What is the Form No. 06/HTQT: Application form for confirmation of Vietnamese residents?

What is the Form No. 06/HTQT: Application form for confirmation of Vietnamese residents?

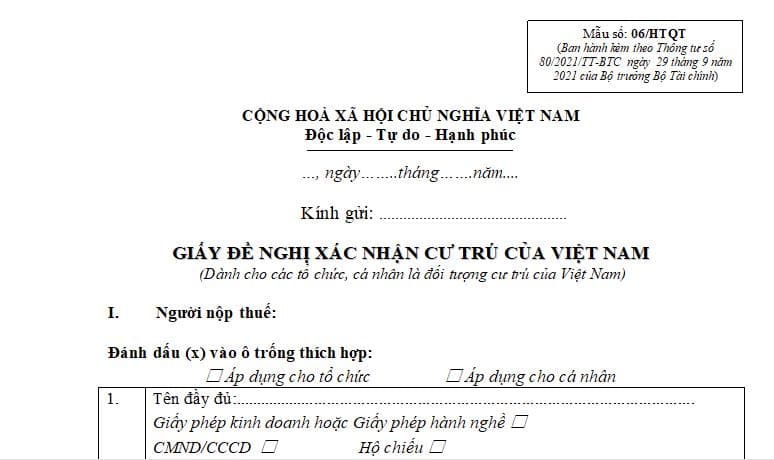

The application form for confirmation of Vietnamese residents No. 06/HTQT of Vietnam is issued according to Form No. 06/HTQT enclosed with Circular 80/2021/TT-BTC, as follows:

>> Download application form for confirmation of Vietnamese residents No. 06/HTQT

What is the Form No. 06/HTQT: Application form for confirmation of Vietnamese residents? (Image from the Internet)

What are the procedures for confirming the taxpayers who are Vietnamese residents?

Based on Subsection 2, Part 2, Administrative Procedures issued together with Decision 2780/QD-BTC of 2023, the procedures for confirming the taxpayers who are Vietnamese residents are as follows:

- Procedure steps:

+ Step 1: Organizations and individuals requesting confirmation as Vietnam tax residents under the tax agreement shall prepare a request dossier and send it to the Tax Department where the taxpayer registration is located.

+ Step 2: Tax authority reception:

- In case the dossier is submitted directly at the tax authority or by postal service: the tax authority receives, processes the dossier, and returns the results as prescribed.

- In case the dossier is submitted to the tax authority via electronic transactions, the receipt, inspection, acceptance, and processing of the dossier shall be done through the tax authority's electronic data processing system.

- Implementation methods:

+ Direct submission at the tax authority's headquarters;

+ Sending via postal service;

+ Or electronic dossier submission through the tax authority's electronic transaction portal.

How many days must a resident individual be in Vietnam subject to personal income tax?

According to the provisions at Point a, Clause 1, Article 1 Circular 111/2013/TT-BTC (amended by Article 2 Circular 119/2014/TT-BTC), a resident individual is a person who meets one of the following conditions:

- Being present in Vietnam for 183 days or more within a calendar year or for 12 consecutive months from the first day of arrival in Vietnam, with both the arrival and departure days counted as one (01) day. The arrival and departure days are based on the immigration authority's certification on the individual's passport (or laissez-passer) upon entry and exit from Vietnam. If entry and exit occur on the same day, it is counted as one day of residence.

An individual present in Vietnam as guided at this point is the individual's physical presence within Vietnam's territory.

- Having a regular place of residence in Vietnam.

Thus, a resident individual subject to personal income tax must be present in Vietnam for 183 days or more within a calendar year or for 12 consecutive months from the first day of arrival in Vietnam or meet the conditions regarding having a regular place of residence in Vietnam.

What is the deadline for first-time taxpayer registration for Vietnamese residents when personal income tax obligations arise?

Based on Article 33 of the 2019 Tax Administration Law, the deadline for first-time taxpayer registration is as follows:

First-time taxpayer registration deadline

...

2. For taxpayers registering directly with the tax authority, the registration deadline is 10 working days from the following days:

a) Issuance date of the business registration certificate, license for establishment and operation, investment registration certificate, or establishment decision;

b) The start of business operations for organizations not subject to business registration or business household, and individuals subject to business registration but not yet issued a business registration certificate;

c) The date of liability for tax withholding and payment on behalf of another party arises; the date an organization pays income on behalf of individuals under a business cooperation contract or document;

d) The date of signing the contract for foreign contractors, subcontractors declaring tax directly with the tax authority; the date of signing the contract, oil and gas agreement;

dd) The date when the personal income tax obligation arises;

e) The date of the request for tax refund arises;

g) The date other obligations with the state budget arise.

3. Organizations and individuals paying income have the responsibility to register for taxpayers on behalf of individuals with income no later than 10 working days from the day the tax obligation arises in case the individual does not have a tax identification number; register taxpayers on behalf of dependents of taxpayers no later than 10 working days from the date taxpayers register for family deductions according to law in case dependents have not yet obtained a tax identification number.

The first-time taxpayer registration deadline for Vietnamese residents when personal income tax obligations arise is 10 days.