What is the Form 02/TAIN - Severance tax finalization in Vietnam?

What is the Form 02/TAIN - Severance tax finalization in Vietnam?

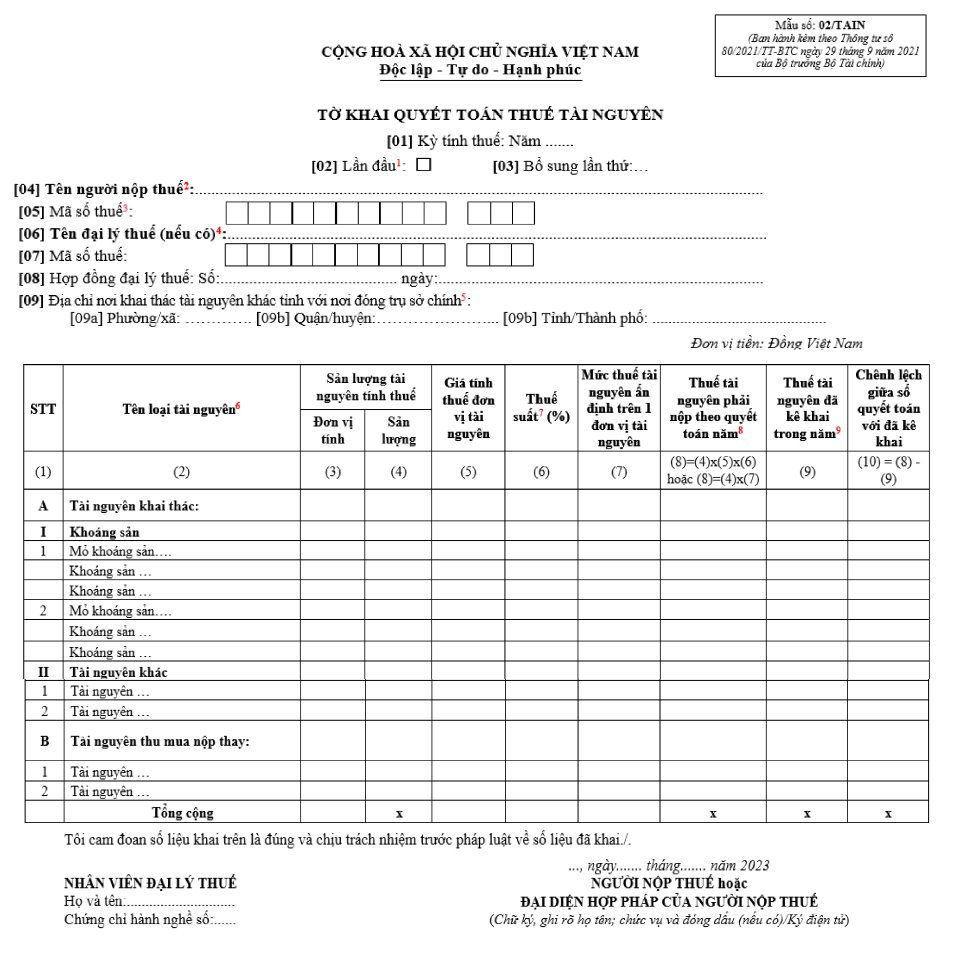

The form for the severance tax finalization is Form 02/TAIN-VSP as prescribed in Appendix 2 issued together with Circular 80/2021/TT-BTC, as follows:

Download Form 02/TAIN severance tax finalization: Here

What is the Form 02/TAIN - Severance tax finalization in Vietnam? (Image from the Internet)

What does an application for severance tax finalization include in Vietnam?

According to subsection 5.2, Section 5, Appendix 1 issued together with Decree 126/2020/ND-CP, the documents for filing a severance tax finalization include:

- Severance tax finalization according to Form 02/TAIN in Appendix 2 issued together with Circular 80/2021/TT-BTC

- Supplementary schedule for allocating severance tax payable to localities entitled to revenue from hydropower production activities - Form 01-1/TAIN issued together with Circular 80/2021/TT-BTC

What is the current severance tax rate?

According to Article 7 of the severance tax Law 2009, the severance tax rate is prescribed as follows:

- The severance tax rate framework is specified as follows:

| No. | Group, Type of Resource | Tax Rate (%) |

|---|---|---|

| I | Metallic Minerals | |

| 1 | Iron, manganese | 7 - 20 |

| 2 | Titanium | 7 - 20 |

| 3 | Gold | 9 - 25 |

| 4 | Rare earth | 12 - 25 |

| 5 | Platinum, silver, tin | 7 - 25 |

| 6 | Tungsten, antimony | 7 - 25 |

| 7 | Lead, zinc, aluminum, bauxite, copper, nickel | 7 - 25 |

| 8 | Cobalt, molybdenum, mercury, magnesium, vanadium | 7 - 25 |

| 9 | Other metallic minerals | 5 - 25 |

| II | Non-Metallic Minerals | |

| 1 | Soil for leveling, construction | 3 - 10 |

| 2 | Stone, excluding lime stones and for cement production; gravel; sand, excluding sand for glass production | 5 - 15 |

| 3 | Soil for bricks | 5 - 15 |

| 4 | Granite, refractory clay | 7 - 20 |

| 5 | Dolomite, quartzite | 7 - 20 |

| 6 | Kaolin, mica, technical quartz, sand for glass production | 7 - 15 |

| 7 | Pyrite, phosphorite, lime stones and for cement production | 5 - 15 |

| 8 | Apatite, serpentine | 3 - 10 |

| 9 | Anthracite coal (underground) | 4 - 20 |

| 10 | Anthracite coal (open-pit) | 6 - 20 |

| 11 | Brown coal, fat coal | 6 - 20 |

| 12 | Other coal | 4 - 20 |

| 13 | Diamond, ruby, sapphire | 16 - 30 |

| 14 | Emerald, alexandrite, black opal | 16 - 30 |

| 15 | Adite, rodyolite, pyrope, beryl, spinel, topaz | 12 - 25 |

| 16 | Crystalline quartz (colored), cryolite, white opal, fire opal, feldspar, turquoise, nephrite | 12 - 25 |

| 17 | Other non-metallic minerals | 4 - 25 |

| III | Crude Oil | 6 - 40 |

| IV | Natural Gas, Coal Gas | 1 - 30 |

| V | Natural Forest Products | |

| 1 | Group I Timber | 25 - 35 |

| 2 | Group II Timber | 20 - 30 |

| 3 | Group III, IV Timber | 15 - 20 |

| 4 | Group V, VI, VII, VIII Timber and other types of timber | 10 - 15 |

| 5 | Branches, tops, stumps, roots | 10 - 20 |

| 6 | Firewood | 1 - 5 |

| 7 | Bamboo, reed, thatch, rattan, and other similar plants | 10 - 15 |

| 8 | Agarwood, Ky Nam | 25 - 30 |

| 9 | Star anise, cinnamon, cardamom, amomum, perilla | 10 - 15 |

| 10 | Other natural forest products | 5 - 15 |

| VI | Natural Marine Resources | |

| 1 | Pearls, abalone, sea cucumbers | 6 - 10 |

| 2 | Other natural marine resources | 1 - 5 |

| VII | Natural Water | |

| 1 | Natural mineral water, natural hot water, bottled or canned natural water | 8 - 10 |

| 2 | Natural water used for hydropower production | 2 - 5 |

| 3 | Natural water used for production and business, excluding the water specified at Points 1 and 2 of this Group | |

| 3.1 | Surface water | 1 - 3 |

| 3.2 | Groundwater | 3 - 8 |

| VIII | Natural Birds’ Nests | 10 - 20 |

| IX | Other Resources | 1 - 20 |

- Specific tax rates for crude oil, natural gas, coal gas are determined incrementally based on average daily extraction volume.

- Based on the provisions of Clauses 1 and 2, Article 7 of the severance tax Law 2009, The Standing Committee of the National Assembly stipulates specific tax rates for each type of resource for each period ensuring the following principles:

+ Suitable for the list of groups, types of resources within the tax rate framework specified by the National Assembly;

+ Contributing to state management of resources; protecting, exploiting, using resources reasonably, economically, and efficiently;

+ Contributing to ensuring state budget revenues and stabilizing the market.

What are the bases for calculating severance tax in Vietnam?

According to Article 4 of Circular 152/2015/TT-BTC, the bases for calculating severance tax are specified as follows:

Bases for Tax Calculation

1. The bases for calculating severance tax are taxable resource quantities, severance tax prices, and severance tax rates.

2. Determining the severance tax payable during the period

severance tax payable during the period = Taxable resource quantities x severance tax price per unit x severance tax rate

If the state agency designates a severance tax on a per-unit basis for exploited resources, the severance tax payable is determined as follows:

severance tax payable during the period = Taxable resource quantities x Designated severance tax on a per unit basis

The designation of severance tax is based on the tax authority's data system, in accordance with the provisions on tax designation as prescribed by tax management laws.

Thus, the bases for calculating severance tax are taxable resource quantities, severance tax prices, and severance tax rates.