What is the Form 01/TTDB - Excise tax declaration fom in Vietnam?

Which goods are subject to excise tax in Vietnam?

Based on Article 2 of Law on excise tax 2008 and Article 2 of Decree 108/2015/ND-CP, the goods subject to excise tax include:

- Cigarettes, cigars, and other tobacco products used for smoking, inhaling, chewing, sniffing, sucking;

- Alcohol;

- Beer;

- Automobiles with fewer than 24 seats, including cars designed to carry both people and goods with two or more rows of seats and a fixed partition between the passenger compartment and the cargo compartment;

- Motorbikes with two wheels, motorbikes with three wheels with an engine capacity of over 125cm3;

- Aircraft, yachts (used for civilian purposes).

- All kinds of gasoline;

- Air conditioners with a capacity of 90,000 BTU or less;

- Playing cards;

- Joss paper, votive paper products (excluding votive toys for children and educational tools).

Note: Goods subject to excise tax must be complete products, excluding parts for assembling such goods.

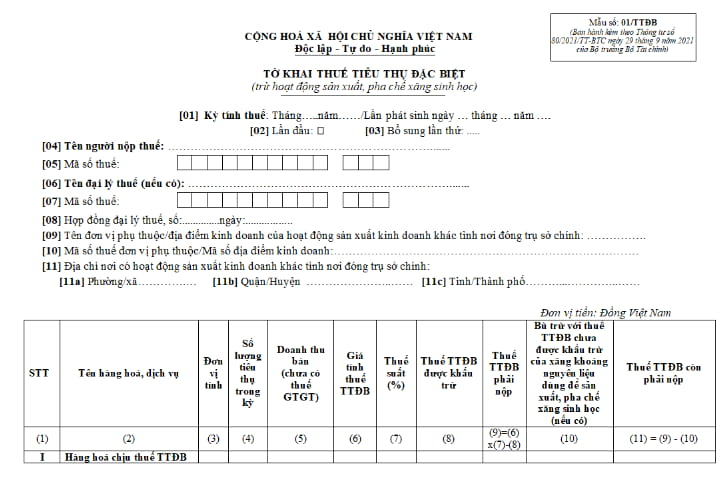

What is the Form 01/TTDB - Excise tax declaration fom in Vietnam? (Image from the Internet)

What is the Form 01/TTDB - Excise tax declaration fom in Vietnam?

Appendix 2 of Form 01/TTDB issued together with Circular 80/2021/TT-BTC: excise tax declaration form (excluding the activities of manufacturing and blending biofuel), as follows:

Download Form 01/TTDB: Here

When is the time for excise tax declaration in Vietnam?

According to Article 8 of Decree 126/2020/ND-CP, the excise tax declaration is stipulated as follows:

The excise tax is declared monthly, except in cases where it must be declared for each occurrence for:

- The excise tax of taxpayers engaging in business and export who have not yet paid the excise tax at the production stage and then did not export but sold domestically. The excise tax of business establishments purchasing domestically produced automobiles, aircraft, yachts exempt from excise tax but then changed their use to taxable ones.

- The excise tax on import-export goods. If export-import goods do not need to be declared for each occurrence, they should follow the Ministry of Finance's guidelines.

What is the excise tax rate for goods?

The excise tax rates for goods in 2024 are stipulated in Article 7 of Law on excise tax 2008, amended by Clause 4 Article 1 of the Law on excise tax Amendment 2014, Clause 2 Article 2 of Law No. 106/2016/QH13 and Article 8 of the Law Amending the Law on Public Investment, Public-Private Partnership Investment, Investment Law, Housing Law, Bidding Law, Electricity Law, Enterprise Law, excise tax Law, and Civil Judgment Enforcement Law 2022 as follows:

| No. | Goods | Tax Rate (%) |

|---|---|---|

| 1 | Cigarettes, cigars, and other tobacco products | 75 |

| 2 | Alcohol | |

| a) Alcohol of 20 degrees or more | 65 | |

| b) Alcohol below 20 degrees | 35 | |

| 3 | Beer | 65 |

| 4 | Automobiles with fewer than 24 seats | |

| a) Cars carrying up to 9 passengers, except those specified at Points 4d, 4e, and 4g of the Tax Schedule in Article 7 of the Law on excise tax 2008 (amended 2014, 2016) | ||

| - With an engine capacity of 1,500 cm3 or less | 35 | |

| - With an engine capacity of over 1,500 cm3 to 2,000 cm3 | 40 | |

| - With an engine capacity of over 2,000 cm3 to 2,500 cm3 | 50 | |

| - With an engine capacity of over 2,500 cm3 to 3,000 cm3 | 60 | |

| - With an engine capacity of over 3,000 cm3 to 4,000 cm3 | 90 | |

| - With an engine capacity of over 4,000 cm3 to 5,000 cm3 | 110 | |

| - With an engine capacity of over 5,000 cm3 to 6,000 cm3 | 130 | |

| - With an engine capacity of over 6,000 cm3 | 150 | |

| b) Cars carrying 10 to 16 passengers, except those specified at Points 4d, 4e, and 4g of the Tax Schedule in Article 7 of the Law on excise tax 2008 amended by Clause 4 Article 1 of the Law on excise tax Amendment 2014, Clause 2 Article 2 of Law No. 106/2016/QH13 | 15 | |

| c) Cars carrying 16 to fewer than 24 passengers, except those specified at Points 4d, 4e, and 4g of the Tax Schedule in Article 7 of the Law on excise tax 2008 amended by Clause 4 Article 1 of the Law on excise tax Amendment 2014, Clause 2 Article 2 of Law No. 106/2016/QH13 | 10 | |

| d) Cars carrying both people and goods, except those specified at Points 4d, 4e, and 4g of the Tax Schedule in Article 7 of the Law on excise tax 2008 amended by Clause 4 Article 1 of the Law on excise tax Amendment 2014, Clause 2 Article 2 of Law No. 106/2016/QH13 | 15 | |

| - With an engine capacity of 2,500 cm3 or below | 15 | |

| - With an engine capacity of over 2,500 cm3 to 3,000 cm3 | 20 | |

| - With an engine capacity of over 3,000 cm3 | 25 | |

| đ) Cars running on a combination of gasoline and electric energy, bio-energy, in which the gasoline use ratio does not exceed 70% of the energy used | 70% of the tax rate applicable to the same type of car specified at Points 4a, 4b, 4c, and 4d of the Tax Schedule in Article 7 of the Law on excise tax 2008 amended by Clause 4 Article 1 of the Law on excise tax Amendment 2014, Clause 2 Article 2 of Law No. 106/2016/QH13 | |

| e) Cars running on bio-energy | 50% of the tax rate applicable to the same type of car specified at Points 4a, 4b, 4c, and 4d of the Tax Schedule in Article 7 of the Law on excise tax 2008 amended by Clause 4 Article 1 of the Law on excise tax Amendment 2014, Clause 2 Article 2 of Law No. 106/2016/QH13 | |

| g) Electric cars | ||

| (1) Battery-powered electric cars | ||

| - Cars carrying up to 9 passengers | ||

| + From March 01, 2022 to February 28, 2027 | 3 | |

| - Cars carrying 10 to 16 passengers | ||

| + From March 01, 2022 to February 28, 2027 | 2 | |

| + From March 01, 2027 | 7 | |

| - Cars carrying 16 to 24 passengers | ||

| + From March 01, 2022 to February 28, 2027 | 1 | |

| + From March 01, 2027 | 4 | |

| - Cars designed to carry both people and goods | ||

| + From March 01, 2022 to February 28, 2027 | 2 | |

| + From March 01, 2027 | 7 | |

| (2) Other electric cars | ||

| - Cars carrying up to 9 passengers | 15 | |

| - Cars carrying 10 to 16 passengers | 10 | |

| - Cars carrying 16 to 24 passengers | 5 | |

| - Cars designed to carry both people and goods | 10 | |

| h) Motorhomes regardless of engine capacity | 75 | |

| 5 | Motorbikes with two wheels, motorbikes with three wheels with an engine capacity of over 125cm3 | 20 |

| 6 | Aircraft | 30 |

| 7 | Yachts | 30 |

| 8 | All kinds of gasoline | |

| a) Gasoline | 10 | |

| b) Gasoline E5 | 8 | |

| c) Gasoline E10 | 7 | |

| 9 | Air conditioners with a capacity of 90,000 BTU or less | 10 |

| 10 | Playing cards | 40 |

| 11 | Joss paper, votive paper products | 70 |