What is the form for personal income tax declaration from salaries and remunerations in Vietnam?

What is the form for personal income tax declaration from salaries and remunerations in Vietnam?

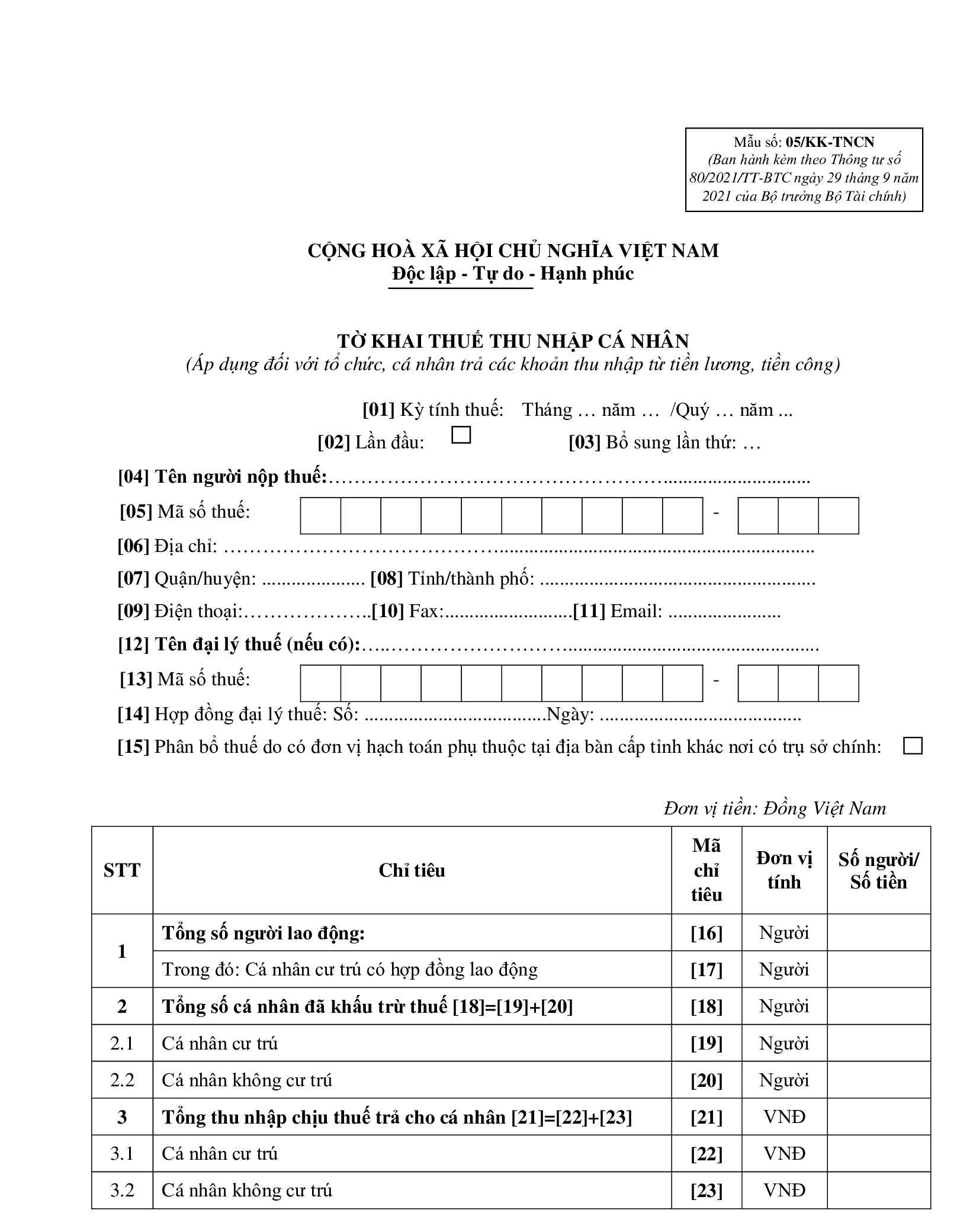

The personal income tax declaration form (applicable to organizations, individuals who pay income from salaries and remunerations) currently is form 05/KK-TNCN issued along with Circular 80/2021/TT-BTC.

Form 05/KK-TNCN is structured as follows:

Download form 05/KK-TNCN

Note:

- Form 05/KK-TNCN is only applicable for organizations, individuals who incur payment of income from salaries and remunerations to individuals in the month/quarter, irrespective of whether there is tax withholding or not.

- Monthly tax declaration period applies to organizations, individuals paying income with total sales of goods and services provision of the previous year exceeding 50 billion VND, or cases where organizations, individuals select monthly tax declaration.

- Quarterly tax declaration period applies to organizations, individuals paying income with total sales of goods and service provision of the previous year of 50 billion VND or less, including organizations, individuals paying income without incurring sales of goods and services provision.

What is the form for personal income tax declaration from salaries and remunerations in Vietnam? (Image from the Internet)

Is it required to submit a declaration when there is no personal income tax incurred in Vietnam?

Based on Clause 3, Article 7 of Decree 126/2020/ND-CP, supplemented by Clause 2, Article 1 of Decree 91/2022/ND-CP, the regulations on cases where the tax declaration dossier is not required are as follows:

Tax declaration dossier

...

- Taxpayers are not required to submit tax declaration dossiers in the following cases:

a) Taxpayers only have activities, business belonging to non-taxable entities according to the laws on each type of tax.

b) Individuals have income exempt from tax according to the personal income tax law and provisions at Point b, Clause 2, Article 79 of the Law on Tax Administration, except individuals receiving inheritance, gifts that are real estate; transferring real estate.

c) Export processing enterprises only have export activities and are not required to submit value-added tax declarations.

d) Taxpayers temporarily suspend operations, business according to the provisions of Article 4 of this Decree.

đ) Taxpayers submit dossiers for the termination of the tax code’s validity, except in cases of ceasing operations, terminating contracts, reorganizing enterprises according to the provisions of Clause 4, Article 44 of the Law on Tax Administration.

e) Personal income tax declarants are organizations, individuals paying income where personal income tax declaration on a monthly, quarterly basis incurs no personal income tax withholding of the income recipient during that month or quarter.

...

According to the above provision, if the personal income tax declarant is an enterprise paying income and no personal income tax withholding arises during that month or quarter for the income recipient, there is no need to submit a tax declaration dossier.

When is the deadline for paying personal income tax in Vietnam?

Pursuant to Clause 1, Article 55 of the Law on Tax Administration 2019, the deadline for personal income tax payment is regulated as follows:

Tax payment deadline

- If the taxpayer calculates the tax, the tax payment deadline is no later than the last day of the tax declaration submission deadline. In case of supplementary tax declaration, the tax payment deadline is the tax declaration submission deadline of the tax period with errors or omissions.

For corporate income tax, temporarily paid by quarter, the tax payment deadline is no later than the 30th of the first month of the subsequent quarter.

For crude oil, the deadline for payment of resource tax, corporate income tax per oil sale is 35 days from the date of domestic sale or from the date of customs clearance according to customs laws for exported crude oil.

For natural gas, the tax payment deadline for resources, corporate income tax is monthly.

- If the tax authority calculates the tax, the payment deadline is the time indicated on the notice from the tax authority.

- For other collections belonging to the state budget from land, water resource exploitation rights fees, mineral resource exploitation fees, registration fees, business license fees, the deadline is as per the Government of Vietnam’s regulations.

- For exported, imported goods subject to taxes under tax regulations, the deadline for tax payment follows the Law on Export and Import Duties; in cases where additional tax arises after customs clearance or goods release, the deadline for arising tax payment is implemented as follows:

a) The deadline for supplementary tax declaration, for determined tax payment applies according to the initial customs declaration tax payment deadline;

b) The deadline for tax payment for goods needing analysis, inspection to determine the correct tax amount; goods without official prices at the time of customs declaration registration; goods with actual payments, goods with adjustments added to customs value that are undeclared at the time of customs declaration registration are implemented according to the provisions of the Minister of Finance.

Therefore, the deadline for paying personal income tax is no later than the last day of the tax declaration submission deadline, meaning the tax payment deadline is also the deadline for submitting the personal income tax declaration if a personal income tax amount is required. In addition, in cases of supplementary tax declaration, the tax payment deadline is the tax declaration submission deadline for the tax period with errors or omissions.