What is the Form 01/TAIN - Severance tax declaration in Vietnam under Circular 80?

What is the Form 01/TAIN - Severance tax declaration in Vietnam under Circular 80?

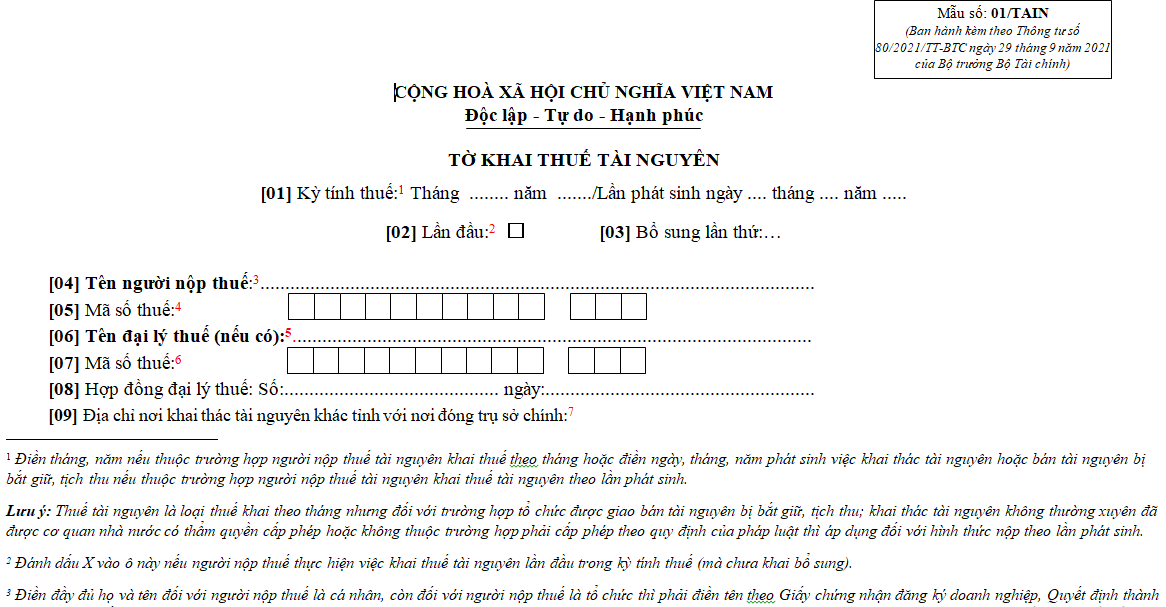

Based on Section 4 Appendix 2 issued together with Circular 80/2021/TT-BTC, the regulation on the severance tax declaration form (Form 01/TAIN) is as follows:

Download Form 01/TAIN: Here

What is the Form 01/TAIN - Severance tax declaration in Vietnam under Circular 80? (Image from the Internet)

How to declare and pay severance tax in Vietnam?

According to Article 8 of the severance tax Law 2009 (guided by Article 8, Article 9 of Circular 152/2015/TT-BTC), severance tax declaration, and payment are as follows:

(1) Tax registration, declaration, payment, and finalization are conducted as follows:

- Taxpayer registration, tax declaration, tax payment, and tax finalization shall be conducted in accordance with the Tax Administration Law 2019, guiding documents, and any amendments or supplements (if any).

- Specifically, tax declaration, payment, and finalization for mineral extraction activities, in addition to being conducted generally, shall be conducted as stated in (2) below.

(2) Tax declaration and finalization for mineral extraction activities.

- Organizations and business households extracting resources are responsible for notifying the tax authorities of the method for determining tax calculation prices for each type of extracted resource, along with the tax declaration dossier of the first month of extraction. In case of changes in the tax calculation price determination method, they must notify the managing tax authority in the month of change.

- Monthly, taxpayers must declare taxes for the entire output of extracted resources in the month (regardless of inventory or being in the processing stage).

- When finalizing taxes, taxpayers must prepare a detailed list accompanying the annual tax finalization return, detailing the extraction output for the year by each mine corresponding to the issued license. The severance tax is determined based on the tax rate of the extracted type of resource corresponding to the output and the tax calculation price as follows:

+ The taxable resource output is the total extracted resource output in the year, regardless of inventory or being in the processing or transportation stage.

+ In case the sold output includes both resource products and industrial products, the converted resource must be calculated from the resource content in the resource and industrial products output to the extracted resource output based on the resource usage norm determined by the taxpayer.

+ The tax calculation price is the average selling price of a unit of resource product, determined by dividing the total resource revenue by the total corresponding sold resource output in the year.

What are applicable subjects for severance tax in Vietnam?

According to Article 2 of Circular 152 /2015/TT-BTC, the subjects liable for severance tax are natural resources within the mainland, islands, inland waters, territorial seas, contiguous zones, exclusive economic zones, and continental shelves under the sovereignty and jurisdiction of the Socialist Republic of Vietnam, including:

- Metallic minerals.

- Non-metallic minerals.

- Products from natural forests, including various types of vegetation and other products from natural forests, excluding animals and star anise, cinnamon, cardamom, and amomum grown by taxpayers in assigned natural forest areas for protection and nurturing.

- Natural marine products, including marine animals and plants.

- Natural water, including surface water and groundwater; excluding natural water used for agriculture, forestry, fishery, salt production, and sea water used for cooling machinery.

Sea water used for cooling machinery must meet environmental requirements, efficient use of circulating water, and technical-economic conditions certified by competent state authorities. If sea water use causes pollution and does not meet environmental standards, it will be handled according to regulations.

- Natural bird nests, excluding bird nests collected by organizations and individuals investing in constructing houses to attract natural swallows to nest, raise, and harvest.

Bird nests collected by organizations and individuals investing in constructing houses to attract and raise natural swallows must comply with regulations.

- Other natural resources as prescribed by the Ministry of Finance in cooperation with relevant Ministries and sectors, reporting to the Government of Vietnam for submission to the Standing Committee of the National Assembly for consideration and decision.