What is the Form 05/HTQT on confirmation of tax paid for royalties in Vietnam?

What is the Form 05/HTQT on confirmation of tax paid for royalties in Vietnam?

The Form for confirmation of tax paid for royalties in Vietnam is specified in Annex I issued in conjunction with Circular 80/2021/TT-BTC. To be specific:

ANNEX I

LIST OF FORMS

(Issued in conjunction with Circular No. 80/2021/TT-BTC dated September 29, 2021 by the Minister of Finance)

| 79 | 1 | 01/DNXN | Request document for confirmation of tax obligations with the state budget |

| --- | --- | --- | --- |

| 80 | 2 | 01/TB-XNNV | Notification on <confirmation/non-confirmation> of tax obligations with the state budget |

| 81 | 3 | 03/HTQT | Request for confirmation of taxes paid in Vietnam for foreign residents |

| 82 | 4 | 04/HTQT | Confirmation of income tax paid in Vietnam |

| 83 | 5 | 05/HTQT | Confirmation of income tax paid in Vietnam for income from dividends, interest on loans, royalties, technical service fees |

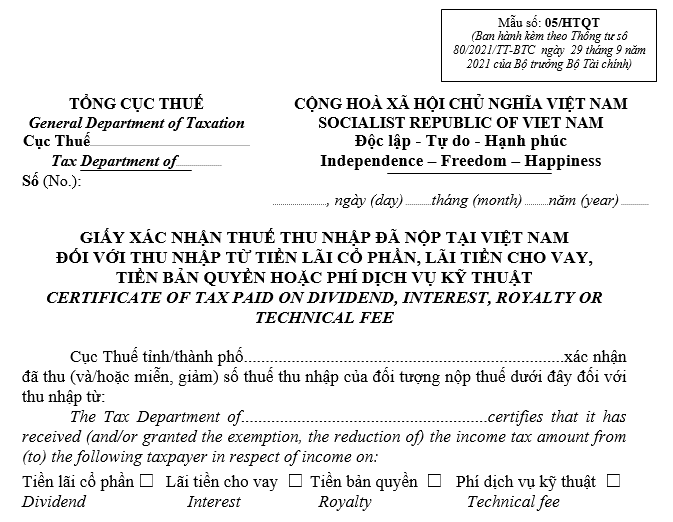

The Form for confirmation of tax paid for royalties in Vietnam is Form 05/HTQT under Annex I issued in conjunction with Circular 80/2021/TT-BTC:

Download Form for confirmation of tax paid for royalties in Vietnam.

Furthermore, point a clause 2 Article 70 of Circular 80/2021/TT-BTC stipulates that the Tax Department at the place where the taxpayer registers their tax is responsible for issuing the Confirmation of tax paid for royalties in Vietnam within 7 working days from the date of receipt of the request dossier.

What is the Form 05/HTQT on confirmation of tax paid for royalties in Vietnam? (Image from the Internet)

What is the time of determination for taxable income from royalties in Vietnam?

Based on clause 2 Article 16 of Law on Personal Income Tax 2007. To be specific:

Taxable income from royalties

1. Taxable income from royalties is the part of income exceeding 10 million VND that the taxpayer receives when transferring, transferring the right to use intellectual property objects, or transferring technology per each contract.

2. The time of determination for taxable income from royalties is the time the organization or individual pays income to the taxpayer.

Therefore, the time of determination for taxable income from royalties is the time the organization or individual pays income to the taxpayer.

When does income from royalties are taxable in Vietnam?

The tax on income from royalties is regulated in Article 30 of the Law on Personal Income Tax 2007 as follows:

Tax on income from royalties and franchise

1. The tax on income from royalties of a non-resident individual is determined by the part of income exceeding 10 million VND per each agreement of transferring, transferring the right to use intellectual property objects, or transferring technology in Vietnam multiplied by the tax rate of 5%.

2. The tax on income from the franchise of a non-resident individual is determined by the part of income exceeding 10 million VND per each franchise agreement in Vietnam multiplied by the tax rate of 5%.

Additionally, Article 22 of Circular 111/2013/TT-BTC provides regulations on tax for income from royalties as follows:

For income from royalties and franchise

1. Tax on income from royalties

a) Tax on income from royalties of a non-resident individual is determined by the part of income exceeding 10 million VND per each agreement of transferring, transferring the right to use intellectual property objects, or transferring technology in Vietnam multiplied by the tax rate of 5%.

Income from royalties is determined according to the guidance in clause 1, Article 13 of this Circular.

b) The time for determining income from royalties is the time the organization or individual pays income from the transfer of copyrights to the non-resident taxpayer.

2. Tax on income from franchise

a) Tax on income from the franchise of a non-resident individual is determined by the part of income exceeding 10 million VND per each franchise agreement in Vietnam multiplied by the tax rate of 5%.

Income from the franchise is determined according to the guidance in clause 1, Article 14 of this Circular.

b) The time for determining income subject to tax from the franchise is the time the franchise payment is made between the franchisee and the franchisor.

Thus, the tax on income from royalties of non-resident individuals is determined by the part of income exceeding 10 million VND per each agreement of transferring, transferring the right to use intellectual property objects, or transferring technology in Vietnam multiplied by the tax rate of 5%.

Income from royalties is determined according to the guidance in clause 1, Article 13 of Circular 111/2013/TT-BTC.