What is the Form 30/DK-TCT - Application form for relocation to the tax authority in charge of the new location in Vietnam in 2025?

What is the Form 30/DK-TCT - Application form for relocation to the tax authority in charge of the new location in Vietnam in 2025?

Based on sub-point b.2.2, point b, clause 2, Article 10 of Circular 86/2024/TT-BTC (document effective from February 6, 2025), governing changes in taxpayer registration information that alter the direct tax authority for organizations as follows:

Location for submission and application for amendments to tax registration

...

- Changing taxpayer registration information with alternation of supervisory tax authority

...

b) Taxpayers who are directly registered with the tax authority under the provisions of points a, b, c, d, đ, h, n of clause 2, Article 4 of this Circular when there is a change in the address of the head office to another province or centrally-affiliated city or a change in the address of the head office to another district within the same province or centrally-affiliated city that changes the direct tax authority, shall proceed as follows:

...

b.2) At the tax authority where the relocation is to occur

...

b.2.2) application for amendments to tax registration, includes:

- The application form for relocation to the tax authority in charge of the new location, form number 30/DK-TCT issued with this Circular.

...

Simultaneously, based on point b, clause 3, Article 25 of Circular 86/2024/TT-BTC (document effective from February 6, 2025), governs changes in taxpayer registration information that alter the direct tax authority for households and individuals as follows:

Location for submission and application for amendments to tax registration

...

- Families and business individuals regulated at point i, clause 2, Article 4 of this Circular when changing the address of the head office to another province or centrally-affiliated city, or changing the address of the head office to another district within the same province or centrally-affiliated city that changes the direct tax authority

...

b) At the relocation destination

Families and business individuals shall submit the application for amendments to tax registration at the District Tax Department or the Regional Tax Department of the relocation destination within 10 (ten) working days from the date the tax authority of the previous location issues a Notification about the taxpayer's relocation using form number 09-MST issued with this Circular. The application for amendments to tax registration is the application form for relocation to the tax authority in charge of the new location, form number 30/DK-TCT issued with this Circular.

...

Thus, the application form for relocation to the tax authority in charge of the new location is form number 30-DK-TCT issued in Appendix 2 attached to Circular 86/2024/TT-BTC. Form number 30-DK-TCT is used when the taxpayer changes taxpayer registration information with alternation of supervisory tax authority.

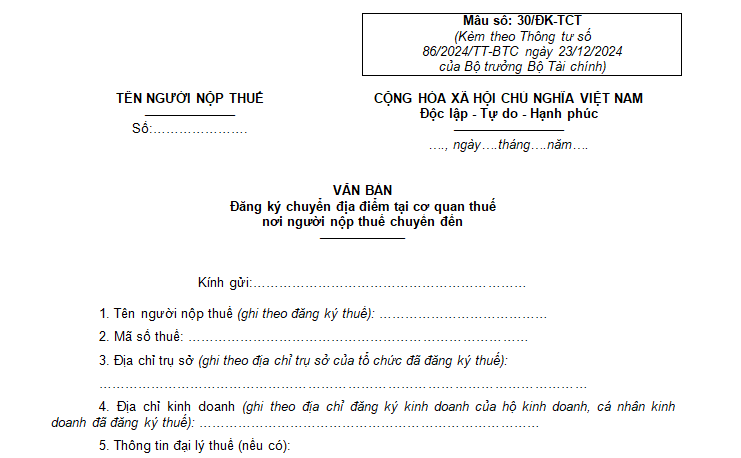

To be specific, form number 30-DK-TCT, the application form for relocation to the tax authority in charge of the new location, is as follows:

Download Form number 30-DK-TCT, application form for relocation to the tax authority in charge of the new location.

What is the Form 30/DK-TCT - Application form for relocation to the tax authority in charge of the new location in Vietnam in 2025? (Image from Internet)

How to handle application for amendments to tax registration with alternation of supervisory tax authority for organizations in Vietnam?

Based on Article 11 of Circular 86/2024/TT-BTC (document effective from February 6, 2025), governing the handling of application for amendments to tax registration with alternation of supervisory tax authority for organizations as follows:

- At the tax authority of the previous location:

+ Within 05 (five) working days from the date of signing the decision to impose administrative sanctions on tax or the audit conclusion (for documentation requiring inspection at the taxpayer's premises), 07 (seven) working days from the date of receiving documentation from the taxpayer (for documentation not requiring inspection at the taxpayer's premises), and meanwhile the taxpayer has fulfilled obligations with the tax authority of the previous location under the provisions of clause 3, Article 6 of Decree 126/2020/ND-CP, the tax authority issues a Notification about the taxpayer's relocation using form number 09-MST issued with Circular 86/2024/TT-BTC to the taxpayer and the tax authority of the new location.

+ Beyond the above time, if the taxpayer has not fulfilled obligations with the tax authority of the previous location, the deadline for the tax authority to issue a Notification about the taxpayer's relocation using form number 09-MST issued with Circular 86/2024/TT-BTC is readjusted to 03 (three) working days from the date the taxpayer fulfills tax obligations with the tax authority of the previous location.

+ Determining whether a taxpayer is subject to inspection at the taxpayer's premises follows the regulations of tax management law.

+ A taxpayer relocating their main business location to a new head office, if they still have business activities in a different provincial area than the location of the head office and have a tax declaration and payment obligation with the tax authority in that provincial area under the regulations of tax management law (the tax authority managing the revenue), does not need to perform a tax obligation transfer under this provision.

- At the tax authority of the new location:

+ Within 03 (three) working days from the date of receiving full documentation from the taxpayer, the receiving tax authority is tasked with updating the changes into the taxpayer registration application system, issuing a Certificate of Taxpayer Registration or Notification of the updated tax code information sent to the taxpayer.

How to Hhndle application for amendments to tax registration with alternation of supervisory tax authority for individual and household businesses in Vietnam?

Based on Article 26 of Circular 86/2024/TT-BTC (document effective from February 6, 2025), governing the handling of application for amendments to tax registration with alternation of supervisory tax authority for individual and household businesses as follows:

- At the tax authority of the previous location:

+ Within 05 (five) working days from the date of signing the decision to impose administrative sanctions on tax or the audit conclusion (for documentation requiring inspection at the taxpayer's premises), 07 (seven) working days from the date of receiving documentation from the taxpayer (for documentation not requiring inspection at the taxpayer's premises), and meanwhile the taxpayer has fulfilled obligations with the tax authority of the previous location under the provisions of clause 3, Article 6 of Decree 126/2020/ND-CP, the tax authority issues a Notification about the taxpayer's relocation using form number 09-MST issued with Circular 86/2024/TT-BTC to the taxpayer and the tax authority of the new location.

+ Beyond the above time, if the taxpayer has not fulfilled obligations with the tax authority of the previous location, the deadline for issuing a Notification about the taxpayer's relocation using form number 09-MST issued with Circular 86/2024/TT-BTC is readjusted to 03 (three) working days from the date the taxpayer fulfills obligations with the tax authority of the previous location.

+ Determining whether a taxpayer is subject to inspection at the taxpayer's premises follows the regulations of tax management law.

- At the tax authority of the new location:

+ Within 03 (three) working days from the date of receiving full documentation from the taxpayer, the receiving tax authority is tasked with updating the changes into the taxpayer registration application system, issuing a Certificate of Taxpayer Registration or Notification of the updated tax code information sent to the taxpayer.