What is the Form No. 02/SO-KTT account balance sheet in Vietnam?

What is the Form No. 02/SO-KTT on account balance sheet in Vietnam?

According to Section 3, Appendix 4 issued together with Circular 111/2021/TT-BTC, the account balance sheet provides a concise record of the beginning balance, increases, decreases during the period, and ending balance of accounting accounts reflecting the taxes to be collected, collected, remaining to be collected, refundable, refunded, remaining to be refunded, exempted, reduced, debts deferred, and debts written off by the tax authority.

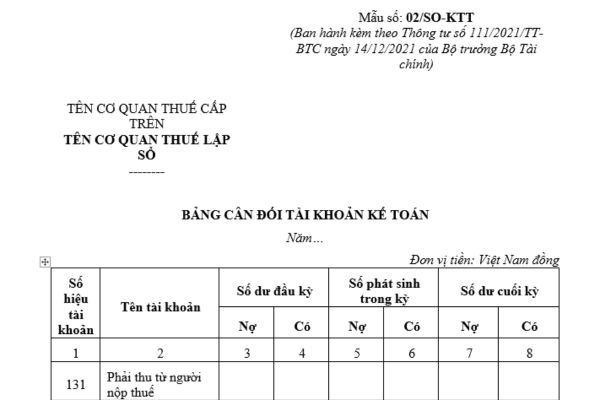

Form No. 02/SO-KTT is the account balance sheet regulated in Appendix 4 issued together with Circular 111/2021/TT-BTC.

Below is Form No. 02/SO-KTT account balance sheet:

DOWNLOAD >>> Form No. 02/SO-KTT account balance sheet

What is the basis for preparing the account balance sheet in Vietnam?

The basis for preparing the account balance sheet as regulated in Section III, Appendix 4 issued together with Circular 111/2021/TT-BTC is as follows:

III. CONTENT AND METHOD OF TAX ACCOUNTING RECORDING

...

1. Purpose:

The Balance Sheet of Accounting Accounts provides a concise record of the beginning balance, increases, decreases during the period, and ending balance of accounting accounts reflecting the taxes to be collected, collected, remaining to be collected, refundable, refunded, remaining to be refunded, exempted, reduced, debts deferred, and debts written off by the tax authority.

2. Basis for preparation:

a) Tax accounting books according to accounting accounts.

b) Balance Sheet of the previous year's accounting accounts.

Before preparing the Balance Sheet of Accounting Accounts, it is necessary to complete the recording, closing of the Tax Accounting Books as required, and to check and reconcile accurately between the related figures in the books.

...

The basis for preparing the account balance sheet includes:

- Tax accounting books according to accounting accounts.

According to Article 25 Circular 111/2021/TT-BTC, the Tax Accounting Books is a form of data established in the Tax Accounting Subsystem, used to record, reflect, store fully and systematically all amounts of tax to be collected, collected, remaining to be collected, refundable, refunded, remaining to be refunded, exempted, reduced, debts deferred, and debts written off during the process of performing tax management operations by tax authorities at all levels.

- Balance Sheet of the previous year's accounting accounts.

Before preparing the Balance Sheet of Accounting Accounts, it is necessary to complete the recording, closing of the Tax Accounting Books as required, and to check and reconcile accurately between the related figures in the books.

What is the Form No. 02/SO-KTT account balance sheet in Vietnam? (Image from the Internet)

What are instructions for preparing the account balance sheet in Vietnam?

The content and methods for preparing the account balance sheet are guided in Section III, Appendix IV issued together with Circular 111/2021/TT-BTC as follows:

(1) Column 1, 2 - Account number, account name: Record the account number, record the names of all Level 1 accounts and Level 2, Level 3 accounts (if any).

(2) Column 3, 4 - Beginning balance: Reflect the beginning balance of the report year. Data for recording in these columns are based on the beginning balance line in the Tax Accounting Books or the ending balance of the previous year's Balance Sheet. In which, accounts with Debit balance are reflected in the "Debit" column, accounts with Credit balance are reflected in the "Credit" column.

(3) Column 5, 6 - Transactions during the period: Reflect the total Debit transactions and total Credit transactions of accounts during the report period. Data recorded in these columns are based on the transaction totals line for each corresponding account in the Tax Accounting Books. In which, total "Debit" transactions of accounts are summarized in the "Debit" column, total "Credit" transactions of accounts are summarized in the "Credit" column.

(4) Column 7, 8 - Ending balance: Reflect the balance at the end of the report year. Data for recording in these columns are based on the ending balance line in the Tax Accounting Books or calculated based on the beginning balance columns (columns 3, 4), transactions during the period (columns 5, 6) in this year's Balance Sheet. The data in columns 7, 8 are used to prepare the next year's Balance Sheet.

After recording all the relevant data for the accounts, the total for the Balance Sheet must be computed. The data in the Balance Sheet must ensure:

- Total beginning Debit balance (Column 3) = Total beginning Credit balance (Column 4)

- Total Debit transactions during the period (Column 5) = Total Credit transactions during the period (Column 6)

- Total ending Debit balance (Column 7) = Total ending Credit balance (Column 8)