prime Minister at the proposal of the Ministry of Planning and Investment and relevant line ministries.

Establishments carrying out socialized education, vocational training, healthcare, cultural, sports and environmental activities must satisfy the requirements on operation scope and standards under the Prime Minister's decisions.

(3) Land for construction of gratitude houses, great-unity houses and nursing homes for lonely elderly people, people with disabilities or orphans, and social disease- treatment establishments.

(4) Within-quota residential land in geographical areas with extreme socio-economic difficulties.

(5) Within quota residential land of persons engaged in revolutionary activities before August 19, 1945; war invalids of 1/4 or 2/4 grade; persons entitled to policies like war invalids of 1/4 or 2/4 grade; diseased soldiers of grade 1/3; heroes of people's armed forces; heroic Vietnamese mothers; natural parents and nurturing persons of martyrs during their childhood; spouses of martyrs; martyrs' children eligible for monthly allowances; Agent Orange victims who are revolutionary activists; and disadvantaged Agent Orange victims.

(6) Within-quota residential land of poor households identified under the Prime Minister's decision on poverty line. In case provincial-level People's Committees have specified a poverty line applicable in their localities according to law, poor households shall be identified under the poverty line promulgated by provincial-level People's Committees.

(7) Households and individuals whose residential land is recovered by the State in a year under approved master plans or plans will be exempt from tax on recovered land and the land in the new place of residence in that year.

(8) Land with garden houses certified by a competent state agency as historical-cultural relics.

(9) Taxpayers facing difficulties due to force majeure circumstances, if the value of damage related to land and houses on land accounts for over 50% of the taxable price.

In this cases, certification of commune-level People's Committees of the localities where exists such land is required.

(10) A household or individual shall be exempted from the annual tax on non-agricultural land use if the tax payable, after reduced owing to any tax exemption or deduction as per the Law on taxation of non-agricultural land use and guiding documents, is fifty thousand Vietnam dongs or less. If such household or individual has several land parcels in a province, the exemption of the tax on non-agricultural land use, according to this Article, shall be based on the total tax payable on all land parcels. The procedure for exemption of non-agricultural land use tax, according to this Article, is governed by Circular 153/2011/TT-BTC.

A household or individual who has paid the tax on non-agricultural land use to the state budget though being eligible for exemption of such tax as per this Circular, shall receive a refund of the tax from tax authorities according to the Law on tax administration and guiding documents.

Which entities are subject to the non-agricultural land use tax reduction in Vietnam?

According to the provisions in Article 11 of Circular 153/2011/TT-BTC, the entities eligible for a 50% reduction in non-agricultural land use tax include:

(1) Land of investment projects in the sectors eligible for investment promotion; investment projects in geographical areas with socioeconomic difficulties; land of enterprises with between 20% and 50% of their employees being war invalids or diseased soldiers.

(2) Within-quota residential land in geographical areas with socio-economic difficulties.

( 3) Within-quota residential land of war invalids of 3/4 or 4/4 grade; persons enjoying policies like war invalids of 3/4 or 4/4 grade; martyrs' children enjoying monthly allowances,

(4) Taxpayers facing difficulties due to force majeure circumstances, provided the value of damage related to their land and houses on land accounts for between 20% and 50% of the taxable price.

In this cases, certification of commune-level People's Committees of the localities where exists such land is required.