What is the Form 01-TT on cash receipt in Vietnam according to Circular 200?

What is the Form 01-TT on cash receipt in Vietnam according to Circular 200?

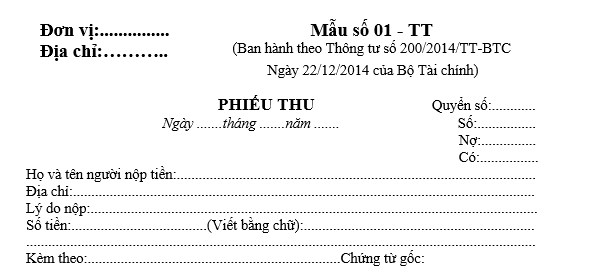

The current cash receipt form for enterprises is Form No. 01-TT as stipulated in Appendix 3 issued together with Circular 200/2014/TT-BTC:

Download Form 01-TT on cash receipt

What is the Form 01-TT on cash receipt in Vietnam according to Circular 200? (Image from the Internet)

What is the guidance on filling out Form 01-TT on cash receipt in Vietnam according to Circular 200?

In Form No. 01-TT stipulated in Appendix 3 issued together with Circular 200/2014/TT-BTC, the guidance is provided as follows:

[1] Clearly write the name and address of the enterprise using the receipt voucher.

[2] - The issuance of a receipt voucher aims to determine the actual cash, foreign currency,... entering the fund and serves as a basis for the cashier to collect money, record the fund, and the accountant to record the relevant receipts. All amounts of Vietnamese currency, foreign currency entering the fund must have a receipt voucher.

- For foreign currency, prior to entering the fund, they must be checked and a "Foreign Currency List" attached to the receipt voucher must be prepared.

- The receipt voucher must be bound into a book and numbered for each book used in one year. Each receipt voucher must state the book number and the number of each receipt voucher. The receipt voucher numbers must be sequentially numbered in an accounting period. Each receipt voucher must clearly state the date, month, year of the voucher issuance, date, month, year of money collection.

- The receipt voucher is prepared by the accountant in 3 copies, with all content on the voucher filled in and signed by the accountant. It is then reviewed by the chief accountant and approved by the director, then passed to the cashier for fund entry procedures. After receiving the full amount, the cashier records the actual amount of money entering the fund (in words) on the receipt voucher before signing and stating their name.

- The cashier keeps 1 copy for fund recording, 1 copy is given to the depositor, and 1 copy is kept at the issuing location. At the end of the day, all receipt vouchers accompanied by original documents are transferred to the accountant for accounting records.

[3] Clearly state the purpose of the deposit. For example: collection for sales, product, excess advance collection...

[4] Write the amounts entering the fund by number and in words, clearly stating the unit of currency as VND, or USD...

[5] Indicate the number of original documents attached to the receipt voucher.

[6] If collecting foreign currency, clearly record the exchange rate at the time of fund entry to calculate the total amount in the denomination for accounting records.

What are regulations on the transfer of balances in accounting books in Vietnam according to Circular 200?

Based on Article 126 of Circular 200/2014/TT-BTC, the regulation on transfer of balances in accounting books is as follows:

Enterprises shall convert the balances of the following accounts:

- Detailed balances of gold, silver, precious metals, gemstones reflected on Account 1113 and 1123 are converted as follows:

+ The value of gold (not considered monetary gold), silver, precious metals, gemstones used as inventory is transferred to reflect on accounts related to inventory, such as: Account 152 - Raw materials, materials or Account 156 - Goods according to the principle of matching with the purpose of use and classification at the enterprise;

+ The value of gold (not considered monetary gold), silver, precious metals, gemstones not used as inventory is transferred to reflect on Account 2288 - Other investments;

- The balances of bonds, treasury bills, promissory notes held to maturity, not held for business purposes (purchased for selling with intention to profit from price differences) reflected on Account 1212 short-term securities investments are transferred to Account 128 - Investments held to maturity (detailed for each Level 2 Account);

- Balances of long-term borrowings, long-term deposits reflected on Account 228 – Other long-term investments are transferred to Account 128 - Investments held to maturity (detailed for each Level 2 Account);

- The value of real estate products constructed or produced by the enterprise, tracked on Account 1567 - Real Estate Products, is transferred to track on Account 1557 - Real Estate Finished Products. Account 1567 only reflects real estate purchased for resale like other types of goods.

- The balance of Account 142 - Short-term prepaid expenses is transferred to Account 242 – Long-term prepaid expenses;

- The balance of Account 144 - Pledge, deposit, short-term deposit is transferred to Account 244 – Pledge, mortgage, deposit, deposit;

- Balances of reserve accounts reflected on Accounts 129, 139, 159 are transferred to Account 229 - Asset impairment reserve (detailed for each Level 2 Account in accordance with the reserve content);

- The value of real estate invested, constructed by the enterprise (not purchased for resale like goods) reflected as real estate products on Account 1567 is transferred to Account 1557 - Real Estate Finished Products;

- Balances of investments in associated companies reflected on Account 223 are transferred to Account 222 - Investments in joint-ventures, associated companies;

- Balances of Account 311 - Short-term debt, Account 315 - Long-term debt due, Account 342 - Long-term debt are transferred to Account 341 - Borrowings and finance lease payables;

- Accruals for repair and maintenance costs to keep fixed assets operational (for fixed assets requiring periodic maintenance according to technical requirements), environmental remediation costs, site restoration, and similar items reflected on Account 335 – Payable expenses are transferred to Account 352 – Estimated payable reserves (details in Account 3524);

- Balances of Account 415 - Financial reserve fund are transferred to Account 414 - Development investment fund;

Note: Other details reflected on related accounts if contrary to Circular 200/2014/TT-BTC must be adjusted according to the regulations of this Circular.