What is the environmental protection tax declaration form - Form 01/PBVMT in Vietnam?

What does the environmental protection tax declaration dossier in Vietnam include?

Under sub-section 21, Section 2, Administrative Procedures issued with Decision 1462/QD-BTC in 2022, the environmental protection tax declaration dossier includes:

- The environmental protection tax declaration made in Form No. 01/TBVMT according to Appendix 1 of the list of tax declaration dossiers issued with Decree 126/2020/ND-CP and Circular 80/2021/TT-BTC.

- The supplementary table for determining the environmental protection tax payable by provinces benefiting from coal, form No. 01-1/TBVMT according to Appendix 1 of the list of tax declaration dossiers issued with Decree 126/2020/ND-CP and Circular 80/2021/TT-BTC (for cases where taxpayers allocate environmental protection taxes payable for gasoline and oil to each province where dependent units are headquartered as stipulated);

- The supplementary table for the distribution of environmental protection tax payable for gasoline and oil to the provinces benefiting from revenue, form No. 01-2/TBVMT according to Appendix 1 of the list of tax declaration dossiers issued with Decree 126/2020/ND-CP and Circular 80/2021/TT-BTC (for cases where taxpayers determine the tax payable for each province where the coal mining company is headquartered as stipulated).

Number of dossiers: 01 set

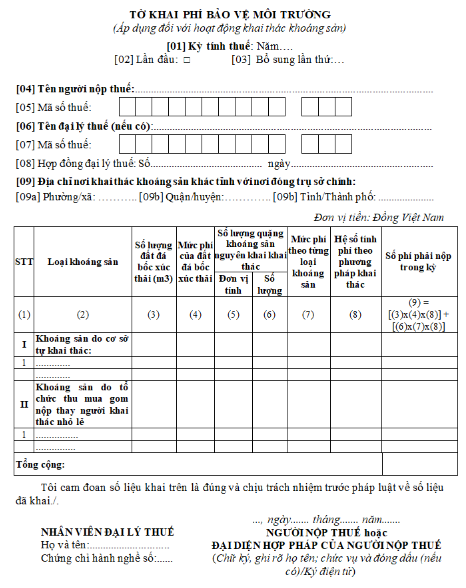

What is the environmental protection tax declaration form - Form 01/PBVMT in Vietnam? (Image from Internet)

What is the environmental protection tax declaration form - Form 01/PBVMT in Vietnam?

The environmental protection tax declaration form - Form 01/PBVMT is stipulated in Appendix 2 issued with Circular 80/2021/TT-BTC:

Download the environmental protection tax declaration form - Form 01/PBVMT: Here

Notes on the environmental protection fee declaration form in mineral exploitation are as follows:

Items [09a], [09b], [09c]:

- Declare information on the locality where the taxpayer has mineral exploitation different from the province where the headquarters are located as stipulated in Point i, Clause 1, Article 11 of Decree 126/2020/ND-CP dated October 19, 2020, of the Government of Vietnam. In case the taxpayer has mineral exploitation in multiple districts, it is declared in this Item as follows:

+ If the Tax Department is the tax management agency, the taxpayer declares one representative district where mineral exploitation arises.

+ If the Regional Tax Sub-Department is the tax management agency, the taxpayer declares one representative district under the Regional Tax Sub-Department where mineral exploitation arises.

What is the tariff table for environmental protection tax in 2024?

According to Article 8 of the Environmental Protection Tax Law 2010, the tariff table is as follows:

- Absolute rates are specified in the tariff table below:

|

No. |

Goods |

Calculation unit |

Tax rate |

|

I |

Gasoline, oil, grease |

|

|

|

1 |

Gasoline, except ethanol |

lit |

1.000-4.000 |

|

2 |

aircraft fuel |

lit |

1.000-3.000 |

|

3 |

diesel oil; |

lit |

500-2.000 |

|

4 |

Petroleum |

lit |

300-2.000 |

|

5 |

Fuel oil |

lit |

300-2.000 |

|

6 |

lubricants |

lit |

300-2.000 |

|

7 |

Grease |

kg |

300-2.000 |

|

II |

Coal |

|

|

|

1 |

Lignite |

Tấn |

10.000-30.000 |

|

2 |

Anthracite Coal (anthracite) |

Tấn |

20.000-30.000 |

|

3 |

Fat coal |

Tấn |

10.000-30.000 |

|

4 |

Other coal |

Tấn |

10.000-30.000 |

|

III |

Hydrogen-chlorofluorocarbon liquid (HCFC). |

kg |

1.000-5.000 |

|

IV |

Taxable-plastic bag |

kg |

30.000-50.000 |

|

V |

Herbicide which is restricted from use |

kg |

500-2.000 |

|

VI |

Pesticide which is restricted from use |

kg |

1.000-3.000 |

|

VII |

Forest product preservative which is restricted from use |

kg |

1.000-3.000 |

|

VIII |

Warehouse disinfectant which is restricted from use |

kg |

1.000-3.000 |

- On the basis of the tax bracket prescribed in Clause 1 of this Article, the National Assembly Standing Committee provide for specific tax rate to each type of dutiable goods ensuring the following principles:

+ The tax rate on taxable goods in line with socio-economic development policy – social in each period;

+ The tax rate on taxable goods shall be determined under the extent of causing negative environmental impacts of the goods.

Which goods are not subject to environmental protection tax in Vietnam?

According to Article 4 of the Environmental Protection Tax Law 2010, goods not subject to environmental protection tax in Vietnam include:

- Goods not specified in Article 3 of Environmental Protection Tax Law 2010 shall not be subject to environmental tax.

- Goods provided for in Article 3 of Environmental Protection Tax Law 2010 shall not be subject to environmental tax in the following cases:

+ Goods transported in transit or transshipped through the border gate, Vietnam border in accordance with the law, including the transportation of goods from exporting countries to importing countries through the border gate of Vietnam but it is not made import & export procedures into and out of Vietnam; transit goods through the border gate, the border of Vietnam on the basis of agreements signed between the Government of Vietnam and a foreign government or an agreement between agencies, representative authorized under the provisions of law by government of Vietnam and foreign governments;

+ Goods temporarily imported for re-export within the time limit prescribed by law;

+ Goods directly exported by production facilities or entrusted for the export business to export, except for organizations, households and individuals to purchase goods which environmental protection taxable subject to export.