What is the Form 01/HT on VAT refund request in Vietnam?

What is the Form 01/HT on VAT refund request in Vietnam?

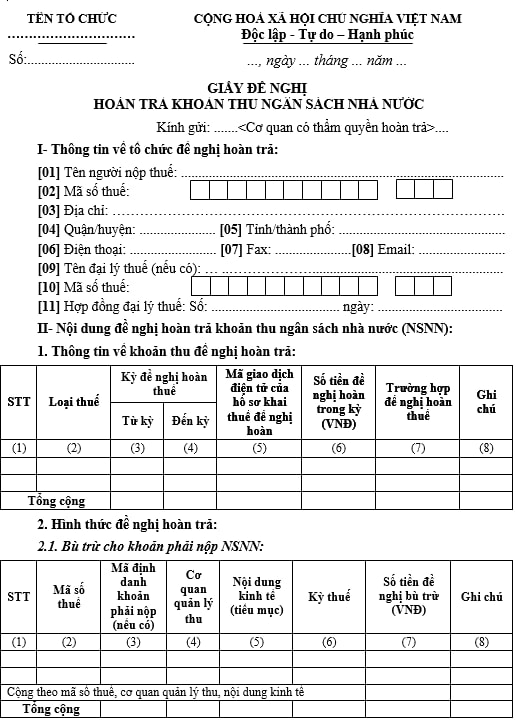

The VAT refund request form is Form No. 01/HT - a request form for the refund of state budget revenues issued in accordance with Circular 80/2021/TT-BTC, as follows:

Download Form No. 01/HT: Here

What is the Form 01/HT on VAT refund request in Vietnam? (Image from the Internet)

What are cases eligible for VAT refund in Vietnam?

Based on Article 13 of the Law on Value Added Tax 2008 amended by Clause 7 Article 1 of the Law on Value Added Tax Amendment 2013 amended by Clause 3 Article 1 of the Law on Value Added Tax, Excise Tax, and Tax Management Amendment 2016, the following cases are eligible for VAT refund:

(1) Business establishments paying VAT by the deduction method, if there is input VAT not yet fully deducted in the month or quarter, can carry it over to the next period.

In cases where business establishments registered to pay VAT by the deduction method have new investment projects, and during the investment stage, the VAT on purchased goods and services used for investment has not yet been deducted and the remaining VAT is three hundred million dong or more, they are eligible for a VAT refund.

Business establishments are not eligible for VAT refunds but can carry over the undeducted VAT of the investment projects to the following period as per investment law regulations in the following cases:

- Investment projects of business establishments that do not contribute sufficient charter capital as registered; operating in conditional business sectors without meeting the business conditions as per the Investment Law or failing to maintain sufficient business conditions during operation;

- Investment projects for resource and mineral exploration licensed from July 1, 2016, or investment projects for manufacturing products with the total value of resources, minerals plus energy costs accounting for 51% or more of the product cost according to the investment project.

(2) Business establishments exporting goods or services within the month or quarter with input VAT not yet fully deducted from three hundred million dong or more are eligible for a VAT refund on a monthly or quarterly basis, excluding imported goods for export and goods not exported from the customs areas according to the Customs Law.

Refunds will be processed before verification for taxpayers producing export goods who have not violated tax and customs laws for two consecutive years and are not high-risk entities as prescribed by the Tax Administration Law.

(3) Business establishments paying VAT by the deduction method are eligible for a VAT refund when there is a change in ownership, reorganization, merger, dissolution, bankruptcy, termination of operations with overpaid VAT or undeducted input VAT.

(4) Foreigners, overseas Vietnamese with passports or entry papers issued by foreign competent authorities are eligible for VAT refunds on goods purchased in Vietnam carried along when exiting.

(5) The VAT refund for programs and projects funded by non-refundable official development assistance (ODA) or non-refundable aid and humanitarian aid programs is regulated as follows:

- Program or project owners or primary contractors, organizations designated by foreign donors managing programs or projects using non-refundable ODA, are eligible for refunds on VAT paid for goods and services purchased in Vietnam to serve the programs or projects;

- Organizations in Vietnam utilizing non-refundable aid or humanitarian assistance from foreign organizations or individuals for purchasing goods and services for non-refundable aid or humanitarian assistance projects in Vietnam are eligible for VAT refunds paid for those goods and services.

(6) Diplomatic entities eligible for diplomatic privileges according to legal regulations on diplomatic privileges purchasing goods and services in Vietnam for use are eligible for VAT refunds stated in VAT invoices or payment receipts indicating the payment amount, including VAT.

(7) Business establishments granted VAT refund decisions by competent authorities according to the law and in cases of VAT refunds according to international agreements to which the Socialist Republic of Vietnam is a member.

How long is the VAT refund processing time in Vietnam?

Based on Clauses 1 and 2, Article 75 of the Law on Tax Administration 2019, the specific timeline for processing VAT refund applications is as follows:

(1) For applications eligible for preliminary refund

For applications eligible for preliminary refund, the processing time is a maximum of 6 working days from the date the tax administration agency issues a notification of acceptance and the deadline for processing the refund application.

The tax administration agency must issue a refund decision to the taxpayer or notify the taxpayer that their application will be transferred for verification before refund if it falls under Article 73(2) of the Law on Tax Administration 2019, or notify that the refund will not be processed if the application does not meet refund criteria.

If the information in the tax refund application differs from the tax administration agency's records, the agency must notify the taxpayer in writing to provide explanations and additional information.

The time for explanation and additional information is not included in the refund application processing time.

(2) For applications eligible for verification before refund

For applications eligible for verification before refund, the processing time is a maximum of 40 days from the date the tax administration agency issues a written notification of acceptance and the deadline for processing the refund application.

The tax administration agency must issue a refund decision to the taxpayer or notify that the refund will not be processed if the application does not meet refund criteria.

Note: If the above deadlines are not met due to the tax administration agency's fault, in addition to the refundable tax amount, the agency must also pay interest at a rate of 0.03% per day on the amount to be refunded and the days of delay.

Interest payment funds are sourced from the central budget as per legal regulations on the state budget.

- What are VAT calculation methods in Vietnam?

- When is an e-invoice issued without the a valid seller's digital signature in Vietnam?

- Vietnam: Shall a VAT invoice include 02 foreign currencies?

- How long is the duration of exemption from licensing fees for a new enterprise in Vietnam? What are cases of licensing fee exemption in Vietnam?

- What are cases where the input VAT must not be deducted in Vietnam? What are the conditions for VAT input deduction?

- What are cases where personal income late payment interest is charged in Vietnam?

- How long can a taxpayer delay submitting tax declaration dossiers before their information is published in Vietnam?

- What is the Form 01/CT-KTT for amendments to the information of tax accounting books in Vietnam?

- When is the deadline for submitting annual financial statements in Vietnam? How much is the penalty for late submission?

- Shall import-export duties be paid in foreign currency in Vietnam?