What is the Form No. 05/TNDN on corporate income tax return in Vietnam?

What is the Form No. 05/TNDN on corporate income tax return in Vietnam?

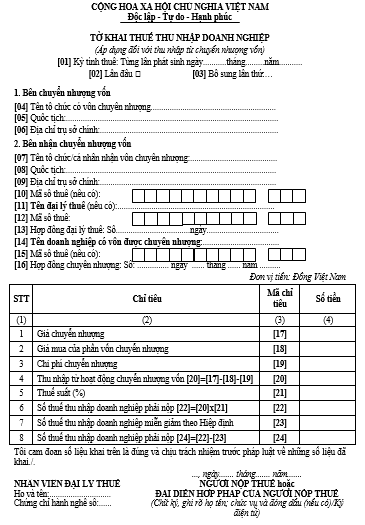

Form No. 05/TNDN Corporate Income Tax Return, the latest version, is stipulated in Circular 80/2021/TT-BTC as follows:

Download form No. 05/TNDN: here

What is the Form No. 05/TNDN on corporate income tax return in Vietnam? (Image from the Internet)

What are subjects for application of the Form 05/TNDN in Vietnam?

Based on Article 14 of Circular 78/2014/TT-BTC, the subjects for application are as follows:

Organizations and individuals receiving capital transfer are responsible for declaring on behalf of foreign contractors, preparing data, compiling tax declaration dossiers for each occurrence and submitting to the tax authority that directly manages the enterprise where the foreign contractor invests.

In cases where the organization or individual receiving the capital transfer is also a foreign contractor, the organization established in accordance with Vietnamese law, where the foreign contractor invests, compiles the tax declaration dossier for each occurrence and submits it to the tax authority that directly manages the enterprise where the foreign contractor invests. The deadline for submitting tax declaration dossiers is no later than the 10th day from the date the tax obligation arises.

What incomes are exempt from corporate income tax in Vietnam?

According to Article 4 of the 2008 Law on Corporate Income Tax, amended and supplemented by Clause 3 of Article 1 of the 2013 Law on amendments to the Law on Corporate Income Tax, and further amended by Clause 1 through Clause 2 of Article 1 of Law No. 71/2014/QH13 on amended tax laws of 2014, the incomes exempt from corporate income tax include:

- Income from agriculture, livestock, aquaculture, processing agricultural products, seafood, and salt production of cooperatives; income of cooperatives operating in agriculture, forestry, fishery, and salt production in areas with difficult socio-economic conditions or particularly difficult socio-economic conditions; income of enterprises from agriculture, livestock, aquaculture, processing agricultural products, seafood in areas with particularly difficult socio-economic conditions; income from offshore fishing activities.

- Income from technical service activities directly serving agriculture.

- Income from implementing scientific research contracts and technology development, products in the trial production phase, and products made from new technologies applied for the first time in Vietnam.

- Income from the production, trading of goods, and services by enterprises with an average annual number of employees with disabilities, rehabilitated drug addicts, HIV/AIDS-infected individuals accounting for 30% or more, and the average annual number of employees from twenty or more, excluding enterprises operating in the finance and real estate business.

- Income from vocational training dedicated to ethnic minorities, disabled people, children with special circumstances, and social evils subjects.

- Income distributed from the contribution of capital, joint ventures, and affiliated enterprises in the country, after having paid corporate income tax as per this Law.

- Donations used for educational activities, scientific research, culture, arts, charity, humanity, and other social activities in Vietnam.

- Income from the transfer of certified emission reductions (CERs) by enterprises certified for emission reductions.

- Income from tasks assigned by the Government of Vietnam to the Vietnam Development Bank in investment development credit, export credit; income from credit activities for the poor and other policy subjects of the Vietnam Social Policy Bank; income of state financial funds and other non-profit state funds as stipulated by law; income of an entity with 100% of its charter capital owned by the state established by the Government of Vietnam to handle bad debts of credit institutions in Vietnam.

- Income that forms undivided assets of socialized establishments in the fields of education, training, healthcare, and other socialized areas to reinvest in developing those establishments in accordance with specialized laws on education, training, healthcare, and other socialized areas; undivided income of cooperatives established and operating in compliance with the Cooperative Law.

- Income from technology transfer prioritized for transfer to organizations and individuals in socio-economically exceptionally difficult areas.