What is the Form 05/TB-TDT on notification of successful e-tax payment in Vietnam?

What is the Form 05/TB-TDT on notification of successful e-tax payment in Vietnam?

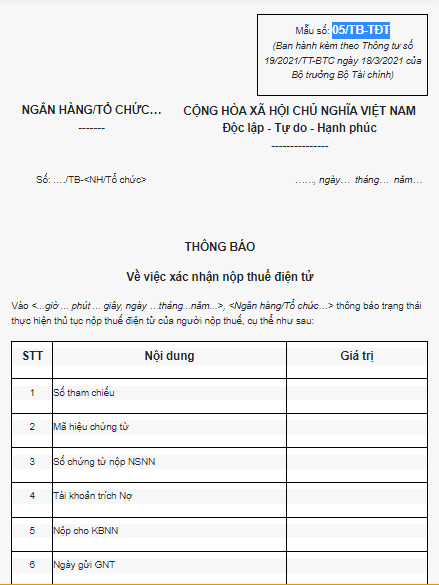

Based on the list of form templates issued along with Circular 19/2021/TT-BTC, the notification of successful e-tax payment is Form 05/TB-TDT, as follows:

>>> Download Form 05/TB-TDT on notification of successful e-tax payment.

Form 05/TB-TDT on notification of successful e-tax payment in Vietnam (Image from the Internet)

When is the time to submit e-tax dossiers in Vietnam?

Based on Article 8 of Circular 19/2021/TT-BTC which regulates the timing for submitting e-tax dossiers as follows:

* Timing for submitting e-tax dossiers, paying e-taxes

- Taxpayers can conduct electronic tax transactions 24 hours a day (from 00:00:00 to 23:59:59) and 7 days a week, including holidays and Tet. The submitted dossier will be considered as filed on the same day if successfully sent from 00:00:00 to 23:59:59 hours of that day.

- The time for confirming the submission of e-tax dossiers is determined as follows:

+ For electronic taxpayer registration dossiers: the date the tax authority's system receives the dossier, as indicated on the Notification of Electronic Taxpayer Registration Dossier Receipt sent by the tax authority to the taxpayer (as per form 01-1/TB-TDT (Download) issued with this Circular).

+ For tax declaration dossiers (excluding tax declaration dossiers where the tax management agency calculates the tax and informs the taxpayer according to Article 13 of Decree 126/2020/ND-CP): the date the tax authority's system receives the dossier, as indicated on the Notification of Receipt of Electronic Tax Declaration Dossier sent by the tax authority to the taxpayer (as per form 01-1/TB-TDT (Download) issued with this Circular), provided that the tax declaration dossier is accepted as per the Notification of Acceptance of Electronic Tax Declaration Dossier sent by the tax authority to the taxpayer (as per form 01-2/TB-TDT (Download) issued with this Circular).

For tax declaration dossiers with accompanying documents submitted directly or sent by post: the time for confirming the submission of the tax declaration dossier is the date the taxpayer completes the full submission as regulated.

+ For dossiers not regulated under points b.1, b.2 above: the date the tax authority's system receives the dossier, as indicated on the Notification of Acceptance of Electronic Dossier sent by the tax authority to the taxpayer (as per form 01-2/TB-TDT (Download) issued with this Circular).

+ The time for confirming the submission of e-tax dossiers mentioned in this clause is the basis for the tax authority to determine the time of dossier submission, calculate the late submission or resolve the tax dossier according to the Tax Administration Law, the guiding documents, and the regulations in this Circular.

- Electronic tax payment dates are determined according to Clause 1, Article 58 of the Tax Administration Law 2019.

* The time the tax authority sends notifications, decisions, documents to taxpayers is considered within the same day if the documents are successfully sent from 00:00:00 to 23:59:59 hours of the day.

Does the tax authority use form 01-1/TB-TDT for notification of e-enquiry in Vietnam?

Based on Clause 2, Article 33 of Circular 19/2021/TT-BTC, it is regulated as follows:

Receiving, processing, and responding to taxpayers' questions and issues

1. Creating and sending questions, issues

Taxpayers create and send questions, issues to the tax authority in accordance with Point a, Clause 5, Article 4 of this Circular.

Taxpayers explain, supplement relevant information, documents regarding electronic questions or issues (if any) to the tax authority as per Point a, Clause 5, Article 4 of this Circular.

2. Notification of receipt of questions, issues

No later than 15 minutes after receiving the taxpayers' questions or issues, the electronic portal of the General Department of Taxation sends a Notification of Receipt of Electronic Questions or Issues (as per form 01-1/TB-TDT issued with this Circular) to the taxpayer as prescribed in Clause 2, Article 5 of this Circular.

3. Processing and responding to issues

a) Processing questions, issues:

a.1) The tax authority is responsible for resolving taxpayers' questions, issues according to the Tax Administration Law, Tax Laws, and guiding documents.

a.2) During the process of resolving taxpayers' questions, issues, if further explanation or documents are needed, the tax authority sends a request for explanation, supplementary information, documents to the taxpayer as per Clause 2, Article 5 of this Circular.

The electronic portal of the General Department of Taxation receives explanatory documents, supplementary information, documents from taxpayers for issues already received electronically.

b) Responding to issues

The tax authority sends the result of responding to the issues to the taxpayer as per Clause 2, Article 5 of this Circular.

Accordingly, in line with the above regulations, the tax authority will use form 01-1/TB-TDT to notify the receipt of questions, issues from taxpayers.