What is the fee declaration form according to Circular 80? What is the guidance on filling out fee declaration form in Vietnam?

What is the fee declaration form in Vietnam according to Circular 80?

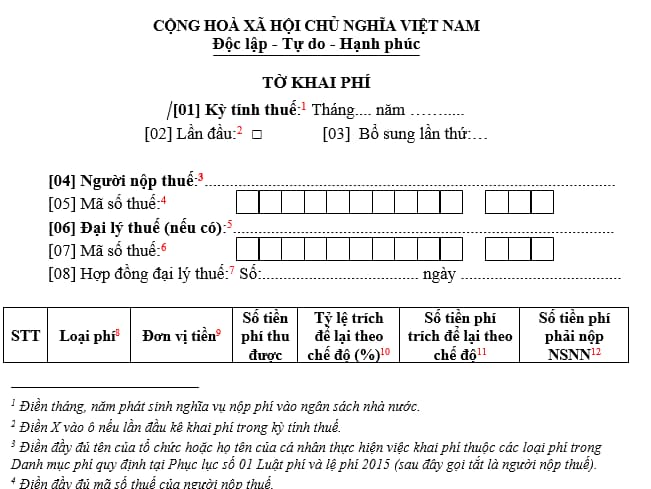

The fee and charge declaration form under the State budget is implemented according to form number 01/PH issued together with Circular 80/2021/TT-BTC:

Download: Fee Declaration Form (Form number 01/PH) under the State budget here

What is the guidance on filling out the fee declaration form (Form Number 01/PH) under the State Budget of Vietnam issued with Circular 80?

Below is the guidance for filling out the fee declaration form (Form number 01/PH) under the State budget:

[1] Enter the month and year when the obligation to pay fees to the State budget arises.

[2] Check the box if this is the first time declaring fees for the tax calculation period.

[3] Fill in the full name of the organization or the full name of the individual undertaking the fee declaration among the types of fees listed in the Fee Schedule Appendix number 01 of the Law on Fees and Charges 2015 (hereinafter referred to as the taxpayer).

[4] Enter the full taxpayer identification number.

[5] Fill in the full name of the tax agent if the taxpayer has entered into a contract with a tax agent to declare fees on their behalf.

[6] Enter the full taxpayer identification number of the tax agent (if applicable).

[7] Enter the full contract number and date of signing of the agency contract (if applicable).

[8] The type of fee is stipulated in the Fee Schedule Appendix 01 Law on Fees and Charges 2015

[9] Based on the provisions in Clause 4, Article 3 of Decree 120/2016/ND-CP, the currency for paying fees in Vietnam is Vietnamese Dong, except where the law permits fee collection in freely convertible currencies. If prescribed to collect fees in a freely convertible foreign currency, the fee can be collected in foreign currency or in Vietnamese Dong based on conversion from foreign currency into Vietnamese Dong at the following exchange rates:

- In case of fee payment at a commercial bank or other credit institutions, apply the buying exchange rate of the commercial bank or credit institutions where the fee payer opens the account at the time of fee payment.

- In case of fee payment directly at the State Treasury, apply the exchange rate recorded at the time of fee payment announced by the Ministry of Finance.

- In case of direct fee payment in cash or other forms to the fee-collecting organization, apply the foreign currency buying exchange rate via wire transfer of the Head Office of the Joint Stock Commercial Bank for Foreign Trade of Vietnam at the time of payment or by the end of the working day preceding a holiday or a day off.

Fees and charges collected abroad are collected in the local currency or in freely convertible foreign currency.

[10] Based on the provisions in Point b, Clause 1, Article 5 of Decree 120/2016/ND-CP, percentage set aside is calculated as follows:

| Percentage Set Aside (%) | = | Annual Budget of Necessary Costs for Service Provision, Fee Collection ___________________________________ |

x 100 |

| Annual Estimated Fee Revenue |

In which:

- The annual budget of necessary costs for service provision, fee collection is based on the spending content in Clause 2, Article 5 of Decree 120/2016/ND-CP and based on policies, standards, and spending norms as prescribed.

- The annual estimated fee revenue is determined by the fee-collecting organization based on the projected fee and the number of services provided within the year.

- In cases of adjusting the percentage set aside, the revenue and expenditure projections are also based on the revenue and expenditure data from the preceding year.

- The maximum percentage set aside must not exceed 100%.

[11] Based on the provisions in Point a, Clause 1, Article 5 of Decree 120/2016/ND-CP, the amount of fees to be set aside is the product of the collected fees and the percentage set aside.

[12] The amount of fees payable to the State budget (at item (7)) is the collected fees (at item (4)) minus the fees set aside according to policies (at item (6)).

What is the fee declaration form (Form Number 01/PH) under the State Budget of Vietnam? What is the guidance on fee declaration form?

What are principles for determining the fee or charge level under the State Budget of Vietnam?

According to the provisions in Article 9Law on Fees and Charges 2015, the principles for determining the fee level under the State budget are as follows:

- The level of fees is pre-determined, not intended to cover costs; the registration fee is calculated as a percentage of the asset value; ensures fairness, transparency, and equality regarding the rights and obligations of citizens.

What are regulations on cases of exemption or reduction for fees and charges in Vietnam?

Based on Article 10 Law on Fees and Charges 2015, the cases exempted from or eligible for fee and charge reductions are prescribed as follows:

- Those eligible for exemption or reduction of fees and charges include children, poor households, the elderly, people with disabilities, those who contributed to the revolution, ethnic minorities in economically and socially disadvantaged regions, and some special subjects as prescribed by law.

- The Standing Committee of the National Assembly specifies the subjects eligible for exemption or reduction of court fees and charges.

- the Government of Vietnam specifies the subjects eligible for exemption or reduction for each fee or charge under its jurisdiction.

- The Minister of Finance, People's Councils of provinces, specifically stipulate the subjects eligible for exemption or reduction concerning each fee or charge under their jurisdiction.

- Shall the TIN of dependant be changed to a personal TIN in Vietnam?

- Shall an employee with a contract of less than 6 months be subject to enforcement by deduction of money from the taxpayer’ salary or income in Vietnam?

- How long is the tax enforcement decision effective in Vietnam?

- What is the deadline for submitting taxes of the fourth quarter in Vietnam? What types of taxes are declared quarterly in Vietnam?

- Do Lunar New Year gifts valued at 2 million for employees subject to personal income tax in Vietnam?

- What are cases where non-refundable ODA project owners are entitled to refund of VAT in Vietnam?

- What is the form for notification of payment of land and housing registration fee by tax authority in Vietnam according to Decree 126?

- What are 03 conditions for VAT deduction in Vietnam from July 1, 2025?

- Is the e-tax transaction code generated uniformly in Vietnam?

- What crime will be imposed for tax evasion with an amount of from VND 100,000,000 in Vietnam?