What is the duty-free allowance book template - Template No. 02h3 applicable to diplomatic officers in Vietnam?

What is the duty-free allowance book template - Template No. 02h3 applicable to diplomatic officers in Vietnam?

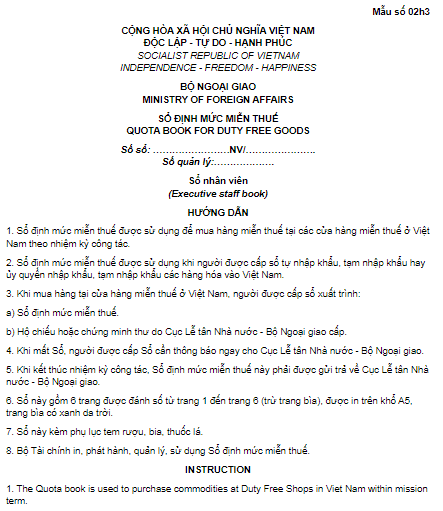

Under Appendix 7 of the forms/templates for tax exemption, tax reduction, tax refund, and non-taxation issued together with Decree 18/2021/ND-CP, the duty-free allowance book template - Template No. 02h3 applicable to diplomatic officers in Vietnam is specified as follows:

>>> Download the duty-free allowance book template - Template No. 02h3 applicable to diplomatic officers in Vietnam.

What is the duty-free allowance book template - Template No. 02h3 applicable to diplomatic officers in Vietnam? (Image from the Internet)

Which authorities have the power to issue duty-free allowance books to diplomatic officers in Vietnam?

Under Point c, Clause 8, Article 5 of Decree 134/2016/ND-CP, the procedure for issuing the duty-free allowance books is as follows:

Power to issue the duty-free allowance book or increase allowance therein

Directorate of State Protocol – The Ministry of Foreign Affairs or an agency authorized by the Ministry of Foreign Affairs shall issue duty-free allowance books made in Template No. 02h1 Download or Template No. 02h2 Download or Template No. 02h3 Download to the entities mentioned in Point a and Point b Clause 1 of this Article 1 within 05 working days from the day on which adequate documents are received.

Customs Departments of provinces where the organizations mentioned in Clause 1 of this Article are located shall issue duty-free allowance books Template No. 02h4 Download or Template No. 02h5 Download to the entities mentioned in Point c and Point d Clause 1 of this Article within 05 working days from the day on which adequate documents are received.

The Ministry of Foreign Affairs shall monitor and issue duty-free allowance book to the entities granted diplomatic immunity and privileges mentioned in Point c Clause 1 of this Article if they have been issued with duty-free allowance books by the Ministry of Foreign Affairs before the effective date of this Decree.

After a duty-free allowance book is issued, the issuing authority mentioned in this Point shall update the General Department of Customs with information in the duty-free allowance book via the National Single-window Information Portal.

Thus, the Directorate of State Protocol – The Ministry of Foreign Affairs or an agency authorized by the Ministry of Foreign Affairs shall issue duty-free allowance books to diplomatic officers.

Is an international treaty required in the application for issuing duty-free allowance books to diplomatic officers in Vietnam?

Under clause 8 Article 5 Decree 134/2016/ND-CP, the procedure for issuing the duty-free allowance books is as follows:

Procedures for issuance of duty-free allowance book or increase of allowance therein

- Application submitted by an organization shall include the following documents:

The written request for issuance of the issuance of the duty-free allowance book or allowance increase (Form No. 01 or Form No. 01a in Appendix VII hereof: 01 original copy;

Notice of the establishment of the representative agency in Vietnam after the duty-free allowance book is issued for the first time: 01 photocopy;

Documents proving completion of re-export, destruction or transfer of the goods in case the entity specified in Point a, Point b Clause 1 of this Article requests additional allowance on automobiles or motorcycles to the duty-free allowance book: 01 photocopy;

The international treaty or agreement between Vietnam’s government and the foreign non-governmental organization which specifies the categories and allowance on duty-free goods: 01 photocopy;

The Prime Minister’s decision on duty exemption if the international treaty or agreement between Vietnam’s government and the foreign non-governmental organization does not specify the categories and allowance on duty-free goods (for the organizations specified in Point c, Point d Clause 1 of this Article): 01 photocopy.

- Application submitted by an individual shall include the following documents:

The written request for issuance of the issuance of the duty-free allowance book or allowance increase (Form No. 02 or Form No 02i in Appendix VII hereof: 01 original copy;

The ID card issued by the Ministry of Foreign Affairs (for the individuals specified in Point a, Point b Clause 1 of this Article: 01 photocopy;

Documents proving completion of re-export, destruction or transfer of the goods in case the entity specified in Point a, Point b Clause 1 of this Article requests additional allowance for automobiles or motorcycles to the duty-free allowance book: 01 photocopy;

The work permit or a legally equivalent document issued by a competent authority if the applicant is a member of an international organization or non-governmental organization (for persons mentioned in Point d Clause 1 of this Article): 01 photocopy;

The international treaty or agreement between Vietnam’s government and the foreign non-governmental organization which specifies the categories and allowance on duty-free goods: 01 photocopy;

The Prime Minister’s decision on duty exemption if the international treaty or agreement between Vietnam’s government and the foreign non-governmental organization does not specify the categories and allowance on duty-free goods (for the entities specified in Point c, Point d Clause 1 of this Article): 01 photocopy.

Thus, the application for issuing the duty-free allowance books to diplomatic officers in Vietnam must include an international treaty or agreement between the Government of Vietnam and foreign non-governmental organizations.